On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

This seemingly ordinary tender became a market benchmark because of the record-breaking transaction prices.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

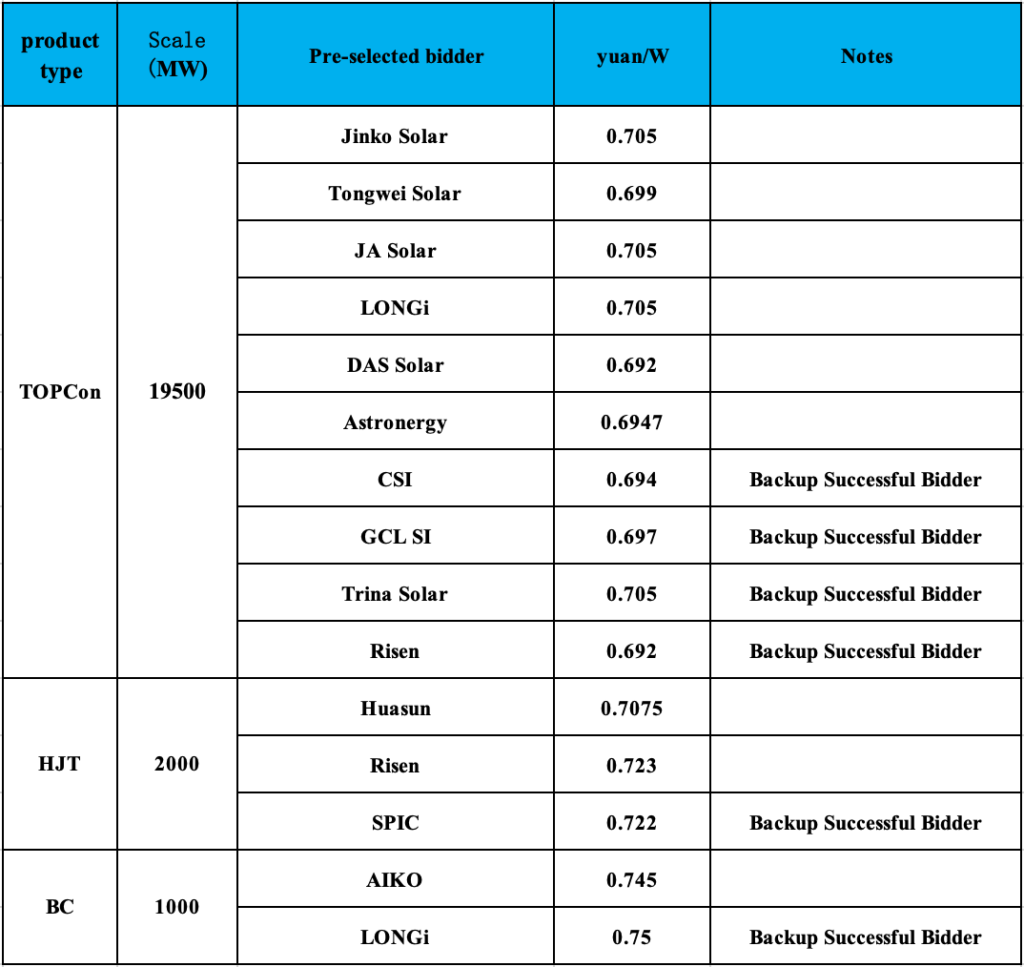

Among the results, the winning bid for the 19.5GW tunnel oxide passivated contact (TOPCon) module in Lot 1 was RMB0.692-0.705/W, while the 2GW heterojunction technology (HJT) module in Lot 2 was priced at RMB0.7075-0.723/W and the 1GW back contact (BC) module in Lot 3 reached a high of RMB0.745/W.

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.”

LONGi was quoted at RMB0.75/W for its BC modules, as shown in the table above.

On the same day, a 6GW project by Jinneng Holding was awarded a price of RMB0.72/W. The company plans to procure 6GW of bifacial glass-glass TOPCon modules.

Towards market-oriented bidding

Behind these figures lies a “price curve” driven by policy. In February this year, China’s National Development and Reform Commission issued the ’Notice on Deepening the Market-Oriented Reform of New Energy Feed-in Tariffs to Promote High-Quality Development of New Energy’.

The document set 1 June 2025 as a policy turning point; after this date, new projects will fully implement market-oriented bidding, and PV power plants that lose the guarantee of fixed feed-in tariff will have to face the risks of uncertain returns.

This triggered a rush among developers, with distribution companies rushing to take orders, speeding up production and racing to meet grid connection targets. Module orders flooded manufacturers like a deluge.

The collective rush to install has led to a surge in module prices. After the winning bid prices of leading companies rose, second- and third-tier manufacturers also followed suit, fueling a spiral of rising prices. For example, the transaction price of BC modules, which reached RMB0.75/W, had risen by more than 20% since the beginning of the year.

It is worth noting that although the current price of China’s n-type modules has surpassed the 0.75 yuan/W mark, polysilicon prices have remained relatively stable, as shown in the graph below.

According to data from the Silicon Industry Branch on 12 March, the transaction price for n-type recycled material this week was RMB39,000-46,000/ton, with an average of RMB41,700/ton.

The transaction price for n-type granular silicon was RMB38,000-41,000/ton, with an average of RMB39,000/ton. The transaction price for p-type polysilicon was RMB32,000-36,000/ton, with an average of RMB34,000/ton.

The Silicon Industry Branch stated that the pace of this round of rush installation has been too fast, with price adjustments mainly reflected in the module sector. Due to the substantial polysilicon inventory, it is challenging for the price increase to be transmitted to the silicon sector. At this stage, companies are mainly focusing on stabilising prices and reducing inventory.