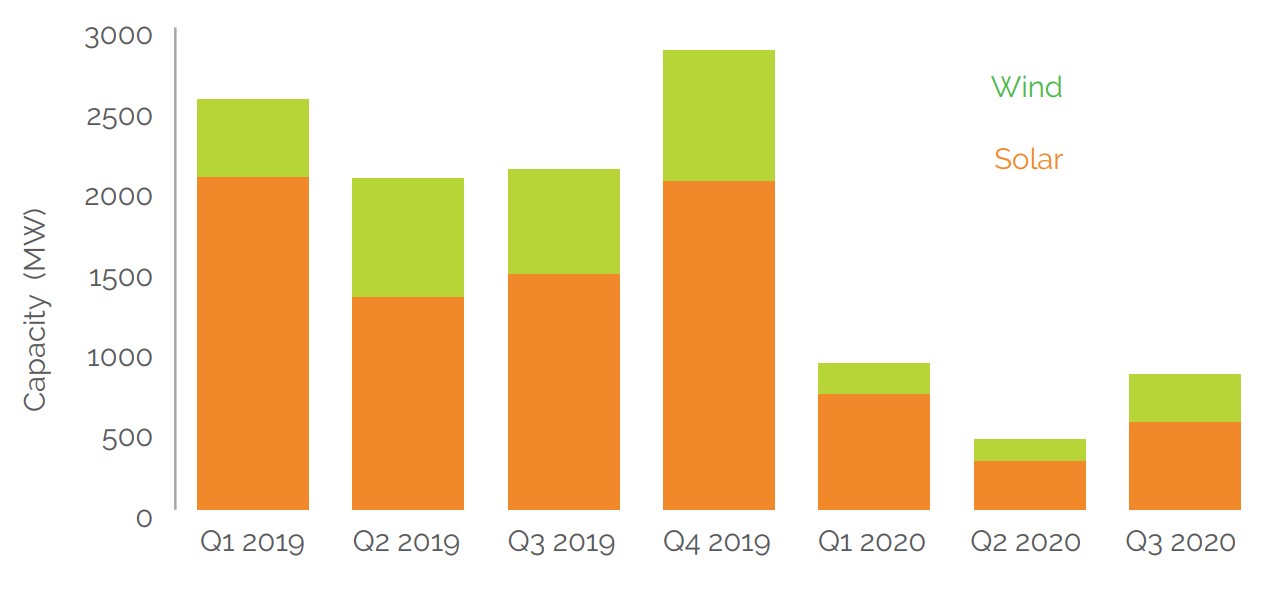

Despite recording a 70% year-on-year reduction in utility-scale solar installations in the first nine months of 2020, India’s renewable energy market is beginning to show signs of improvement, figures from JMK Research & Analytics reveal.

About 1.4GW of utility-scale PV capacity was added in the country between January and September 2020 as COVID-related disruptions derailed project construction earlier in the year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

With India ramping up development efforts to reach its 100GW solar generation capacity objective by 2022, JMK originally anticipated 8GW of new solar installations this year – a figure that has now been revised to just 2.8GW.

The consultancy notes, however, that the market is recovering, with 545MW of solar capacity installed in Q3, an 80% increase on the previous quarter.

Installation activity is set to further pick up in the fourth quarter as shipments of solar equipment in the country increase. Figures from JMK show 1.5GW of string inverters and 1.5GW of central inverters were supplied in India during Q3, while the country received 2.7GW of modules. These shipment numbers are almost double the figures from Q2 2020.

Those shipment figures would appear to back up projections included within the International Energy Agency's Renewables 2020 outlook, also published today, which show India to be among the frontrunners for renewables deployment next year as projects delayed by the pandemic begin to complete.

With a 30% market share, LONGi was the main supplier of modules in the third quarter, according to JMK, followed by India’s Adani. Nearly 50% of the shipments were said to be high efficiency mono PERC modules.

While India currently ships most of the equipment used in solar projects from China, the country’s government is aiming to spur on domestic manufacturing through new production hubs as well as an extension of duties on Chinese imports.

In terms of cumulative installations across utility-scale solar and wind, as of September 2020 Adani is India’s leading player with a 2.8GW operating portfolio and another 11GW of projects in the pipeline, JMK said.

The consultancy now expects the solar sector to “pick up substantially” in the first half of 2021, with an estimated 2.5 – 3GW of new capacity to be added in the first quarter and 8.8GW of additions for the full year.

However, with India’s total installed solar capacity as of September 2020 standing at 36GW, the prospect of the country reaching its 100GW target by 2022 looks increasingly ambitious. Recent analysis from Wood Mackenzie said that without additional policy enforcement, that goal is unlikely to be reached.