Tax credit transference measures introduced under the Inflation Reduction Act have led to billions of dollars of new investment in solar and other clean energy projects. Alfred Johnson and Katie Bays look at some of the risk mitigation and due diligence best practices that can reduce the complexity and cost of tax credit transactions.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The 2022 Inflation Reduction Act (IRA) is the biggest investment in clean energy in history. It makes principal use of tax credits to drive investment in clean energy projects such as solar and storage. Importantly, the IRA established a new tool to efficiently monetise clean energy tax attributes — the ability to sell, or transfer, their Investment Tax Credits (ITCs) to an unrelated third party for cash. Transferability has emerged as a powerful new mechanism to drive investment into clean energy infrastructure.

In the 13 months since credit transfers began to take place, tens of billions of dollars of new investment has flowed into clean energy and decarbonisation projects across the United States. The IRS finalised rules for the tax credit transfer market on 25 April 2024, largely affirming the draft guidance that set the market in motion a year ago. These final rules kicked off a wave of new interest among tax credit buyers and sellers and supported the growth of the tax credit market. With increasing participation comes market competition and, ultimately, deal standardisation.

Transaction due diligence and standardisation

In June 2024, Crux surveyed nearly three dozen of the most experienced legal, tax, and financial advisors and insurers, with experience across hundreds of tax credit transactions. Collectively, the firms interviewed have represented parties in the overwhelming majority of transactions in the emerging transferable tax credit market. The results of this research are published in Crux’s Due Diligence and Risk Mitigation white paper [1]. Crux’s research revealed several important findings.

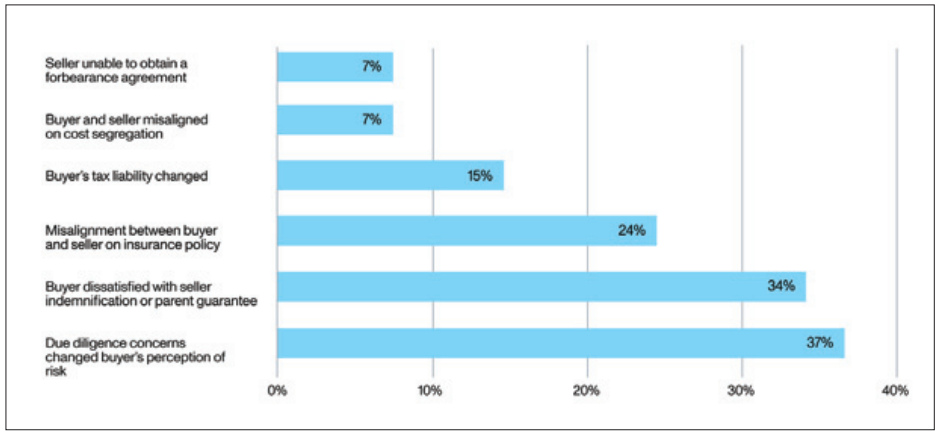

First, deal transparency and up-front alignment on due diligence drive successful transactions. Early alignment between buyer and seller in the due diligence process is crucial for ensuring successful and efficient transactions. According to the survey, nearly 40% of advisors found that due diligence has been a cause of transaction delays. Over 70% of advisors indicated that buyer education is the most important driver of a smooth transaction, while 66% emphasised the importance of seller preparation for due diligence.

