The slowdown of the global economy in 2020 is ultimately going to impact the guidance and forecasting offered by all PV manufacturers during the first couple of months of the year, prior to the effects of COVID-19.

COVID-19 is not simply a short-term blip in Chinese manufacturing plant utilizations, but something that affects all aspects of commerce globally. The impact on annual PV growth turning negative in 2020 has far reaching implications, not just for supply through the value-chain, but on how the PV technology roadmap could be altered quickly.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This article looks at the upside for a technology-buy cycle in the PV industry during 2020, as many of the previously-announced p-mono PERC cell/module expansions are put on hold and ultimately cancelled within China going into 2021.

The themes and data discussed in the article come just a few days after our in-house market research team released the April 2020 edition of the PV Manufacturing & Technology Quarterly report.

The release of the April 2020 report retains the 2020 aspirations of the manufacturing supply-chain but tempers this optimism with the reality of a sector that will likely see about one-third of expected 2020 supply simply not happening now.

Assessing the scale of lost-supply arising from COVID-19

Ultimately, everything upstream at the manufacturing side is contingent on overall end-market demand. Therefore, this issue has to be addressed, however hard it is to quantify at this time.

The first thing to state clearly is that forecasting is impossible today.

During the past decade – or at least since solar has been more than an annual 10GW industry – forecasting anything other than a few months out has been extremely difficult for market-leaders (with sales teams in every country/region globally) or remote market analysts that often rely on teams of 5-10 people at the most adding up guestimates bottom-up across 50-100 significant countries at any time.

Every year, forecasts offered in January or February each year, for the calendar year in question, tend to be at-best 20% correct, and almost always on the low side. Many are still counting 3-6 months the following year, trying to work out what market demand was the year before. The solar industry has been subject to constant policy and trade-related swings and roundabouts, and frequent chronic oversupply; it is fair to conclude that forecasting has in the past been challenging at best.

However, in 2020, it is absolutely impossible; at the company guidance level and for the industry as a whole. Almost all of the former methodologies used to forecast demand are invalid now. Let’s look now at a few of these, and I will explain why they are not relevant at this time.

Forecasting demand bottom-up by country is impossible for 2020. Trying to work out how COVID-19 will impact multiple end-markets in different ways, across rooftop and ground-mount segments, cannot be done by any research organization; nor the leading module suppliers with sales and marketing teams scattered around the world.

Also impossible is looking at upstream production guesses, even focusing on the 10-20 companies controlling supply across the value-chain from poly to module. Many of these companies in question have no idea what is happening outside their sphere of reference, and this includes the leading producers, not just the ones with smaller market-shares.

Finally, one of the back-of-the-envelope routes I have used in the past for reference has been to look at the likely module supplier market leader (in the past few years JinkoSolar), and project likely module shipments across six key regions globally, and then combine these supply volumes with the expected market-share of JinkoSolar, to work out overall supply levels for the year.

Using this method now for 2020 is also something that does not work.

Therefore, we need a different means of forecasting demand for 2020, knowing of course that whatever is forecast will be wrong, as things are simply too uncertain now.

However, there remains some validity to looking at countries where solar deployment will be less affected by COVID-19 lockdown constraints. Additionally, we are in a solar world today where China is in total control of production across all c-Si value-chain segments (and c-Si is 95% of the industry), and where China is still the largest end-market by some margin.

Therefore, what happens for the rest of 2020 is almost certainly going to be defined by two factors: how much China produces (from polysilicon to modules, including China-owned Southeast Asia facilities), and – crucially – how much China is ‘allowed’ to deploy domestically (via additions mandated at the provincial level).

Like many other years in the solar industry, how much China’s provinces want to protect manufacturing could simply be what defines the metrics the rest of the world is left to deal with (in particular module pricing levels and profit margins).

China and non-China top-down projections for 2020

Prior to COVID-19, 2020 was shaping up at another bumper year for solar. Demand was booming in many regions formerly making up the noise as emerging markets. Europe was on a post-incentive upward curve again, the US had utility-scale pipelines several years out, and large-scale solar had moved to site sizes formerly unheard of.

It was more than likely the PV industry would have seen strong growth to something close to the 150GW level of new additions, with forecasts during the year moving from 120-130GW to the final 150GW figure.

Very roughly, this 150GW was split into 40GW in China and 110GW from the rest-of-the-world. Variations existed to this approximation, at the +/- 10-15% level, but overall, this was the broad consensus.

