Tesla has said its strategy to deliver the lowest-cost solar rooftop installations in the US is paying off after it witnessed a doubling of installs in Q3 2020.

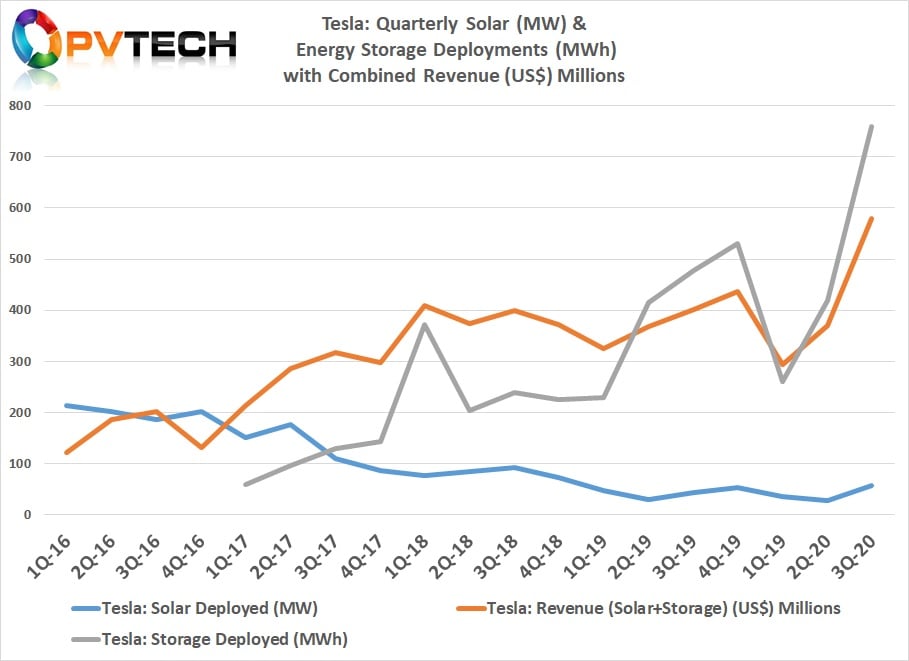

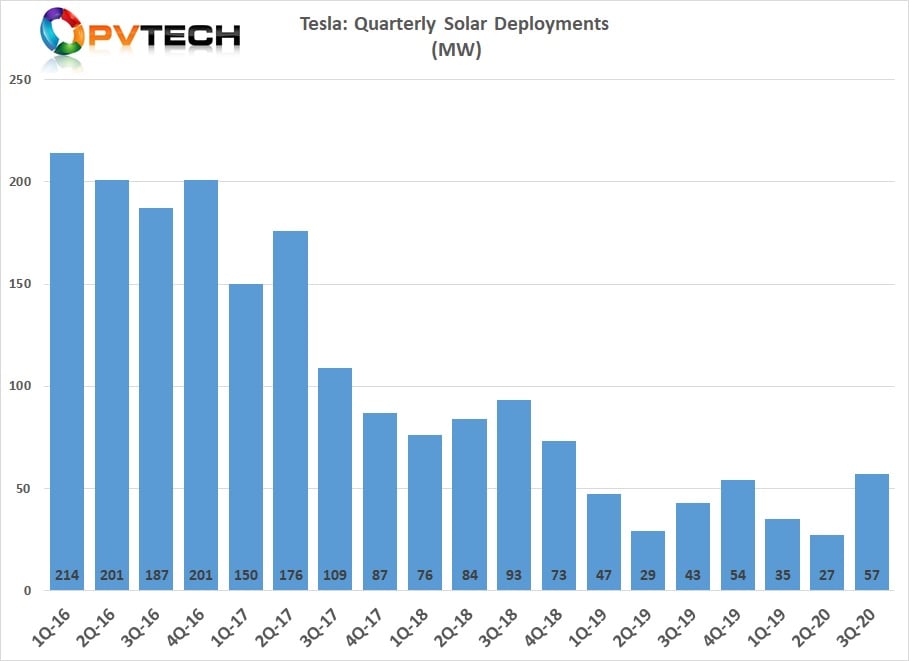

Reporting its Q3 performance late yesterday, Tesla confirmed that it had installed 57MW of solar rooftops in the three months ended 30 September 2020, more than double the 27MW it installed in Q2 2020. Quarterly installs were also up 33% year-on-year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The rebound will come as solace for Tesla after Q2 2020 solar installs dipped to the company’s lowest on record.

Earlier this year Tesla said it would offer the lowest cost solar installation on the US market at US$1.49 per watt. On an earnings call yesterday RJ Johnson, Tesla’s newly appointed energy business lead, said it had managed to do so by leveraging the company’s existing EV ordering infrastructure for its solar business. This has allowed the company to “substantially reduce” its soft costs, keeping its fixed costs relatively flat against an uptick in volume.

Tesla is now looking to roll this out across the rest of the energy business.