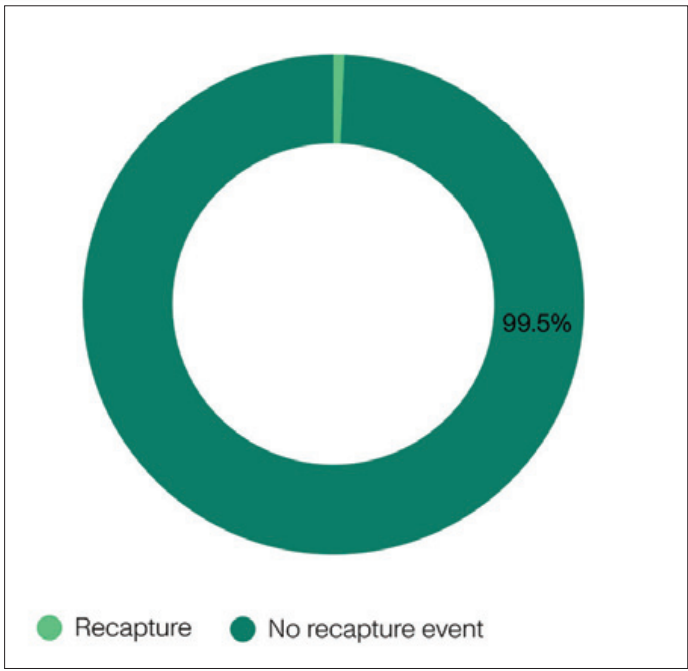

Second, key transaction risks are increasingly well understood by market participants and advisors. The primary risks in tax credit transactions include recapture, eligibility and qualification issues, and basis/excessive credit transfer risks. Across more than 500 transactions, advisors report that recapture has occurred in about 0.5% of historical tax credit and tax equity deals; approximately 80% of advisors who responded to our survey indicated they had never seen a recapture event, highlighting its rarity. Most observed instances of recapture were partial events, related to weather damage. Still, these risks remain important considerations for buyers who need to assess and mitigate them appropriately.

Finally, we found a growing consensus among advisors regarding risk mitigation. There is increasing cohesion among law firms, tax advisors, financial institutions and insurance brokers regarding the essential due diligence items and most commonly negotiated deal terms in tax credit transactions.

Finding 1. Transparency drives better deal outcomes

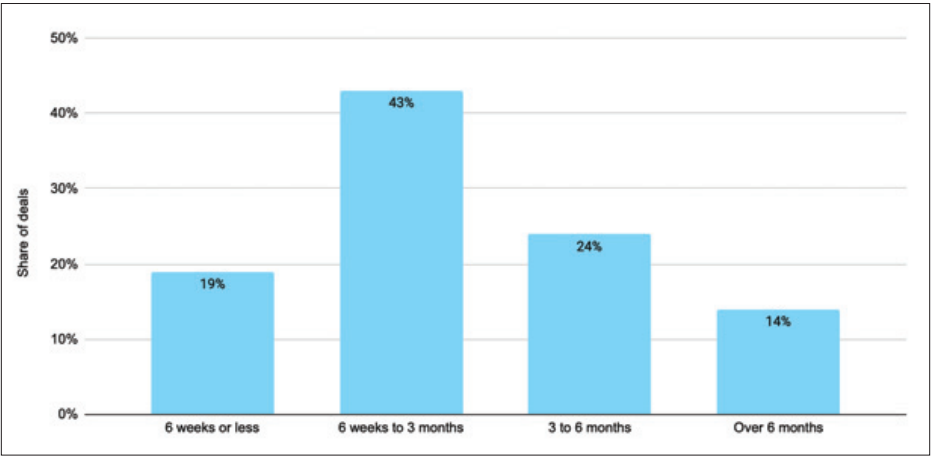

Tax credit deals are, at their core, commercial transactions that look to proper diligence to price risk, insurance, indemnities and guarantees to provide buyers’ financial security. As such, due diligence is an important part of the tax credit transaction process. Crux has observed that well-prepared parties are able to transact in as little as 3-4 weeks when both parties are aligned on the due diligence process and the seller is prepared to furnish the required items. In Crux’s 2024 Mid-Year Market Intelligence Report [2], which was based on US$6.8 billion in 2024 tax credit deals, sellers reported that over 60% of ITC transfer deals closed in under 3 months.

Traditionally, tax equity partnership deals would typically take much longer, around six to nine months. Legal fees for transfers are also somewhat reduced — Crux is observing legal expenses on standalone ITC transactions to be 30-50% of what might be typical for similarly sized traditional tax equity deals.

