Solar asset insurer kWh Analytics has raised US$20 million for business expansion and developing additional solutions to support solar and energy storage asset owners.

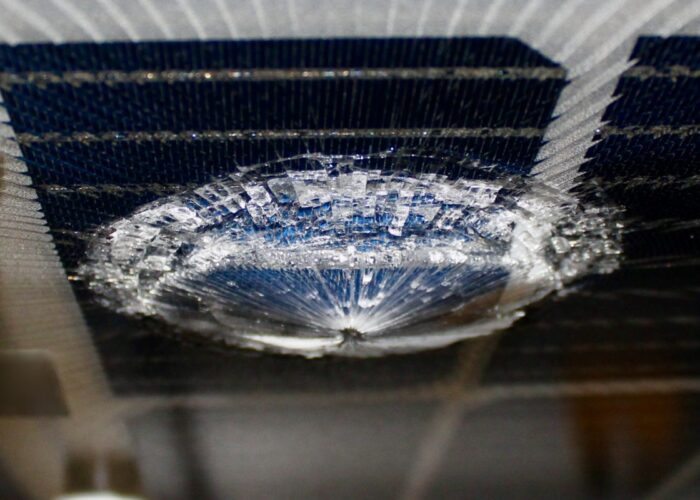

It has also announced the launch of its new ‘Property Product’ that provides all-risk coverage against physical damage for solar, storage, and wind projects, kWh Analytics said.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The San Francisco-based company said it intended to bring the solutions to international markets.

“These new offerings will continue to revolutionise underwriting and pricing within the renewable energy insurance space by leveraging real-world data,” said the company via a media release.

“The world needs more renewable energy to mitigate climate change, and insurance is key to ensuring these projects get built,” said its CEO Richard Matsui.

At the end of last year, kWh Analytics launched a new offering that it said allows PV project owners to receive upfront payments in return for maintaining asset performance.

The company has had a strong focus on solar asset performance recently, with its 2021 Solar Generation Index (SGI), which compiles learnings from more than 350 operational solar assets in the US, showing how the performance of US solar assets against P50 estimates worsened over the last decade. The report made it into PV Tech’s top 10 stories of last year.

kWh Analytics uses a proprietary database of renewable energy project performance, which draws data from more than 300,000 operational assets, to underwrite insurance policies for renewable energy. It is funded by venture capital and the US Department of Energy (DOE).