Tesla has anticipated a solid 2020 on the renewable deployment front after its figures for 2019 proved stellar for storage installs but far less so for PV additions.

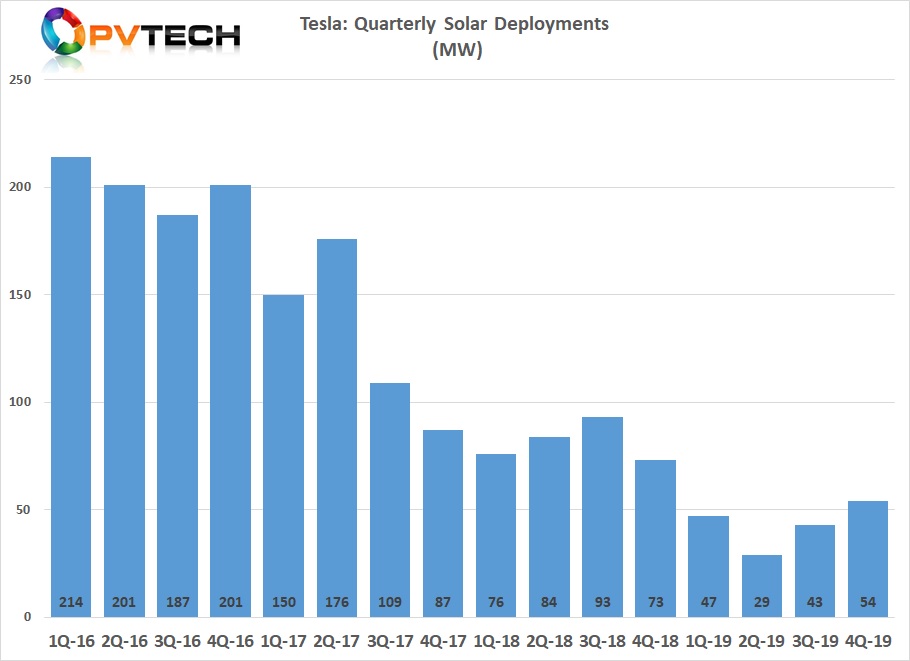

Unveiled earlier this week, Tesla’s full-year results for 2019 indicate (see chart above) the firm reached 173MW solar installations throughout last year, a far cry from the volumes it had recorded in 2017 (522MW) and 2018 (326MW).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Tesla’s year-on-year slump of solar installations took place despite a slight recovery towards the second half of 2019. Quarter on quarter, the firm’s PV roll-out dipped between Q1 2019 (47MW) and Q2 2019 (29MW) but then bounced back in Q3 2019 (43MW) and Q4 2019 (54MW).

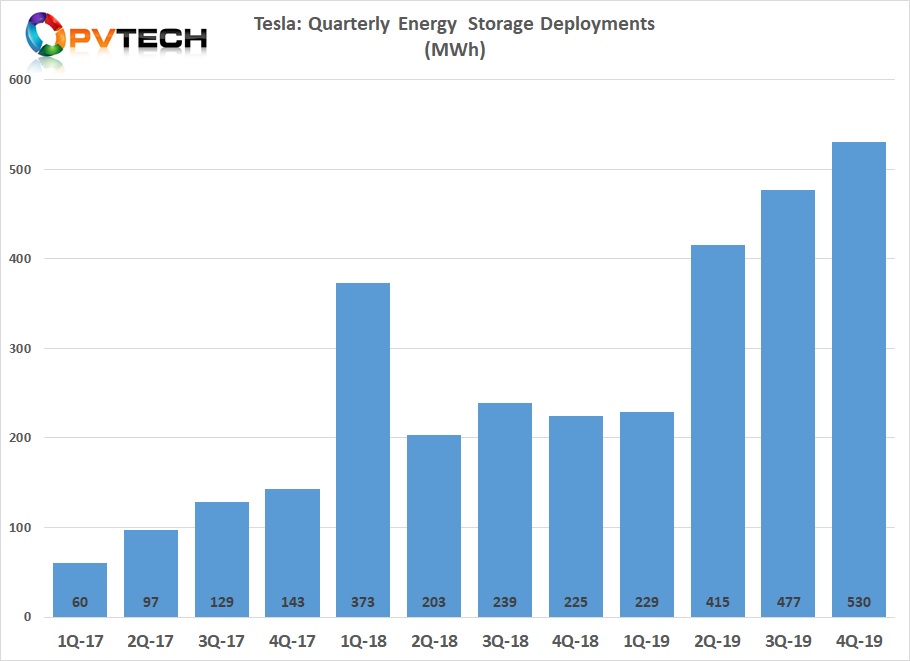

By contrast, the 2019 picture for storage deployments (see chart below) was more upbeat. Tesla’s installs on this front reached a quarterly record in Q4 2019 (530MWh), capping off a year of back-to-back raises from Q1 2019 (229MWh) to Q2 2019 (415MWh) and Q3 2019 (477MWh).

