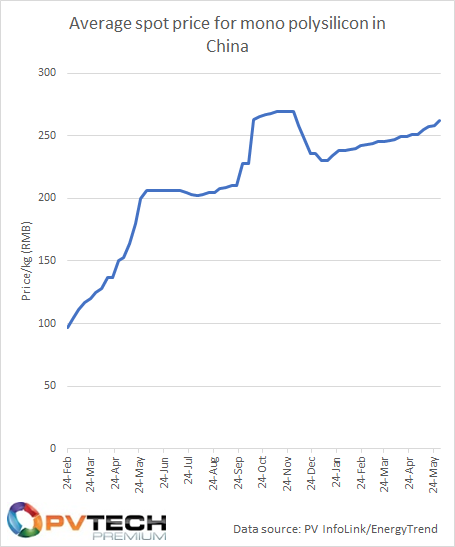

Solar polysilicon prices continued to rise for a fifth consecutive week while PV wafer prices remain flat.

Polysilicon prices have risen since start of the year and, at around RMB262/kg (inclusive of China’s 20% sales tax, equivalent to RMB216.6/kg, or US$32.55/kg, without it) rose to their highest level of the year last week, according to data published by PVInfoLink and EnergyTrend.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Last week’s jump in polysilicon pricing was not only the largest single-week increase since the start of the year, but also took average polysilicon prices to within distance of last year’s record price of RMB269/kg.

That polysilicon prices have remained stubbornly high and rising has defied market forecasts issued earlier this year. By Q2 2022, PVInfoLink and BloombergNEF had forecasted for polysilicon prices to have fallen to RMB180 – 200/kg as the supply/demand relationship eased.

Today’s prices, entering the final month of Q2, are more than 30% ahead of those estimations.

There has also been some industry concern that last week’s earthquake in Sichuan, home to a number of PV manufacturing facilities, could result in reduced output, however no confirmation of those fears has been reported to date.

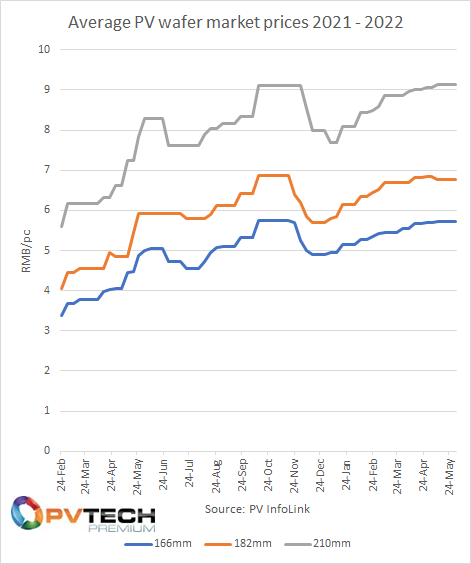

While polysilicon prices have increased, so far this has yet to spread up the solar supply chain to wafers. Prices for 166mm, 182mm and 210mm wafers remained flat for a fourth consecutive week last week while LONGi’s most recent wafer price update, issued on 27 May, confirmed no price increase to its previous price update on 27 April.

Solar cell producer Tongwei however confirmed marginal increases for its 166mm and 182mm solar cells, rising from RMB1.13/W and RMB1.17/W to RMB1.16/W and RMB1.19/W respectively. Prices for 210mm cells remained flat at RMB1.17/W.