US-headquartered high-efficiency solar panel manufacturer SunPower Corp has started changing its long-held strategy of supplying only its in-house produced E Series and X Series panels to residential and C&I (Commerical and Industrial) PV projects in the US.

SunPower has said many times that it would not be deploying its P Series panels in US projects, which use China fabricated P-type mono PERC (Passivated Emitter Rear Cell) technology and assembled at SunPower’s main assembly plant in Mexico, which through September, 2018 is still the case, according to publically available data for California solar installations.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It should be noted that the P Series panels would be classified as in-house should SunPower shift to supplying the P Series in the US and difficult to identify in the data.

Third party supply

The change in strategy is that SunPower is also using panels from other major PV manufacturers, such as ‘Silicon Module Super League’ (SMSL) leader JinkoSolar and SMSL members, Canadian Solar, Hanwha Q CELLS and LONGi Solar.

SunPower has also sourced supply from REC Group and LG Electronics as well as from some other unspecified suppliers from data compiled by ROTH Capital, which PV Tech has been analysing in 2018.

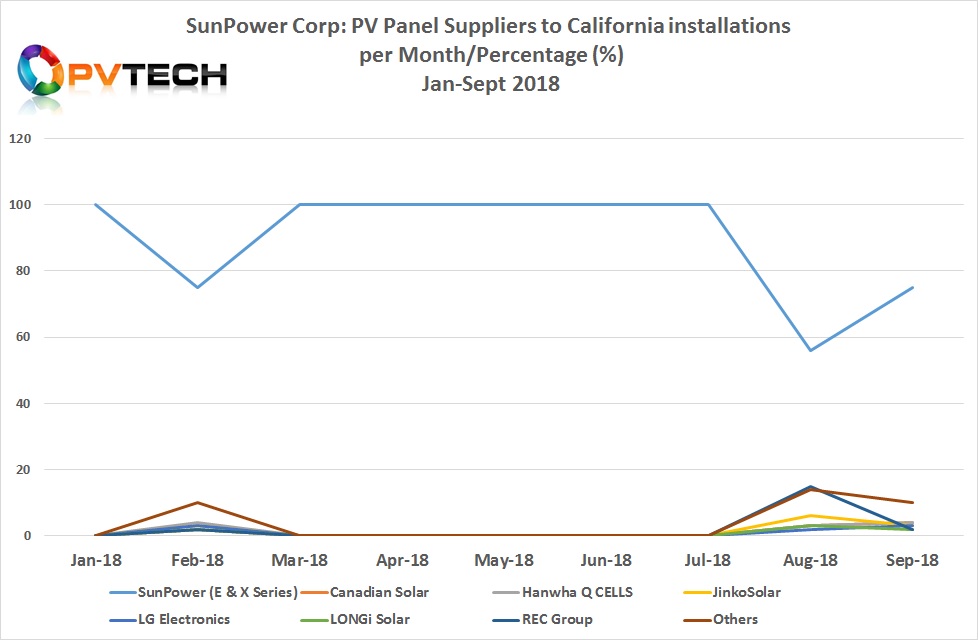

The third party panel usage would seem to have started back in February 2018 but used 100% in-house sources panels through to August, something SunPower had done throughout 2017, as expected.

We had not highlighted before the panel supply changes that occurred in February as SunPower had returned to 100% in-house panel sourcing for the next five months, so gave the impression that some small projects for commercial reasons or in-house supply constraints could have behind the one month anomaly.

As the chart below highlights, the big winner in August and September has been REC Group, which has in-house production of wafers, cells and modules at a single production sight in Singapore. REC is well known for its P-type multicrystalline half cut panels, which have been extensively used SunPower’s rival Sunrun and other non-public installers in the US for both residential and C&I applications for many years.

REC panels accounted for 2% of SunPower’s California installs in February, 2018 but returned to supply 15% of total panels installed by SunPower in August and accounted for 10% in September.

SMSL member and major P-type multicrystalline panel producer, Canadian Solar panels accounted for 2% of installs for SunPower in February and returned to supplying 3% of panels in August and 4% in September.

A similar supply pattern exists for the other third party suppliers, regardless of the cell and panel technology used.

Hanwha Q CELLS, another major P-type multicrystalline panel producer, supplied SunPower installs to the tune of 4% of the total in February, 2018 then 3% in August and 4% in September.

Leading SMSL, JinkoSolar panels accounted for 3% of installs for SunPower in February and returned to supplying 6% of panels in August and 3% in September.

Leading P-type monocrystalline panel producer and SMSL member, LONGi Solar supplied 2% of SunPower’s panel need in February and 3% in August, followed by 2% in September. LONGi Solar had become a major supplier to Sunrun in the first half of 2018.

High-efficiency N-type mono panel producer, LG Electronics followed a similar share as LONGi Solar, having supplied 3% of SunPower’s California installations in February, 2018 then 3% in August and 2% in September.

Not known for using third party panel suppliers in recent years, the fact that SunPower has sourced around 38% of its panel needs in California through to September, 2018 should be treated as a new business strategy, although the mix could meaningfully change quickly, based on PV Tech’s recent analysis of Tesla’s panel purchasing shifts.