The 2019 figures underscored the strong momentum Tesla has enjoyed with its storage business over the past three years. Full-year installs have surged between 2017 (429MWh), 2018 (1.04GWh) and 2019 (1.65GWh).

Following the mixed performance of its overall energy business in 2019, Tesla now expects 2020 will be prolific for storage but also solar. Installs across both segments should, the firm said this week, grow by “at least 50%” this year compared to last year.

Talk of ‘turning point’ after year of court drama

Tesla’s full-year update was followed by a rallying of the firm’s stock on New York exchange Nasdaq to around US$580 per share, a leap from the US$333 it was trading at only last month.

The firm’s posting of a Q4 2019 GAAP net profit of US$105 million marks the second consecutive quarter the indicator is positive, after losses in Q1 2019 (US$702 million) and Q2 2019 (US$408 million). “2019 was a turning point for Tesla,” was how the firm summarised the year this week.

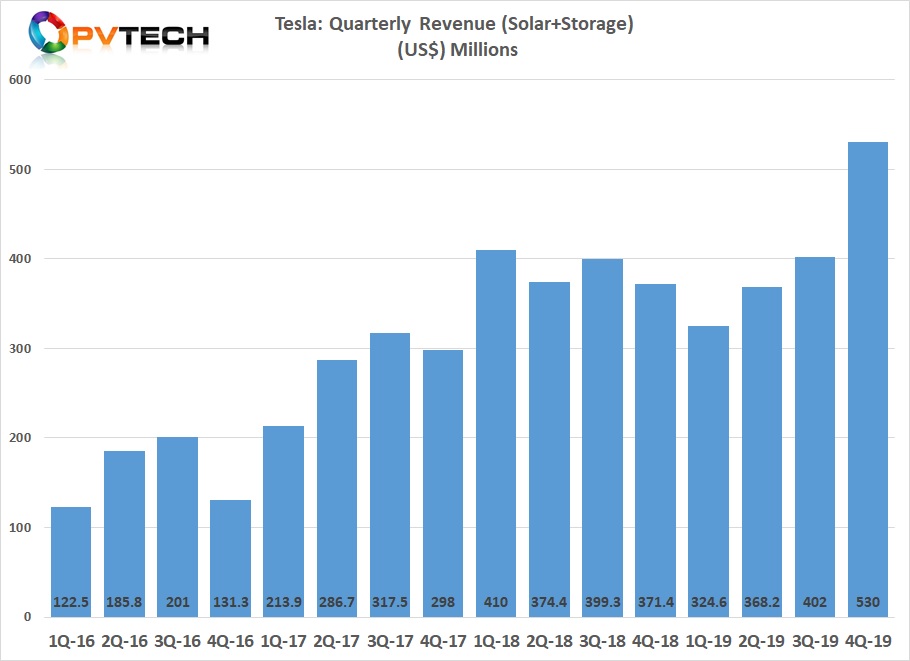

The quarter-on-quarter rise of group-wide revenues, from US$6.3 billion in Q3 2019 to US$7.3 billion in Q4 2019, was mirrored within its energy business. As shown by the chart below, combined turnover from solar and storage has seen back-to-back increases this year.

Discussing its solar operations, the Silicon Valley outfit said this week production of its Solarglass Roof systems scaled up in Q4 2019. “In addition to Tesla installers, we have also partnered with several roofing companies to support installations,” the firm explained.

However, PV Tech recently reported that China-based PV and glass manufacturer, Changzhou Almaden Stock Co Ltd was recently forced to declare that it was supplying Tesla with glass encapsulated solar roof tiles, due to abnormal fluctuations in its stock traded on the Shenzhen Stock Exchange.

Almaden noted that the current supply transaction amount remained small and did not meet the stock market rules on declaring major contracts. The company noted that the supply of glass solar tiles to Tesla had accounted for only 7% of its 2019 operating income (revenue).

As for storage highlights, Tesla said 2019’s last quarter featured the first installation of its 3MWh Megapack battery product. The appetite for the system from global developers and utilities has “surpassed” expectations since it was first announced, the firm claimed.

Tesla’s bullish start of 2020 follows a spat of court controversies for the firm last year, ranging from a lawsuit – later called off – over PV blazes on Walmart rooftops to unionising rows. One of the more recent cases exposed purported worries at Tesla’s top over profitability issues.

The prospects and challenges of solar's new era in the US will take centre stage at Solar Media's Large Scale Solar USA, scheduled to take place in Austin (Texas) on 23-24 June 2020.

Credit for the picture for this story on PV Tech's homepage: Arno Senoner / Unsplash