In typical bullish exuberance, the supply side was more geared to a 170GW industry, and this would have naturally seen pricing and costs continue to fall at the 10-20% level by year-end.

Many of the countries that made up the non-China 110GW of demand for 2020 are 100% supply markets; that is, they have no manufacturing sector, or a tiny amount of module production at best (such as in India).

If demand in these (non-manufacturing) countries collapses in 2020, there is no manufacturing segment at threat. Therefore, much of the build activity can simply to pushed out to 2021 and this in many cases is simply what will happen.

China however cannot afford such a moratorium, domestically and (especially for those module companies that have worked so hard in recent years to have strong overseas market-share) in key end-markets such as India, Australia, Europe and the US.

Therefore, the big loser in the end-market falling significantly from the prior forecast level of 150GW is China, and specifically its manufacturing segment. For most of the companies outside China, their involvement in solar these days is downstream. They can live with a pause in build activities for a year or so. And when 2021 comes around for them, they will be more than happy with the pricing of modules on offer and an energy sector in which solar has become even more competitive.

Let’s return now to what then could happen to 2020 demand.

The quick-forecast approach assumes there is a massive 2H’20 deployment surge in China, taking 2020 China deployment to around 50GW. This is required simply to keep life in many of the Chinese producers, and often if China wants, China gets.

The rest-of-the-world could easily fall by 50% from the previous 110GW level to around 55GW.

This puts 2020 demand at 105GW, with China very close to half global demand.

Should this happen, there are some obvious consequences. Pricing will collapse through the entire c-Si value-chain, and not recover going into 2021. Many of the Chinese module makers will cease operations. It should be noted that shake-out has occurred in China in the past couple of years for polysilicon, ingot, wafer and cell production.

The other obvious operational change this year will be cost-reduction: or, as will be heard time and again on conference calls, cash preservation. Nothing strange here. We have been here before in the PV industry.

Memories of 2012

The last time the PV industry had a major downturn was 1H’12, or more specifically March/April 2012. This happened just after the European market finished its free-for-all FiT opportunities, and came on the back of massive Chinese cell/module expansions the previous few years.

At this time, the industry was dominated by p-multi standard (Al-BSF) cell production. There had been no major drive to introduce new c-Si technologies until then within the industry (other than niche plays by SunPower and Sanyo).

What then happened in the sector was several years of ‘cash-preservation’ and eking out costs across manufacturing plants. By the time this had been exhausted, LONGi had created the new mono-wafer landscape that ushered in p-mono PERC as the mainstream technology today.

Therefore, the previous sector downturn of 2012 did not cause any downturn-driven technology-buy cycle, as is seen in many other adjacent technologies, most notably semi.

One could argue that the 2012 PV industry was not ‘ready’ to do any technology change; it was a low barrier to entry, multi-wafer dominated sector. Few companies had meaningful R&D departments. Many defaulted to European equipment suppliers or research institutes to guide them on changing process flows in manufacturing.

Today, this is not the case. R&D is now far more owned by the leading (Chinese) companies in the sector, and we entered 2020 on the back of a process-change frenzy that left panel users rather confused what was coming next!

Could this be n-type’s key year in the industry?

Interestingly, as 2020 started, n-type was just starting to get prioritised by the industry leaders (JinkoSolar, Canadian Solar, Trina Solar for example). This came of course amid a fanfare of (lesser known) Chinese companies announcing multi-GW-scale n-type (especially heterojunction) plans of sorts, many of which are somewhat vague and no more than provincial MoUs that will go nowhere.

It was always going to be companies like Jinko, Canadian and JA Solar that were going to set the n-type transition alive, ultimately forcing all others to get on board or be left behind.

Therefore, the 2020 industry downturn is very different to 2012, as technology change can now happen, and very possibly will. It could effectively be the first sector downturn-driven technology-buy cycle, with n-type finally moving to multi-GW scales.

Let’s look now at n-type production. This is key, as the capacity announcements (which many industry observers seem adamant to add up, in legacy PV thin-film style) are nothing more than smoke and mirrors.

