Policy uncertainty could stifle “billions of dollars” in private sector investment into renewable energy in the US, according to a survey of investors and developers.

Data published by industry non-profit the American Council on Renewable Energy (ACORE) found that uncertainty over tax credits could cause 84% of investors and 73% of developers to decrease their activity in renewable energy.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

ACORE said that 95% of the new capacity added to the US power grid in 2024 came from renewable energy technologies, including 50GW of new solar PV capacity according to the Solar Energy Industries Association (SEIA). The new clean energy capacity added last year drew in US$115 billion in investment, ACORE said, and sustained 3.5 million jobs.

Federal tax credits for renewable energy deployments, manufacturing and financing have “played an instrumental role in creating a stable market environment to stimulate this growth”, the council said. The most prominent tax credits are those included under the Inflation Reduction Act (IRA), which introduced US$369 billion in tax breaks for renewable energy industries, headlined by the 30% investment tax credit (ITC) and production tax credit (PTC).

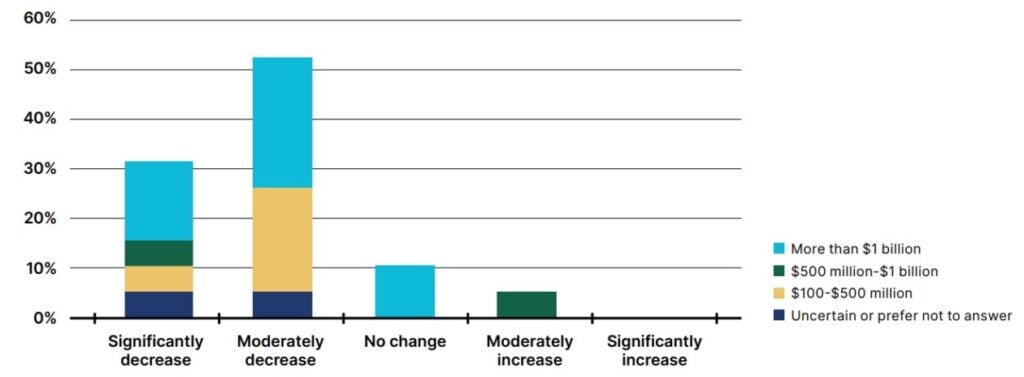

This growth could be imperilled by uncertainty over the future of those tax credits, ACORE’s data shows. 80% of respondents to its survey who had over US$1 billion in US clean energy investments said they would “significantly or moderately” decrease their investment plans if the future is unclear, which ACORE said could result in the “loss of tens of billions of dollars in private sector investment.”

The arrival of Donald Trump in the White House introduced a certain level of uncertainty to the US tax credit landscape.

In an executive order, the president announced a pause on the disbursement of some IRA funds which legal experts from Baker Tilly wrote for PV Tech that it would cool solar industry growth. Since then, US energy analyst firm Clean Energy Associates (CEA) has also voiced its uncertainty over the potential future of the IRA’s domestic content bonus credit for solar PV projects and the Environmental Protection Agency (EPA) head has attempted to recall up to US$20 billion in clean energy grants issued under the Greenhouse Gas Reduction Fund.

In February, a broad coalition of over 1,800 US energy companies signed a letter calling for continued support for federal tax credits. The companies cited the jobs and economic stimulus created by the US renewable energy boom of the last two years, as well as the emergence of a solar module manufacturing base which is reportedly close to meeting US domestic deployment demand.

ACORE’s survey found that continued certainty over federal tax credits would see “massive investments” and “massive energy deployments” in 2025 and beyond. More than half of its respondents said they plan to increase their investments by over 10% in the coming year, with a similar figure for developers planning to increase their energy deployments by over 10%, provided the tax credit situation remains predictable.

It also found that the US market would continue to grow in attractiveness compared with other international markets without policy uncertainty. The US was found to be the most attractive country for renewable energy development and investment by the professional services firm Ernst & Young last June.

PV Tech publisher Solar Media will be organising the fourth edition of Large Scale Solar USA in Dallas, Texas 29-30 April. After a record year for solar PV additions in the US, the event will dive into the ongoing uncertainties on tariffs, tax credits and trade policies as more domestic manufacturing becomes operational. Other challenges, such as the interconnection queues and permitting, will also be covered in Dallas. More information, including how to attend, can be read here.