Leading monocrystalline wafer producer and ‘Solar Module Super League’ (SMSL) member LONGi Green Energy Technology plans to invest approximately US$773 million in expanding monocrystalline ingot and wafer capacity at three sites in China.

LONGi Group noted in financial filings that it would expand monocrystalline ingot production by 6GW at facilities in Baoshan, China at a cost of approximately RMB 1.749 billion (US$261.4 million), while adding a further 6GW at facilities in Lijiang, China at a cost of around RMB 1.937 billion (US$289.5 million).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The company also announced that it increase monocrystalline wafer production by a further 10GW as part of a Phase 2 expansion at facilities in Chuxiong, Yunnan, China. Capital expenditure for Phase 2 was put at around RMB 1.486 billion (US$222.1 million).

The company had also announced separately that it was expanding monocrystalline solar cell capacity by 1GW at a new facility at the Shama Jaya Free Industrial Park, Kuching City, Sarawak, Malaysia at a cost of approximately RMB 840 million (US$125.5 million), which brings total investments planned of around US$898.5 million, so far in 2019.

The investment in the ingot facility in Baoshan is expected to be carried out through July, 2020, while the Lijiang project will take through May, 2020. The 10GW mono wafer project is expected to be completed in March, 2020.

LONGi said that it was continuing to expand capacity to meet future projected demand for high-efficiency mono wafers, while targeting production in Yunnan Province, due to the availability of hydro-electric power.

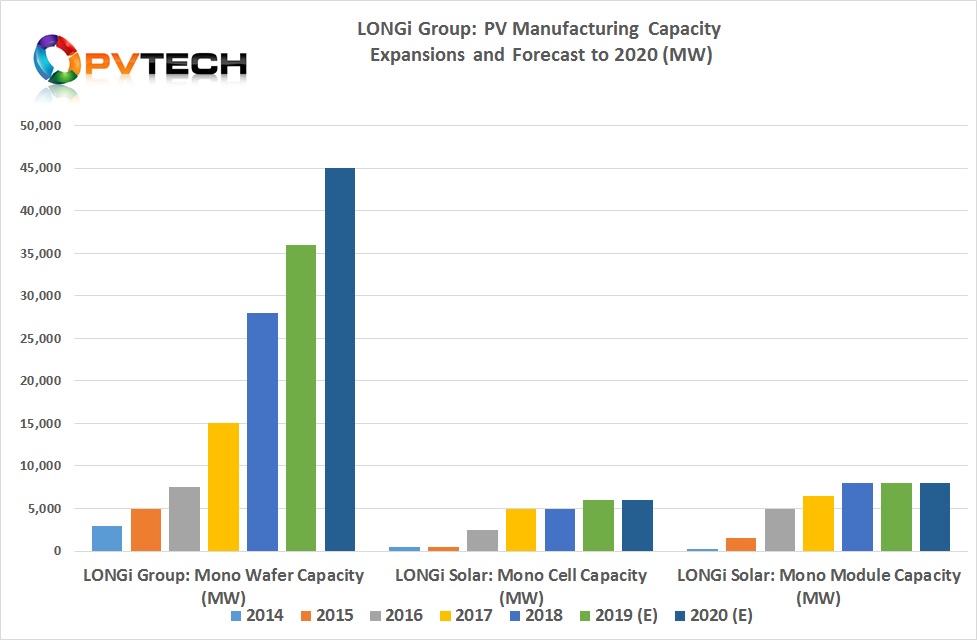

The company had previously announced that it had near-term plans to expand wafer production to 45GW by the end of 2020. The latest expansion announcements would take nameplate capacity to 38GW in 2019.