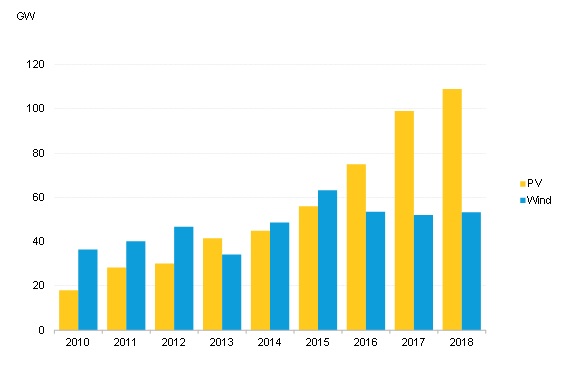

According to provisional data from BloombergNEF (BNEF), global solar PV installations reached 109GW in 2018 as the cost of installing a megawatt of photovoltaic capacity fell 12%, which spurred markets outside China to increase installations.

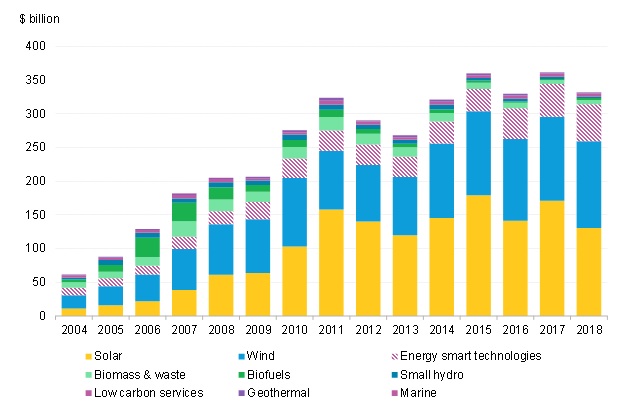

BNEF noted that global investments in the solar sector had declined by 24% to US$130.8 billion in 2018, primarily due to a sharp decline in capital costs, which were driven by solar policy changes in China, under the 531 New Deal, creating surplus product supply.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Jenny Chase, head of solar analysis at BNEF, commented: “2018 was certainly a difficult year for many solar manufacturers, and for developers in China. However, we estimate that global PV installations increased from 99GW in 2017 to approximately 109GW in 2018, as other countries took advantage of the technology’s fiercely improved competitiveness.

Despite the 531 New Deal for solar in China, BNEF noted that China was again the leader in overall clean energy investments in 2018. However, at US$100.1 billion, this was was down 32% on 2017’s record figure because of the plunge in the value of solar commitments, according to BNEF.

BNEF reported that the US was the second-biggest investing country for clean energy in 2018, increasing 12% to US$64.2 billion. This was said to have been driven by wind and solar developers, increasing the pace of investments ahead of the decline in tax credit incentives in the next few years.

Europe experienced a strong rebound in overall clean energy investments, which increased 27% to US$74.5 billion, supported by the financing of five offshore wind projects in the billion-dollar-plus category, BNEF said.