Dr KT Tan, chief technical officer at UK-based Viridian Solar, chronicles how the rapid expansion of solar PV uptake raises critical questions about supply chain transparency and ethical sourcing, particularly given China’s dominance of 95% of polysilicon production and 80% of global solar module manufacturing.

Last year, nearly 600GW of solar PV was deployed globally. At this rate, it’s estimated that over half of the world’s energy will be supplied by solar PV by 2035. The technology is one of the most promising renewable options to tackle both the energy and climate crises.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In the UK alone, the government is planning to treble solar capacity by 2030, potentially doubling the number of jobs that the sector supports to 35,000.

The rise of solar PV has been fuelled by proven technology and rapid cost reduction. Its versatility—it suits both microgeneration and utility scales—has helped to make it an essential part of decarbonisation strategy in many parts of the world.

But such rapid growth raises questions and challenges for any responsible business. The world needs solar modules, but can we definitively know where they are sourced from, and the supply chains that support them?

As an engineer, my focus has historically been technical and strategic, but around three years ago, I embarked on a different kind of journey with my company Viridian Solar. This gave me new insights and took me to parts of the industry that I never imagined seeing.

To start at the beginning: I’ve been with Viridian Solar since 2003, and my main role as chief technical officer has been to work closely with our manufacturing partners on the design and development of our roof-integrated solar modules.

Viridian Solar, a startup when I joined it, grew fast and was bought by Marley in 2021, becoming part of the Marshalls Group in 2022. It was around this time that the issue coincided with worldwide concerns about the provenance and sourcing of solar products.

China’s dominance in the solar PV industry

Despite growing efforts to foster competition elsewhere in the world, China remains the world’s dominant producer of photovoltaic modules by a considerable margin. Recent estimates have placed the country as the dominant producer of polysilicon, ingots and wafers, accounting for nearly 95% of global production and 80% of solar module manufacturing capacity.

This would be surprising if you viewed the sector solely through a geological lens: polysilicon, the essential component for solar modules, is derived from quartz, the type of silica most preferred, due to its very high levels of purity (up to 99% SiO2). Quartz is found on many continents, with Brazil, China, India, Russia, and the US all being major players in quartz mining. The same material is also a key ingredient in the semiconductor industry, albeit with a different level of purity.

However, China has become the dominant player in solar thanks to decades of government support, favourable policies and massive economies of scale. And, in a sector burdened with energy-intensive processes to smelt and purify polysilicon, many Chinese factories are strategically located to benefit from wind, hydro and solar power, as well as cheap coal.

Unsurprisingly, Viridian Solar’s main commercial partners are in China. As questions emerged in the industry about the provenance of solar modules, particularly polysilicon, we set ourselves a mission to map out every level of our supply chain.

This was no easy undertaking. Due to commercial sensitivity, most businesses know their immediate suppliers, and possibly one tier further upstream. Most international standards, such as IEC 61215 and 61730, only require manufacturers to specify the suppliers up to the cell manufacturing level, and this is mainly for performance and safety reasons.

However, we have the advantage of maintaining strong, long-term relationships with our commercial partners. For the past two decades, I’ve been visiting their facilities at least annually to inspect and marvel at the cutting-edge technologies, as well as to discuss quality and innovation. Expanding these visits to include a colleague specialising in environmental, social and governance (ESG) issues was a logical step.

Over the past three years, with the help of local contacts, my ESG colleague and I have visited not only suppliers with whom we have a direct relationship but also begun mapping each level of the supply chain upstream, tier by tier.

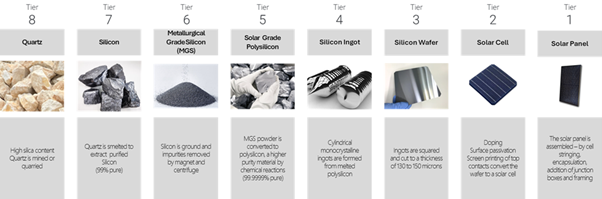

Since the numbering of the tier system lacks universal consensus, here’s our definition to avoid confusion: tier one is for panel assembly; tier two for cells; tier three for wafers; tier four is for ingots; tier five is for polysilicon purification; tier six for MGS (metallurgical grade silicon) powder; tier seven for silicon smelting; and tier eight for quartz extraction.

