According to the latest data from the Silicon Industry Branch of the China Nonferrous Metals Industry Association, the lowest transaction price for mono dense material has dropped to RMB33,000/ton (US$4,535), a 43% decrease from the price at the beginning of 2024, setting a new low for the year.

It is not only much lower than that of the beginning of the year (RMB58,100/ton), but also falls below the production costs of a number of companies, triggering widespread concerns in the industry.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

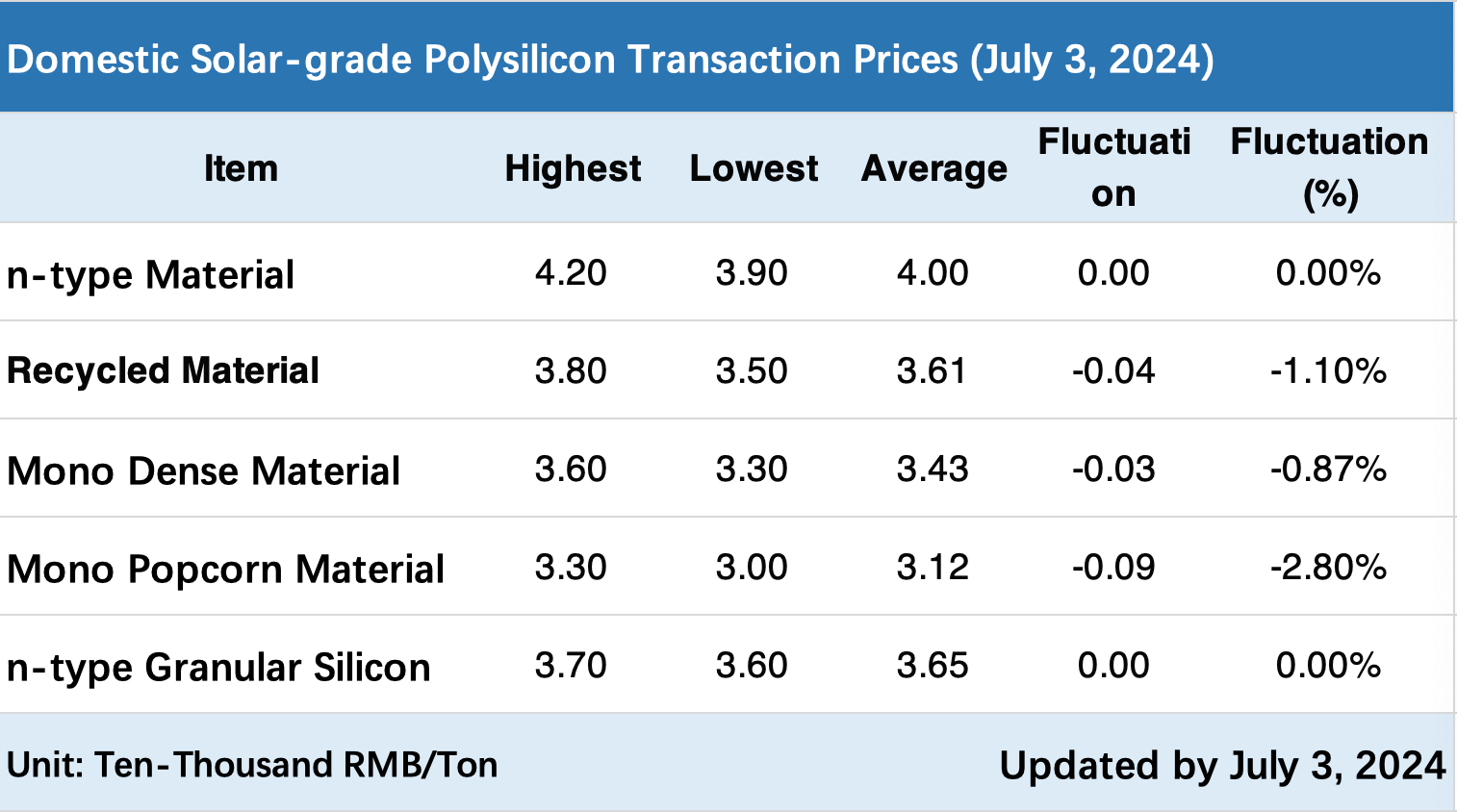

On 3 July, the Silicon Industry Branch updated the polysilicon prices: the transaction price for n-type ingot silicon was RMB39,000-42,000/ton, averaged at 40,000RMB/ton, which was flat month-on-month; the transaction price for mono dense material was RMB33,000-36,000/ton, averaged at 34,300RMB/ton, a decline of 0.87% month-on-month.

The transaction price for n-type granular silicon was RMB36,000-37,000RMB/ton, averaged at RMB36,500RMB/ton, flat month-on-month.

Pricing concerns

According to the Silicon Industry Branch, current silicon prices have already deviated from cost-based pricing logic, and all companies are in the red. To maintain cash flow, companies are taking various measures to minimise losses as much as possible. Most companies have chosen to suspend production and maintenance temporarily. Some have opted to develop differentiated products. A small number of companies, relying on their financial strengths, are operating at full capacity to reduce costs.

The wafer sector is experiencing mixed gains and losses. According to the Silicon Industry Branch in early July, the average transaction price of n-type G10L mono wafers (182 x 183.75mm/130μm/256mm) rose to RMB1.12/piece, an increase of 0.9% month-on-month; while the average transaction price of n-type G12R mono wafers (182x210mm/130μm) fell to RMB1.31/piece, a decrease of 9.66% month-on-month. The average transaction price of n-type G12 mono wafers (210×210 mm/150μm) remained at RMB1.65/piece, flat month-on-month.

The Silicon Industry Branch pointed out that the main reason for current price fluctuation is the temporary supply tension of small-size wafers during the transition from G10L to G12R.

On the supply side, the July wafer output is expected to be 50-52GW, which is essentially flat compared to June. The increase mainly comes from Gokin Solar and TZE (TCL Zhonghuan Renewable Energy Technology CO., LTD.), with a month-on-month increase of about 9.7%, while other companies have reduced production to varying degrees or even suspended production.

Looking at the cell segment, the price of M10 mono TOPCon cells is maintained at RMB0.30/W. As second and third-tier cell companies continue to reduce production, the current cell inventory is down to less than one week, which is reasonable. As for the module segment, the price of 182mm TOPCon bifacial glass-glass modules is maintained at RMB0.86/W.

According to data from China’s National Energy Administration, new installations in May were 19.04GW, a 32.5% year-on-year increase. Domestic installation demand is expected to remain strong in Q3. In addition, the aftereffects of overseas policy risks have subsided. As industry demand picks up, the Silicon Industry Branch estimates that these factors may provide support for module prices.