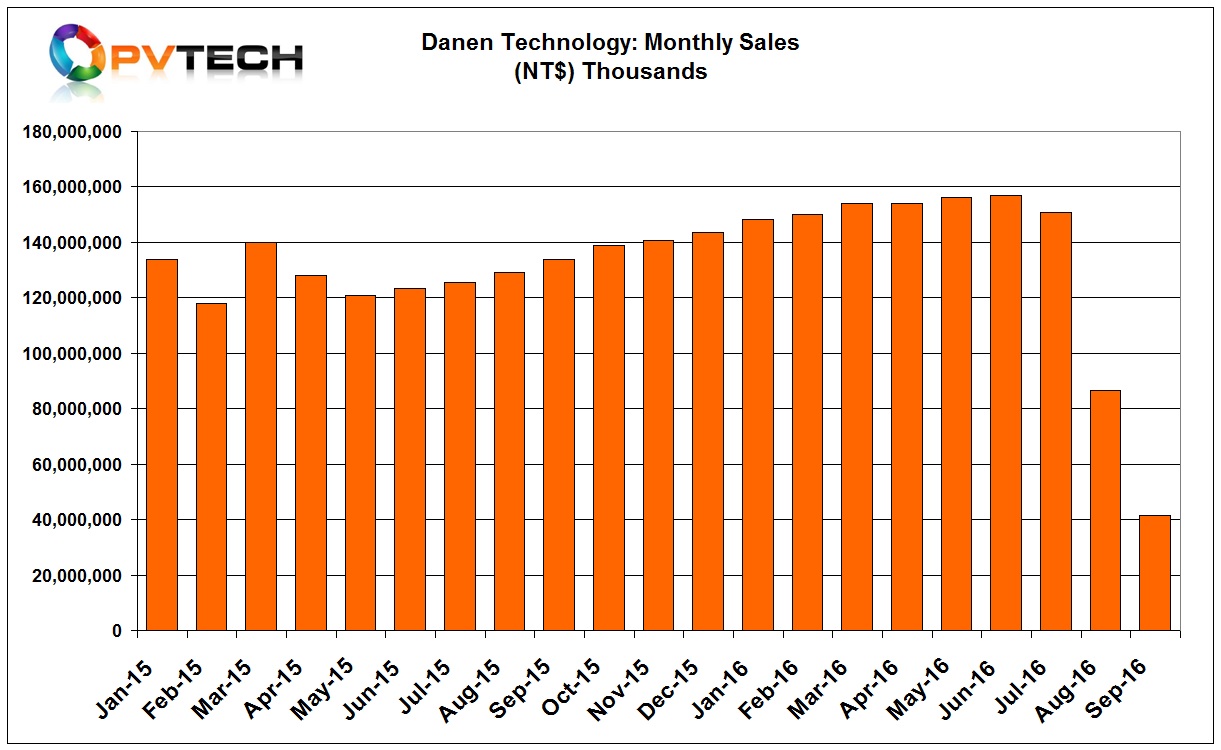

Green Energy Technology

Multicrystalline wafer producer GET reported September, 2016 sales of NT$ 715 million (US$22.7 million), up around 10% from the previous month. However sales are still down 46%, compared with the same period of 2015.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company noted that it was continuing to screen orders, while primarily serving only long-term customers in September as its strategy to minimise wafer ASP declines.

