‘Silicon Module Super League’ (SMSL) member LONGi Green Energy Technology and the leading fully-integrated high-efficiency monocrystalline module manufacturer, reported first half 2017 revenue slightly down from the prior year period as a result of average selling price (ASP) declines, partially offset by product shipment growth.

Strong global demand for mono-Si wafers in the first half of 2017 has led to capacity constraints, notably with the largest producer. Key to the demand was the 24.4GW of new solar installations in China in the first half of the year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In the first half of 2017 the company said that mono-Si wafer production was 877 million units, or around 2,051MW. Mono-Si wafer shipments volume was 868 million pieces. Ingot and wafer production was running at full-capacity.

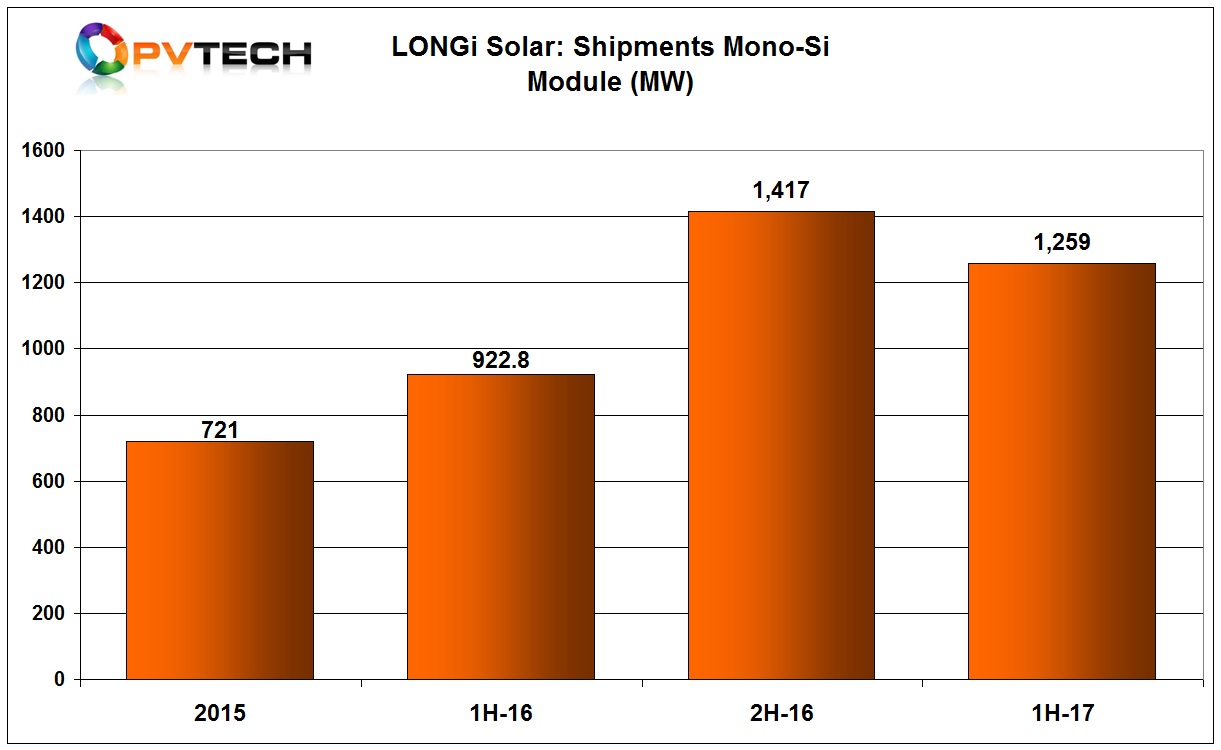

Mono-Si wafer shipments to external customers were 1,259MW in the reporting period and 796MW of shipments for in-house module manufacturer, LONGi Solar.

LONGi said that mono-Si cell shipments were 2,188MW with mono-Si module shipments of 1,259MW. Total mono c-Si module shipments were 2,340.8MW in 2016.

