Despite running at full-capacity, US-headquartered high-efficiency PV module producer SunPower Corp has lowered its full-year revenue guidance as losses mount and margins compress across its utility, commercial and residential markets.

SunPower expects full-year GAAP revenue to be in the range of US$1.85 billion to US$2.05 billion, compared to previous guidance of US$1.8 billion to US$2.3 billion.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The company noted that the lowered revenue guidance was due to project completion schedules changes for some of planned PV power plant projects in Mexico. The company had previously said that these projects would use its outsourced P Series modules from China as project pricing pressure in Mexico was an issue.

Delaying some projects in Mexico also goes in tandem with the production ramp of its joint venture in China, which is expected to reach capacity of around 600MW by year-end.

As a result, SunPower lowered its full-year deployment guidance to be in the range of 1.3GW to 1.45GW, compared to previous guidance of 1.3GW to 1.6GW.

However, gross margins in its three business sectors continued to decline, due to ASP pressure, which could be a contributor to the lowered revenue guidance.

SunPower’s Power Plant segment non-GAAP margins were only 3.2% in the second quarter of 2017, down from 7.8% in the prior year period. Commercial segment non-GAAP margins were 7.1% in the reporting quarter, compared to 13.1% in the second quarter of 2016. Residential segment non-GAAP margins were 20.3% in the second quarter of 2017, compared to 24.6% in the prior year period.

Financial results

SunPower reported second quarter GAAP revenue of US$337.4 million, above the high point of guidance of US$325 million, but down from US$399.1 million in the first quarter of 2017.

Net GAAP loss was US$93.8 million, down from US$134.5 million in the previous quarter. GAAP gross margin in the quarter was 4.5%, compared to a negative 7.8% in the previous quarter.

Capital expenditures reached a low point of US$17.2 million in the second quarter of 2017, down from US$27.9 million in the previous quarter and US$46.3 million in the second quarter of 2016. Solar cell production in the reporting quarter was 270MW, down from 370MW in the prior year period and down from 276MW in the first quarter of 2017.

SunPower deployed a total of 363MW in the second quarter, up from 177MW in the previous quarter. Recognised revenue from deployments was US$226 million, compared to US$230 million in the first quarter of 2017.

Deployments in its Power Plant segment were 86MW in the second quarter, compared to 102MW in the first quarter of 2017. Commercial segment deployments were 66MW, the same as in the previous quarter, while residential deployments were 74MW, up from 62MW in the previous quarter.

Guidance

SunPower guided third quarter GAAP revenue of US$300 million to US$350 million, gross margin of negative 3% to negative 1% and a net loss of US$120 million to US$100 million. The company expects to remain loss making in 2017 as it continues restructuring.

SunPower has also decided to sell 8point3 Energy Partners, its JV yieldco with First Solar but has not included its share of the asset sale into its full-year revenue guidance.

Manufacturing update

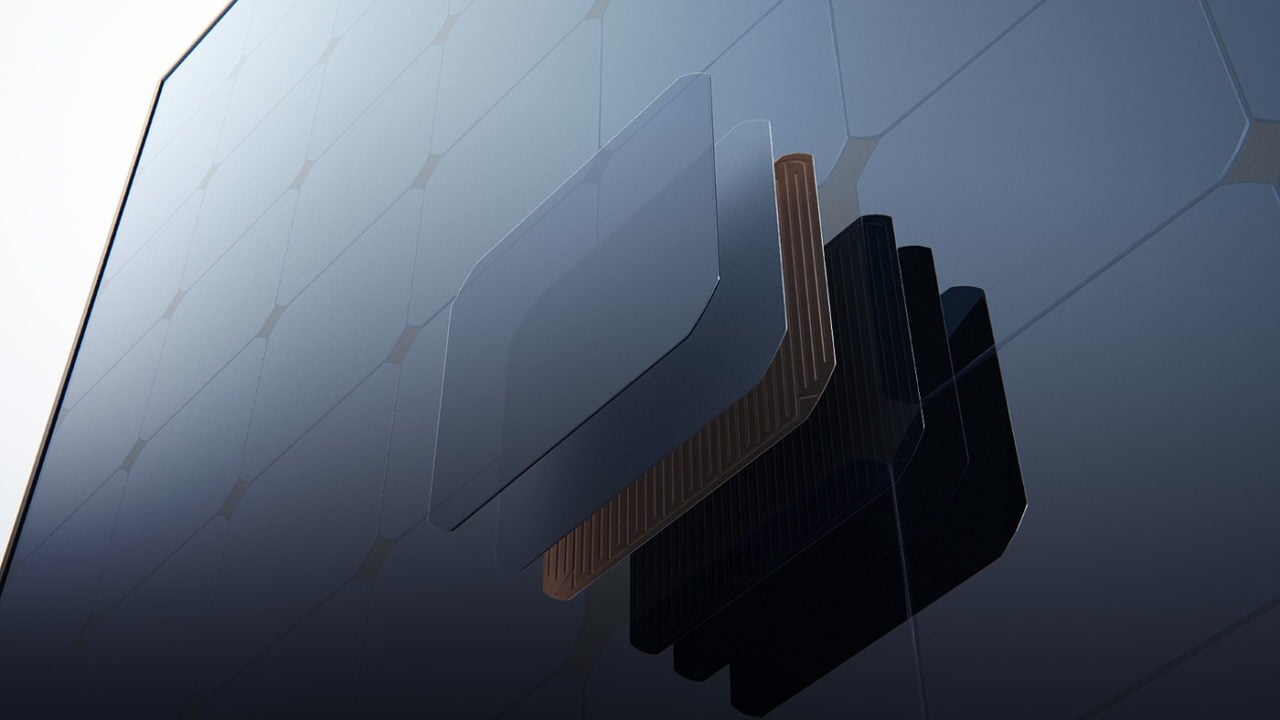

SunPower noted that its lead solar cell production facility, Fab 4 was regularly exceeding conversion efficiencies of 25%, while meeting yield, output and cost reduction targets.

Its China JV was said to have produced its first mono-PERC P-Series modules with conversion efficiencies of 19%.

Utilisation rates were at 100% in the reporting quarter with management expected to remain fully utilized through the rest of the year.

R&D activities have been focused on its next-gen cell and module development and noted it had already manufactured the first next-gen module at its Silicon Valley research facility. The company was also recently awarded U.S. Department of Energy SunShot grant for cost reduction strategies related to its its next-gen cell and module technology.