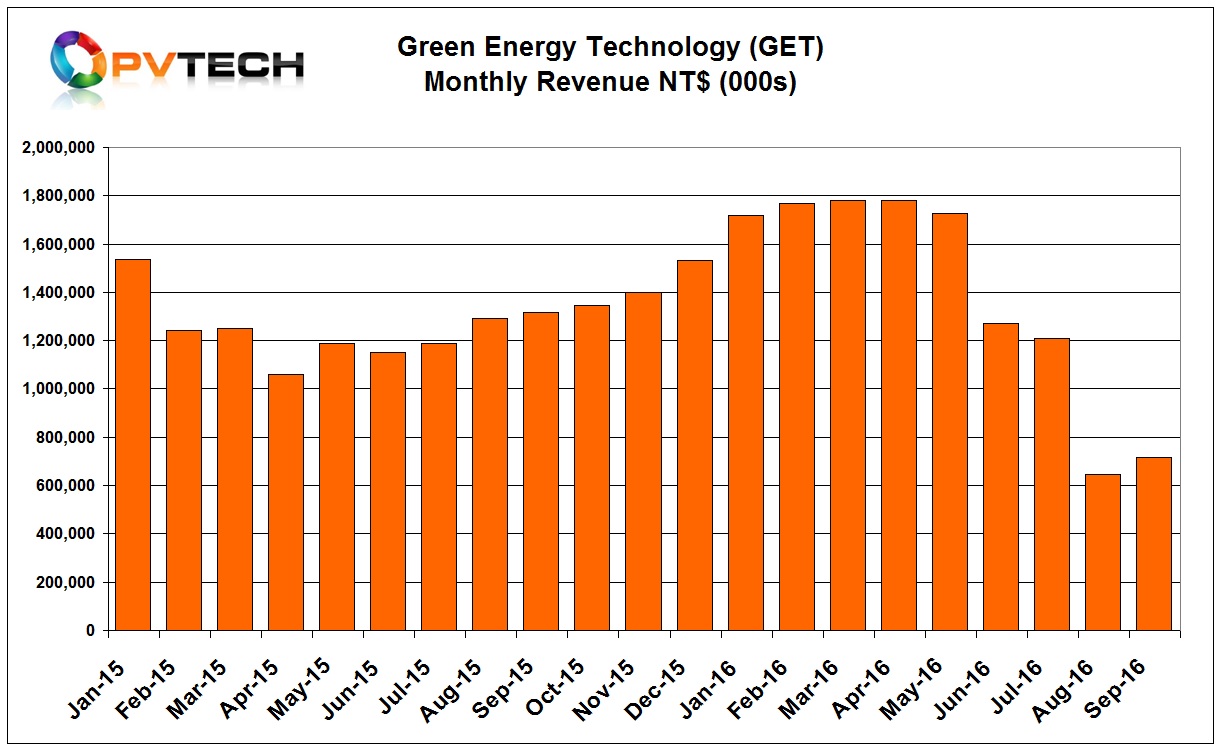

Sino-American Silicon (SAS)

Mono and multicrystalline wafer producer SAS reported September, 2016 sales of NT$ 2,265 million (US$71.9 million), virtually flat with August sales of NT$2,282 million, a 0.72% decline. However, sales are down 8.41% year-on-year.

The company has not been as severely impacted by weak China demand since the end of June but is under ASP pressure.

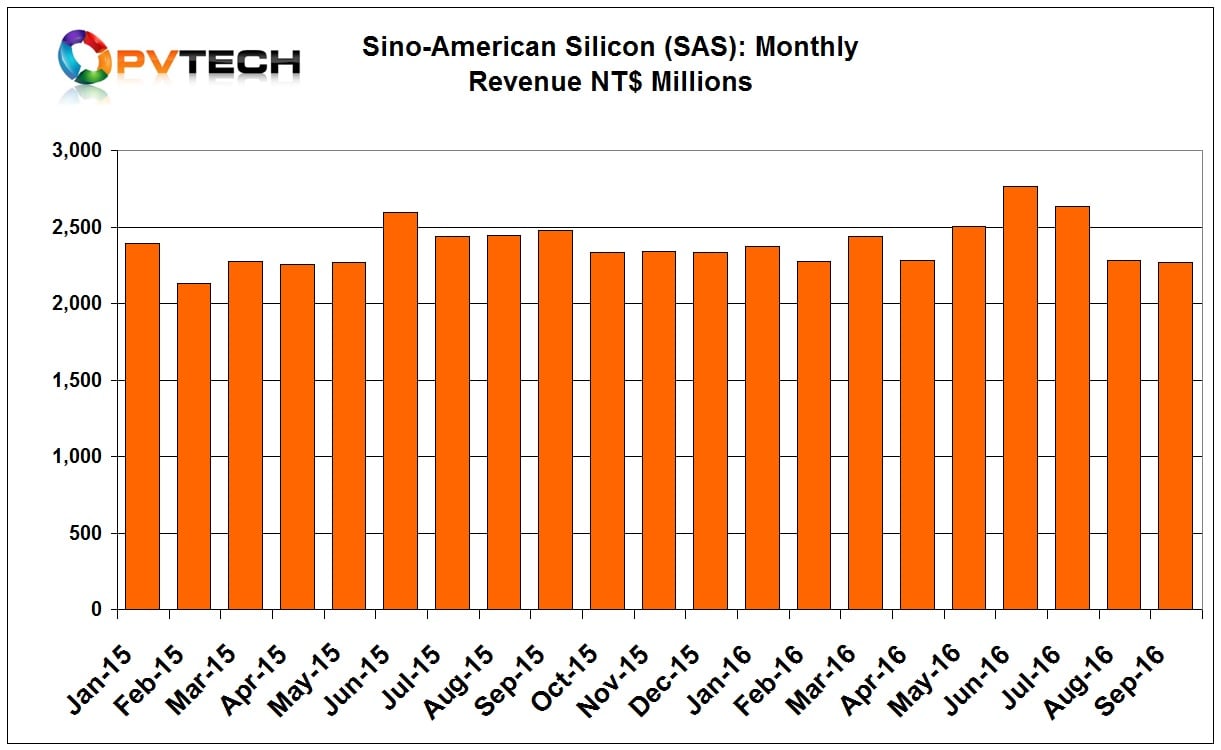

Danen Technology

Multicrystalline wafer producer Danen Technology reported September, 2016 sales of NT$ 41.7 million (US$1.32 million), down from US$2.74 million in the previous month, a 51.83% decline and a 68.86% decline year-on-year.

Like its larger rival, GET the company has adopted a selective order strategy response to weak demand and ASP erosion. Like GET, Danen has lowered production utilisation rates to reduce inventory.

Wafer producers are expecting a seasonal demand upturn in the fourth quarter.