Several utilities – Tucson Electric Power (TEP), UniSource Energy Services (UNSE) and Arizona Public Services (APS) – in Arizona, the US, have released this week their Integrated Resource Plan (IRP), all seeking to increase their renewables capacity over the coming years.

Updated every three years, utilities have released their latest IRP – and filed it to the Arizona Corporation Commission – looking at the needs of their customers in the next 15 years, as well as how much new capacity will be required, which will primarily be coming from renewables as some utilities will be retiring coal-fired power plants in the coming years.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

All three utilities will be looking to add more renewables capacity to the electricity generation mix, of which both solar and storage will benefit the most in the coming years from the updated IRPs. Both technologies will be paired together in order for storage to store excess solar generation during the middle of the day and dispatch it during peak hours, alleviating demand when solar is no longer available.

Arizona is one of the sunniest states in the US with huge potential for the growth of solar PV. As of the end of the second quarter of 2023, the state had 6.6GW of solar capacity installed, according to data from trade association Solar Energy Industries Association (SEIA).

Compared to last year, Arizona climbed two positions and is now the fifth state with the most installed capacity, with SEIA expecting the state to add nearly 10GW over the next five years, the fourth most state to do so in that timeframe.

The total share of renewables towards net electricity generation in Arizona is slightly under the US average of 19.6%, with 17.6% as of the end of June 2023, according to data from the US Energy Information Administration.

APS seeks 3.5GW of utility-scale solar by 2030

With nearly 1.4 million customers and covering 11 of the 14 counties in Arizona, Arizona Public Services will require the most capacity in the coming years to keep on par with the demand. Currently the utility has 9.4GW of operational capacity – of which 784MW of utility-scale solar, nearly half of all renewables – and expects the need for 14.8GW by 2038.

Most of the current installed capacity from utility-scale solar is from projects of less than 20MW, with 16 plants, while only five have a higher capacity and only one plant surpasses 100MW, the Agave Solar with 150MW. The highest plant using solar is not a PV one but a concentrated solar power one with a capacity of 250MW.

As the utility plans to retire its two remaining coal-fired electricity generation in 2025 and 2031 respectively, it will be seeking to add over 6GW of solar and wind capacity, coupled with battery storage. For utility-scale batteries, the utility will limit to 3GW of added capacity until 2027, to mitigate risks associated with technology maturity. However, APS will review this limit as the industry improves the technology. Currently, it has 300MW of operational energy storage output.

During the period from 2024 to 2030, APS targets to add 8.5GW of supply-side resources, of which utility-scale solar will take the highest share with 3.5GW, while 1.4GW from distributed energy resources (DER).

The additional capacity will be sought through all-source request for proposals (ASRFPs). For instance, this year the utility sought at least 1GW of resources, of which 700MW from renewables, through an all-source request for proposals (ASRFPs), nearly similar to what it was seeking in 2022.

Distributed solar generation is also expected to continue its momentum of more than 100MW installed capacity per year in the future and will aim to purchase the excess electricity generated by rooftop solar. By 2038, peak resources of distributed solar is expected to be in excess of 750MW.

“As the amount of DER installed in APS’s service territory continues to increase, APS will be required to purchase increasing amounts of solar production that is not self-consumed by customers,” says the report.

Installed capacity from rooftop solar doubles the one from utility-scale with 1.5GW of rooftop PV at the end of 2022.

Tucson Electric Power to accelerate growth of renewables by 50%

Covering more than 445,000 customers in Southern Arizona, Tucson Electric Power’s updated IRP seeks to accelerate the growth of renewables compared to its numbers of three years ago, as it retires 892MW of coal-fired generation over the next nine years.