However, despite more efficient processes and lower legal fees, due diligence can contribute to transaction delays, particularly if parties are not prepared or are misaligned in their expectations. According to Crux’s survey of financial, legal and tax advisors, due diligence was the cause of a transaction delay in nearly 40% of cases.

Early alignment between parties on the proper scope of due diligence can help keep the transaction on track. Crux has developed a market-validated due diligence checklist by tax credit type to support efficient tax credit transactions and each transaction is supported with a robust data room. Developers and manufacturers, tax credit buyers and intermediaries on the Crux platform utilise this checklist to efficiently execute tax credit transactions. Crux’s standardised data room and transaction management software is informed by billions of dollars of deal activity.

To date, Crux has over US$12 billion of credits listed for sale and US$6 billion of bids have been placed in calendar year 2024. As the volume of deals closed on Crux continues to accelerate, we gain more perspective on what leads deals to succeed or fail. Crux’s tools are designed to streamline the transaction process and ensure that risks are identified and mitigated effectively.

Finding 2. Advisors are increasingly aligned on a discrete set of transaction risks

Unlike a tax equity partnership, where the buyer is an active investor in the project for a period of years, a tax credit transfer conveys a more discrete set of risks. Our survey data revealed a clear and concise list of the risks that advisors identify as most important: issues of eligibility and qualification, risk of excessive credit transfer and risk of recapture (particularly, but not exclusively, for ITCs).

Project eligibility and qualification

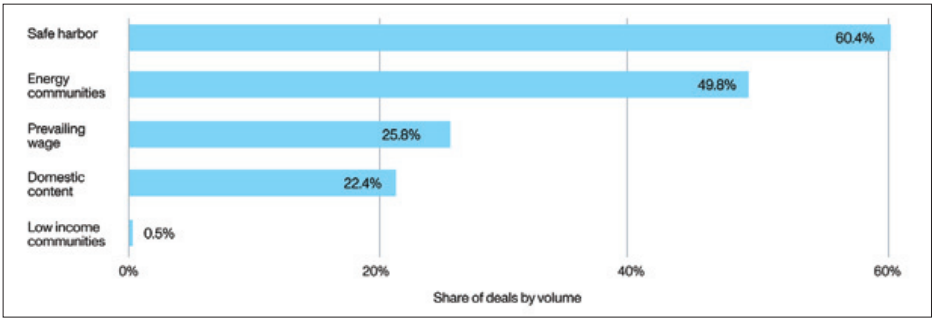

Eligibility for tax credits and any bonus adders is a critically important component of the due diligence process. Eligibility analysis is becoming more central to many advisors’ analysis as the safe harbour windows for certain common bonuses, including the PWA bonus adder, lapsed in 2023. Projects must justify the base tax credit that they are claiming and must demonstrate qualification for any bonus adders. Crux has found that the majority of tax credit transactions in 2024 included the safe harbor and/or another bonus adder.

Due diligence processes will evaluate any bonuses claimed (or eligibility for the safe harbor). Legal memos and opinions may be used by some advisors to substantiate these points, but project developers should expect buyer’s counsel to directly review any materials needed to substantiate tax credit and bonus eligibility. Additionally, new guidance from the IRS on compliance with PWA, the domestic content bonus and ongoing guidance on the energy communities bonus all inform advisors’ review of projects’ eligibility.

Excessive credit transfer and step-up in basis

If a tax credit buyer is determined to have claimed tax credits in excess of the amount a project is eligible to generate or a seller is entitled to sell, the buyer is subject to an excessive credit transfer tax. The tax is equal to the amount of the excessive transfer plus a 20% penalty. If the seller retains a portion of the tax credit, the excess transfer amount is first reduced by the retained portion of the tax credit.

