New solar manufacturing facilities show higher rates of product defects, PV Tech has heard.

In an interview published today with Jeorg Althaus, director of engineering services and quality assurance at Clean Energy Associates (CEA), we heard that new facilities see “low output” and higher “defect rates” regardless of their geography.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Lower output is to be expected as facilities ramp up and new personnel are trained on new machinery – albeit largely automated – but the defect issue is more concerning.

“Regardless of whether it’s in China or Southeast Asia or the US, when you buy from a new production line, there is a ramp-up phase; new machines, new people,” Althaus told us.

These insights come at a time when the solar PV supply chain is in the process of realigning.

Chinese producers are struggling amid low prices and tight margins, brought about largely by overinvestment and the subsequent overcapacity of PV production potential. Chinese-backed manufacturing bases in Southeast Asia are also shutting down in the wake of the US’ antidumping and countervailing duty (AD/CVD) tariffs and large new facilities are being built in the Middle East.

Simultaneously, the US, India and, latterly, the EU, are pushing to support new PV manufacturing capacity to reduce their reliance on Chinese producers for strategically important energy infrastructure.

Althaus’s comments suggest that these shifts – the latest twist on what has become known to some as the “solarcoaster” – expose the industry to more potential pitfalls in module reliability and quality.

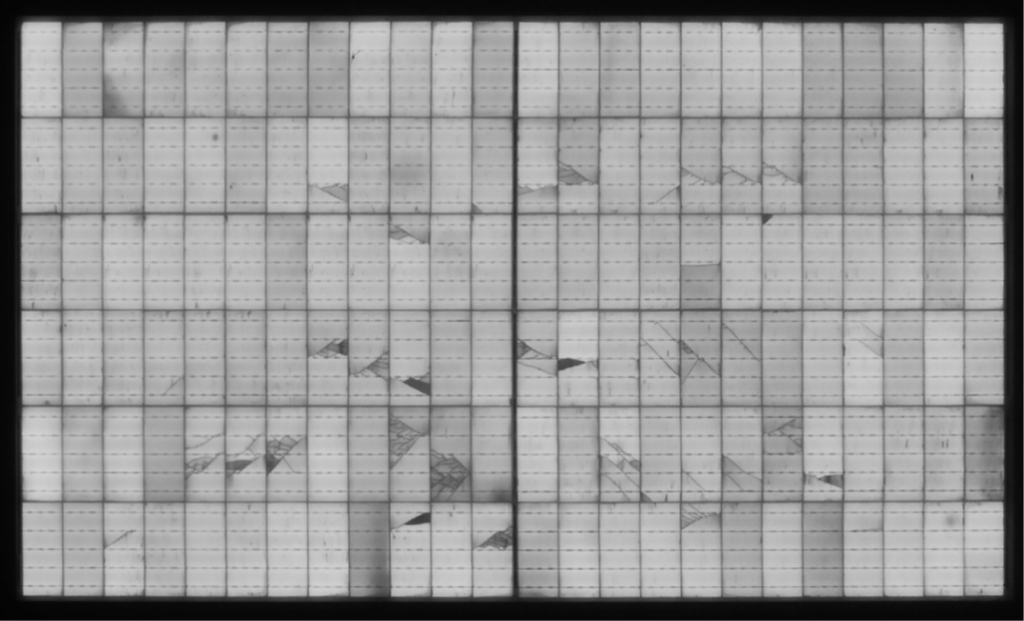

Recent reports have borne this out. Research released by Kiwa PVEL showed that 83% of PV modules failed under stress testing, and Tristan Erion-Lorico, VP of sales and marketing at Kiwa PVEL, told PV Tech Premiumthat cost-cutting is affecting the quality of modules.

Moreover, recent data from kWh Analytics shows that hail, worsened by thin glass, accounts for over 70% of financial losses from US solar PV plants, despite accounting for just 6% of loss incidents.

As well as new locations introducing uncertainty, Althaus suggested that quality assurance at some facilities is less thorough on the night shift than in the daytime. Third parties tend to visit sites during working hours, which opens up some of the production at 24-hour manufacturing facilities to less-than-ideal scrutiny.

You can read our full, premium interview here.