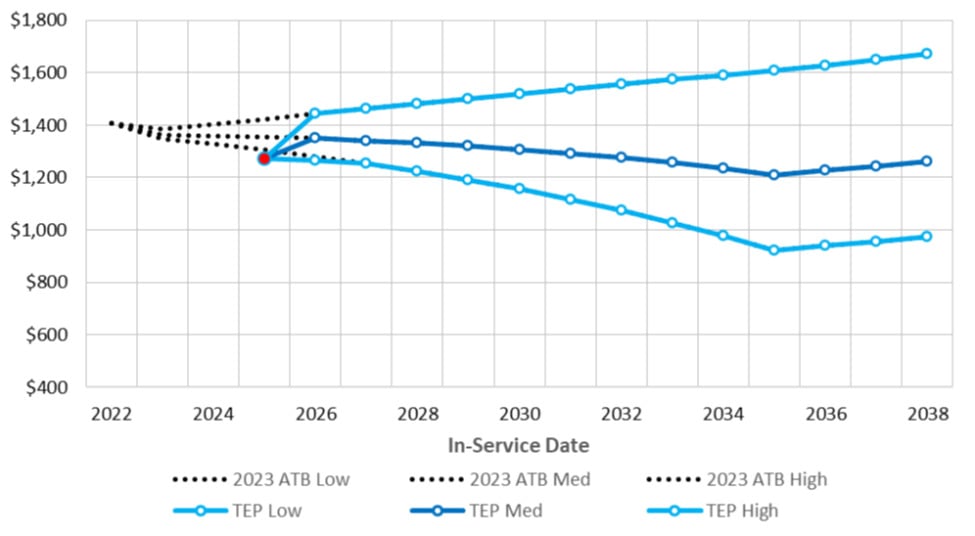

In 2020, the utility targeted to add 1GW of solar, wind and storage capacity additions by 2030, whereas in the 2023 IRP it is looking for 1.5GW, a 50% increase overall. Over the next 15 years, the utility aims to add 2.24GW of solar and wind generation, as well as 1.3GW of energy storage – for which it is currently building a 200MW/800MWh battery storage system, its largest and among the largest in Arizona, as covered by our sister site Energy-storage.news. Renewables will represent 90% of all new resource capacity needed by 2038.

“The path charted by this new IRP is not set in stone. In the near term, our resource mix may vary based on the outcome of all-source requests for proposals that will identify the best resources available on the market to meet TEP’s long-term goals. The process creates opportunities for developers to propose competing technologies that may prove more advantageous than those anticipated in the IRP. We’ll also file regular updates with the Arizona Corporation Commission to ensure we’ve accounted for changes and that we remain on the right track,” said Susan Gray, TEP’s President and CEO.

The utility issued its first ASRFP for new energy and capacity resources in April 2022 where TEP expects to add between 600-800MW of solar PV and energy storage by summer 2026.

UNSE to pair 225MW of solar with 225MW of 4-hour duration energy storage

UNSE is the smaller utility out of the three covered in this article. Its latest IRP – which provides electricity to the Arizonian counties of Mohave and Santa Cruz – is built upon the one made in 2020 and aims to add over 170MW – or 60% – more renewable and energy storage capacity by 2030. One of the major changes since the last IRP in 2020 was UNSE’s joining the real-time Western Energy Imbalance Market in May 2022, through participation with fellow Arizonian utility Tucson Electric Power.

Currently, UNSE owns 301MW of generating capacity and is looking to add 350MW of solar and wind capacity, of which 225MW from solar which would be paired with 225MW of energy storage systems by 2038. As the utility seeks to add more renewables to its portfolio, this is in response to the federal tax incentives from the Inflation Reduction Act (IRA) which would limit long-term costs, according to Susan Grey, president and CEO of UNSE.

These capacity additions will be sought through all-source request for proposals (ASRFPs), inviting developers “to propose competing technologies that satisfy our performance requirements”. This means the utility will be technology agnostic in its search for new capacity for its portfolio.

However, a report published in February 2022 from consulting firm Energy + Environmental Economics outlined how a high share of long-term resource needs would come from solar and storage resources in the Southwest region of the US, as the region transitions towards these renewable technologies. UNSE’s latest IRP outlines the need for more solar-plus-storage capacity too, while continuing to rely on natural gas.

Moreover, the report outlined the lower cost of operations from natural gas in the near term, compared to solar plus four-hour storage capacity, but believes in making significant investments in solar-plus-storage alongside natural gas, as by 2030 cost parity between both technologies will be much closer.