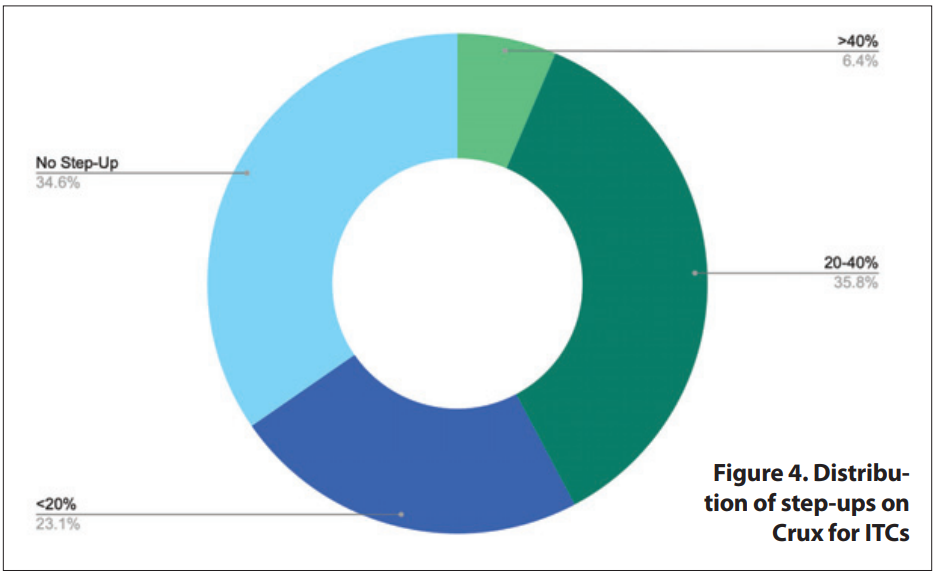

Advisors indicated that they often viewed a project’s step-up in basis through the lens of the risk of excessive credit transfer. As such, advisors tend to scrutinise ITC step-ups with care. Project valuation requires careful and fact-specific analysis. Advisors note that they tend to conduct the most detailed analysis in cases where the seller seeks to transfer all credits, rather than retaining a portion, which would help defray the risk of an excessive tax credit transfer penalty.

Projects may take on an equity investment from an unrelated third party before entering service and, in doing so, step up the project’s cost basis (and ITC value) to fair market value (FMV). Step-up in basis is relatively common in transfer deals. About 65% of ITCs on Crux have a step-up in basis. The majority of all ITC deals (59%) have a step-up under 40%, meaning that the FMV of the investor partner’s project investment increases the cost basis of the ITC by less than 40%.

Crux for ITCs. Chart: Crux.

Cost segregation reports are an important due diligence item for justifying the ITC basis and may inform a third-party appraisal. The appraisal and cost segregation collectively inform the project’s new ITC basis in the case of a step-up in basis. In all cases where a tax credit value is determined based on FMV, advisors are likely to look at the quality of the appraisal, the methodology used by the appraiser and the reputation of the appraiser. A variety of methods may be used by appraisers, including an income approach, cost approach and/or market approach (informed by comparison with comparable projects).

Tax credit recapture

ITCs are subject to the recapture rules currently outlined in Internal Revenue Code (IRC) Section 50. IRC Section 50(a)(1) generally allows for the recapture of some amount of the ITC claimed if, during any tax year, investment credit property is disposed of or otherwise ceases to be investment credit property. The recapture period begins when the project is placed into service and vests proportionally over five years.

Recapture risk follows the ITC, even if it is sold. In final guidance regarding tax credit transferability, the IRS confirmed that the tax credit buyer (the “transferee”) is proportionately liable for recapture of any transferred tax credit. An exception exists in the event that a partner or S corp shareholder has disposed of their interest, in which case the partner/shareholder retains the liability for recapture.

Recapture is a primary risk that tax credit buyers seek to manage, but it is nonetheless a rare event. According to Crux’s survey of advisors, representing hundreds of tax credit transactions across tax equity and transfers, recapture has historically occurred in less than 0.5% of transactions. Approximately 80% of advisors indicated they had never seen a recapture event occur. The remaining 20% of advisors estimate that they had seen recapture occur in 1-2% of transactions. Those who had seen recapture events noted that they are very often partial recapture events, triggered by weather events, disposition of a partnership interest (in tax equity), or a component of a project coming out of service.