While it gave no precise figures for installations – a common trend within its results – the company did note a sequential trebling of installs of its Solar Roof product in Q3 2020, with founder Elon Musk describing it as a “killer product”.

“This will become obvious next year,” Musk said.

The company is now working to accelerate its onboarding of installers who are trained to install the product, described as the biggest hurdle to greater adoption of Solar Roof in the US.

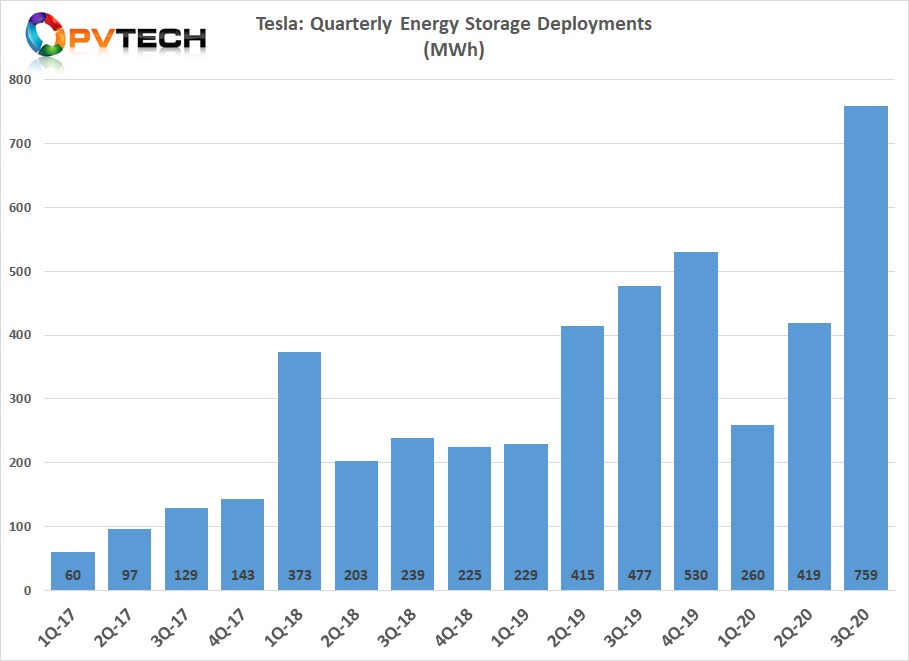

Tesla also noted a significant uptick in energy storage installations, which reached 759MWh in Q3 2020. This was up 81% sequentially and 59% year-on-year, with Tesla indicating it had more demand than supply for energy storage throughout 2021.

Late last month Tesla hosted its Battery Day where it detailed plans to reduce manufacturing costs for energy storage through various means. It expects the changes to be transformational for Tesla’s energy business as a whole, and Musk continues to back the division to be just as big, if not larger than its automotive arm in the future.

Sister publication Energy-Storage.news provided an exhaustive analysis of Tesla’s Battery Day, as well as expert reaction from both a business and technological standpoint.

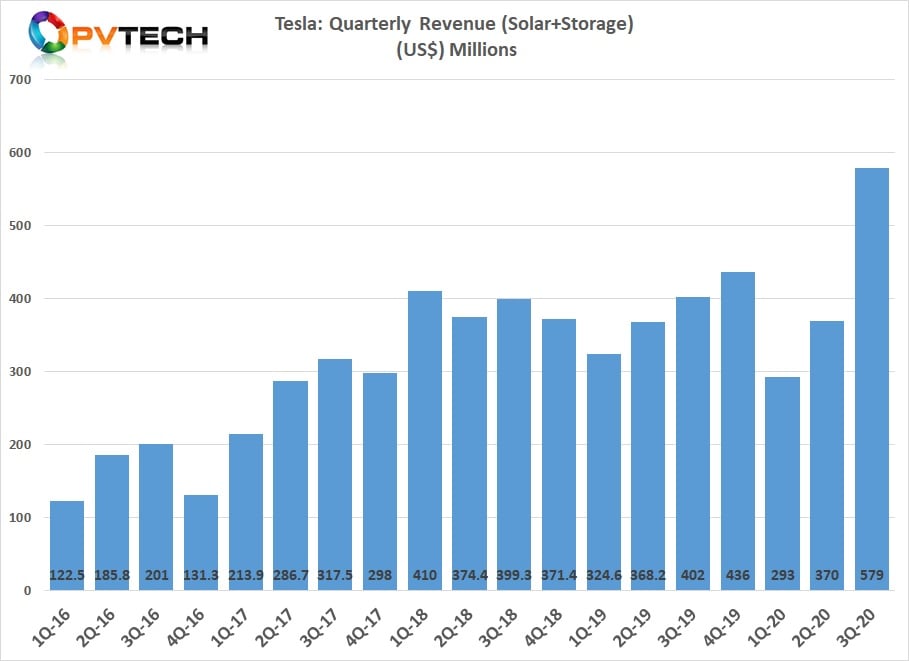

Total energy generation and storage revenue for Q3 2020 stood at US$579 million, up 44% year-on-year.