Manufacturing update

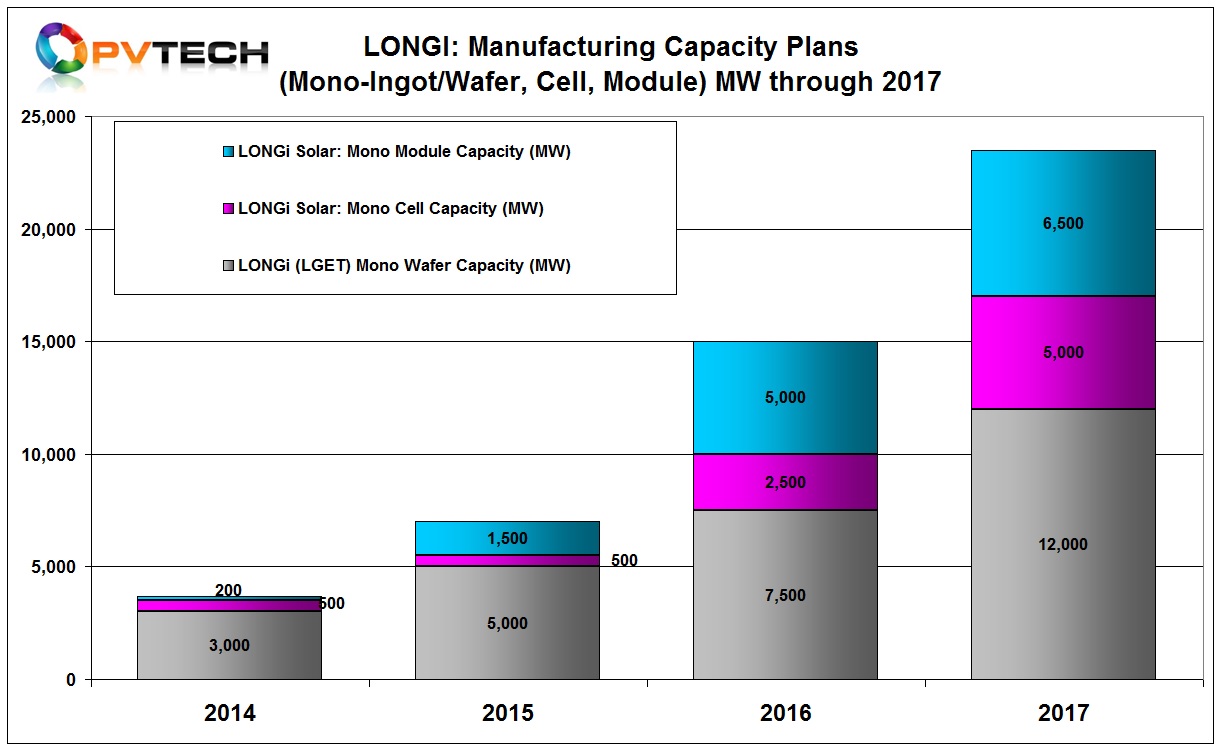

To ease capacity constraints, LONGi noted that it was fast-tracking various ingot and wafer expansion plans currently under construction and pulling in projects nearing completion where possible.

The company also noted that due to technology upgrades and process improvements at a 3GW ingot and wafer expansion project, total nameplate capacity would be 5GW when the project completed construction and tool installation.

LONGi noted that the equipment debugging phase was underway at a 300MW ingot expansion and a 1GW expansion of wafers, which are expected to be in full production in the fourth quarter of 2017.

The company also noted that a 500MW solar cell expansion phase and a 500MW module assembly expansion would also enter production in the fourth quarter of 2017.

Financials

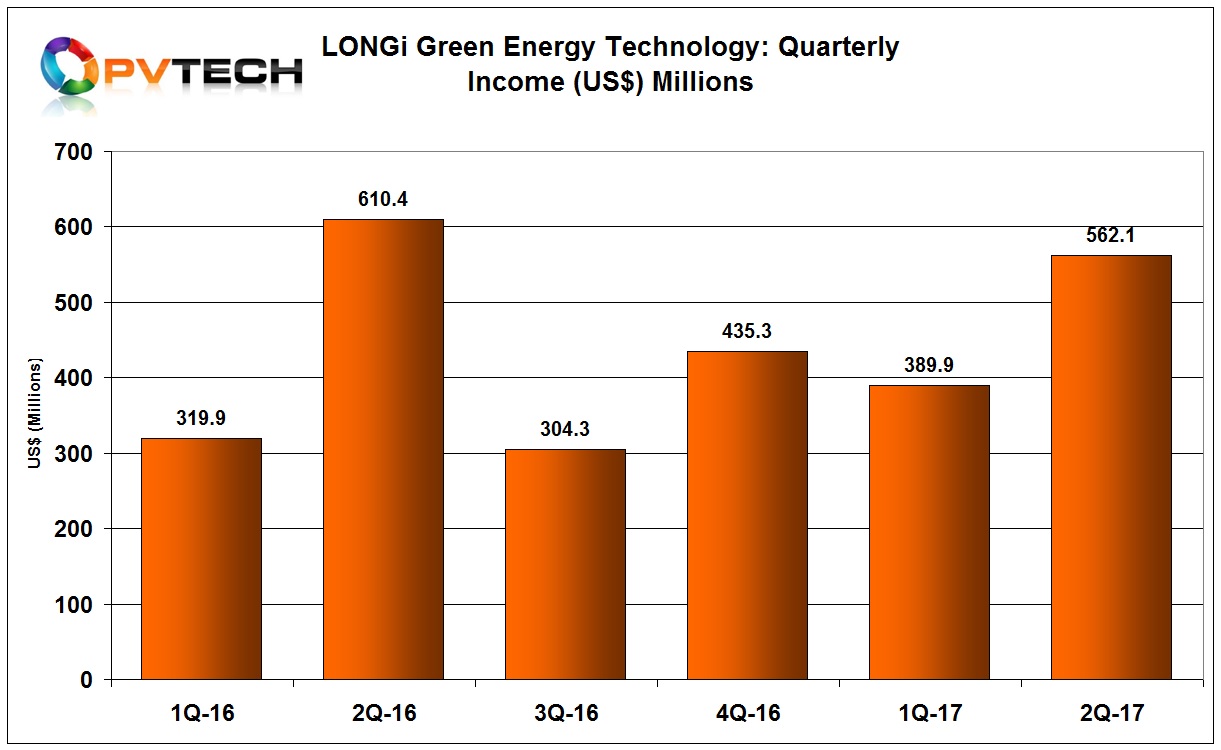

LONGi reported an operating income of RMB6,276 million (US$952 million), down 2.3% from the prior year period.

Having experienced a softening in demand in the first quarter of 2017, sales picked-up strongly in the second quarter as operating income increased by around 44%, quarter-on-quarter.

Net profit attributable to shareholders was RMB1,236 million (US$187.3 million), up 43.6% from the prior year period. Net cash flow from operating activities was US$17.2 million.

To continue to develop mono-SI PERC and bifacial cells and modules as well as ongoing ingot and wafer technology developments, LONGi noted that R&D expenditure in the reporting period had reached around US$67.3 million, compared to US$51.6 million the prior year period.