By the end of 2023, we had not only mapped out the top five tiers in our supply chain but had also visited the majority of these manufacturers to see their facilities firsthand. In addition to checking out the technical process, it provided us with a valuable insight into the local environment.

At this point, we decided to formalise the ringfencing of suppliers. We made agreements with our commercial partners that material could be sourced only through agreed facilities in the first five tiers of manufacturing. This demand has since been incorporated into every purchase order we place and is the first step in our development of a transparency framework.

By the beginning of 2025, we had mapped out (i.e. identified) every entity at every level of our supply chain to tier seven, the point at which raw silica is smelted. Our commercial purchasing agreements had also been extended to cover tiers six and seven.

Due to the unique nature of our product design, we’re confident that our ringfenced sourcing agreements are being honoured. Our modules must be manufactured in accordance with our exact specifications by approved suppliers only. In addition, many of the components within them are strictly controlled and cannot be substituted with generic materials.

We still have some way to go. The mapping continues, as does the work to specify and ringfence additional manufacturing locations into our purchasing agreements. The final stage in our odyssey is the quartz mines. We made our first visit to a mine in March 2025 and have more trips in the pipeline. We plan to keep going until we have mapped (and ideally visited) every entity in our supply chain.

It has been a fascinating journey covering six different Chinese provinces, whose combined surface area is equivalent to that of the entire country of Argentina. We’ve met with leaders and technicians, and developed a greater appreciation of their technologies, as well as working conditions, and the challenges that the factories face at a local level. Tracing back to the source has also helped us develop a richer understanding of our products.

For example, we made some interesting findings during visits to upstream production facilities, which are often out of the spotlight. The general assumption is that they continue to use time-tested techniques, for example, the Czochralski crystal pulling method, the Siemens purification cycle and the electric arc thermal carbonic reduction process.

Contrary to that belief, innovations were thriving in these areas, with the relentless aim of increasing efficiency and reducing cost. A good example is the FBR (Fluidised Bed Reactor) technique for producing granular polysilicon. Since they are all energy-intensive processes, there is a tendency to move towards renewable energy to minimise their carbon footprint, at least according to our supply chain. This is an encouraging development within the sustainable manufacturing agenda.

Working with the Solar Stewardship Initiative

Technical discoveries aside, we’re still in the early stages of our ethical and transparency journey. The entire photovoltaic industry is negotiating complex terrain. Although we have commissioned independent ethical audits in our tier one and two suppliers, it’s clear that widely accepted international standards are urgently needed to foster trust and clarity for governments, customers, installers and brokers.

That’s why Viridian Solar is an active supporter of the Social Stewardship Initiative (SSI), an assurance scheme initiated by Solar Power Europe and Solar Energy UK, which has the backing of more than 50 solar organisations across Europe, as well as the UK government.

The SSI’s mission is clear: to establish solar-specific standards not only in ESG but also supply chain traceability, with the aim of giving more certainty to regulators, customers and business partners in assessing the sustainability of the value chain. As one of the founding members, Viridian Solar has been actively contributing to the standards committee and also a pilot project.

The UK government’s recently published Solar Roadmap lists the SSI as one of the industry standards to tackle sustainable sourcing. We welcome this move to drive more transparency in public sector procurement, as this is a collective challenge that the sector needs to come together to confront.

If industry can come together to remain at the forefront of international efforts at transparency and decent work, we can work towards a solution that is not only transformative for the energy challenge but also rooted in transparency and ethical sourcing; a ‘solar revolution’ that we can be truly proud of.

Author

Dr KT Tan is the chief technical officer at Viridian Solar, a UK-based manufacturer of roof-integrated solar modules. With a PhD in Engineering from the University of Cambridge, he is an expert in solar technology, specialising in areas like roof-integrated systems and advanced cell technologies.