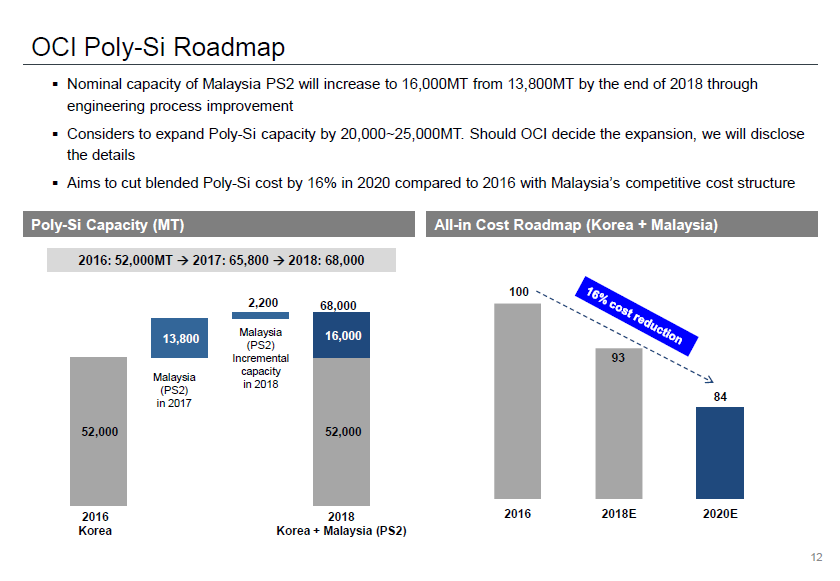

Major Korean-based polysilicon producer OCI Chemical is expanding its production of high-purity polysilicon to meet greater demand for P-type monocrystalline wafers used with PERC (Passivated Emitter Rear Cell) technology.

In reporting record third quarter results, OCI said that it would adopt a “two-track strategy” in regards to polysilicon production both in South Korea and the recently acquired facilities in Malaysia.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company said that its South Korean production of high-purity polysilicon for mono wafers currently only stands at around 42% of capacity. However, this will be increased to around 60% of production capacity in 2018.

OCI has around 52,000MT of polysilicon capacity in South Korea and its average product mix in 2017 for mono-quality polysilicon was said to be only around 35%.

Polysilicon production at its facility in Malaysia, recently acquired from Tokuyama is being expanded from a nameplate capacity of 13,800MT to 16,000MT per annum by the end of 2018, through upgrades and debottlenecking and engineering process improvements.

Production in Malaysia would address markets for high-efficiency multicrystalline wafers competitive cost markets for mono wafers. OCI also aims to cut blended polysilicon costs by 16% by 2020, due to Malaysia’s competitive cost structures.

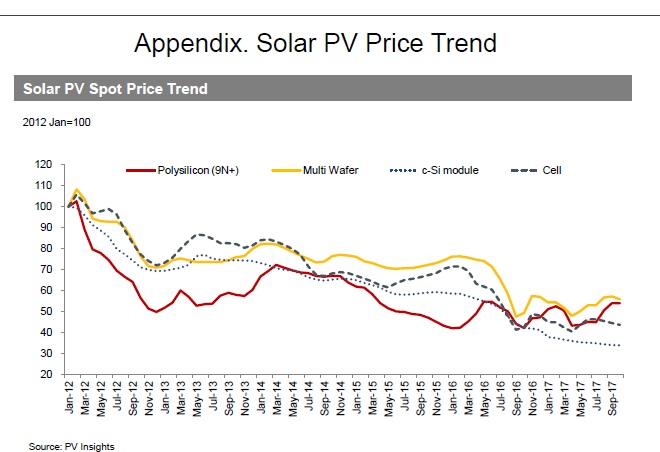

OCI group sales in its Basic Chemical division, which includes its polysilicon operations, increased 27% in the third quarter of 2017, driven by a 13% ASP increase from the second quarter of 2017.

The ASP increases were due to polysilicon shortages in China as plants undertook annual maintenance and the reported forced closure of several polysilicon refineries, due to environmental issues.

Recently, China-based polysilicon producer Daqo New Energy reported third quarter revenue of US$89.4 million, an increase of 17.6% from the prior quarter, noting that the supply of polysilicon has not kept up with strong end-market demand.

As a knock-on result of the shortages, the majority of PV module manufacturers in China have been impacted by a spike in polysilicon prices since the start of the third quarter, impacting margins as wafer ASP’s also increased.

OCI also noted that demand for polysilicon in China remained strong into early next year. OCI is undertaking annual maintenance of its Korean plants in the fourth quarter of 2017.

Daqo’s management noted in its most recent earnings call that it expected overall mono wafer capacity to exceed 50GW by the end of 2018, requiring around 200,000MT of high-purity polysilicon.

PV Tech has extensively covered the major shift away from multi to mono wafer usage, driven by LONGi and more recently Tongwei, to push the industry to high-efficiency cells and modules.

Chinese authorities are also expected to announce soon possible increases in duties on Korean polysilicon imports, which could maintain the higher ASP’s should demand remain strong in China.

is more than 50 gigawatts of wafer supply, which means about – actually need at least 200,000 metric ton polysilicon just for those usage.