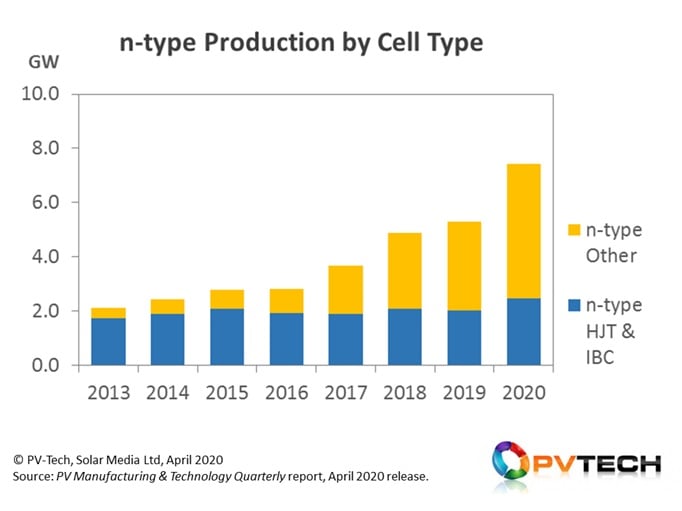

The figure below shows n-type production between 2013 and 2019, with a forecast for 2020. Here, I have split out n-type production for the more advanced n-type architectures (heterojunction and back-contact) and all-other types. The ‘Other’ grouping is where we find n-type process flows similar to p-type cells, typically assigned to n-PERT, TOPCon and other acronyms borrowed from academic circles.

The main uptick in production is forecast for 2020, and has a large contribution from Jinko’s new n-type lines.

It should be noted that the HJT & IBC bars are somewhat misleading, as Panasonic’s mothballing of lines is compensated to a large extent by the growth from new HJT proponents, most notably Hevel in Russia.

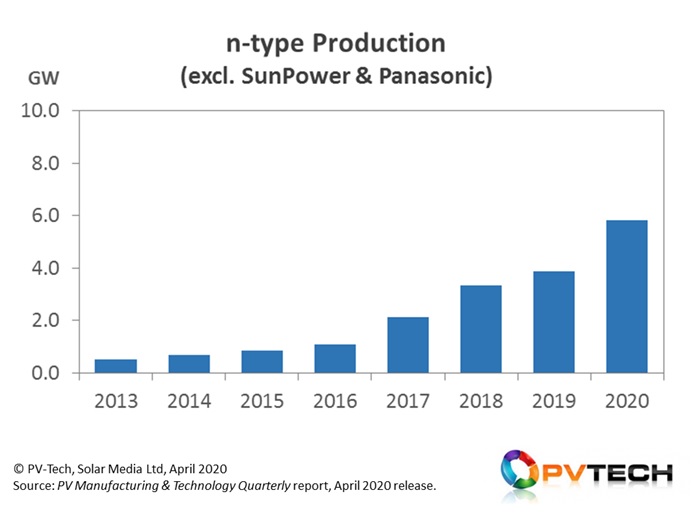

In fact, it is much more intuitive to remove SunPower and Panasonic from the equation when looking at the 2013-2020 period here. As noted above, Panasonic is largely a legacy play with regards PV manufacturing. Whether SunPower does or does not spin out its IBC manufacturing remains an open question, and it is not inconceivable that IBC simply becomes a technology of the past going into 2021.

So, it definitely helps to remove SunPower and Panasonic production data, as this shows the ‘new’ growth trajectory of n-type more clearly. The figure below reflects these trends.

The forecast for 2020 is largely based on plans put in place at the end of 2019, and based on known new capacity ramps during Q1’20. Running alongside this of course are 10’s of GWs of announcements from Chinese companies for HJT factories. However, as noted above, some degree of reality checking is needed here.

Many of the companies announcing MoUs are no more than aspirational; most have never invested in R&D other than a token gesture. For these companies, simply getting one production line running would be a miracle, far less building a multi-GW factory based on a technology that still has much to be ironed out in production.

Therefore, the real impact of a technology-buy cycle driven by the top-10 module suppliers in China may not be seen from a production standpoint until 2021. However, just the fact that more of these leading players are moving on 500MW-to-1GW of new n-type capacity is probably the best leading indicator that n-type could be the real next-thing after p-mono PERC.

Understanding the n-type landscape today

For equipment and material suppliers looking to align with the n-type movers, it has been difficult work in the past few years, with many false starts and unfulfilled promises. Knowing which half-dozen companies to engage with on n-type ramps over the next 12 months will be key, not just for supplier revenue streams, but also in these companies playing an essential part in production line ramps.

The latest release of the PV Manufacturing & Technology Quarterly report contains full details of these key companies. Details on how to subscribe to this report can be found at the link here.