Finding 3. Consensus among advisors regarding risk mitigation for transactions

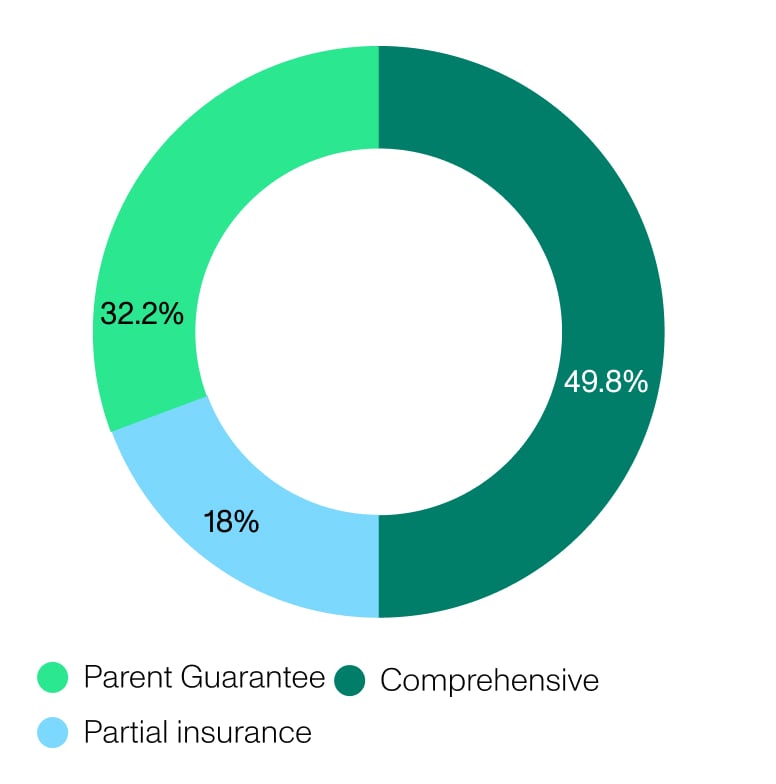

The most common means of risk mitigation in an ITC transaction is to obtain either third-party insurance or a parent guarantee to indemnify the tax credit buyer. Crux’s 2024 Mid-year Market Intelligence Report [2] found that buyers typically mitigate recapture risks on ITC transactions with third-party insurance (68% of deals) or with indemnification by the seller’s parent company (32% of deals).

Insurance policies for ITC deals typically cover the risk of recapture, the ITC basis (including any step-up), and eligibility for the underlying tax credit and any bonuses. The costs of these policies are typically covered by the seller. Sellers with high quality sponsors alternatively may be able to offer a parent guarantee to indemnify the buyer, which can help improve the economics of the transaction for the seller.

Conclusion

As the market continues to evolve, clean energy tax credits will continue to play a crucial role in financing the energy transition. Already, Crux’s research indicates that the market for clean energy tax credits could reach US$20-25 billion in 2024, more than double the estimated US$9 billion in deal activity in 2023. Clean energy developers of all sizes can participate in this robust and liquid marketplace to optimise the benefits of the tax credits their projects are entitled to receive.

References

[1] ‘Risk mitigation and due diligence – emerging standards for transferable tax credit transactions’, Crux, www.cruxclimate.com/tax-credit-risk-due-diligence-white-paper

[2] ‘2024 Mid-Year Market Intelligence Report’, Crux, www.cruxclimate.com/2024-midyear-market-report

Authors

Alfred Johnson is co-founder and CEO of Crux, the sustainable finance technology company changing the way clean energy and manufacturing projects are financed in the US. The company’s first offering is the platform for buyers, sellers and intermediaries to transact and manage transferable tax credits.

Katie Bays is a policy and research strategist at Crux. She has over a decade of experience in clean and conventional energy policy, finance and economics. She has worked extensively with large institutional asset managers advising on policy and political risk to energy companies and projects.