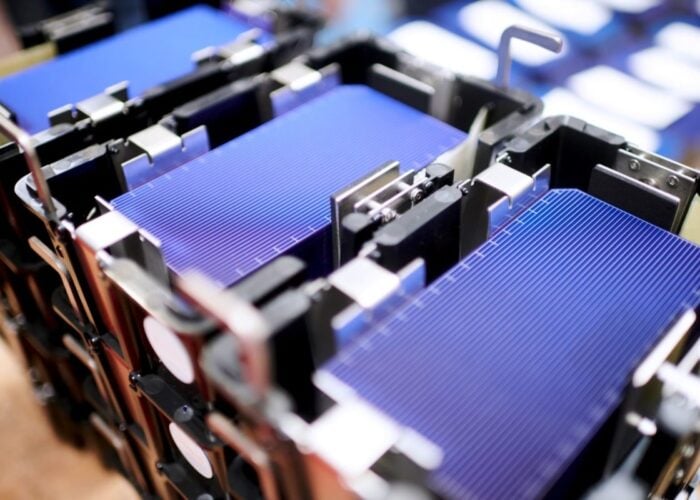

Major Thailand-based financier TMB Bank has issued the country’s first green bond, with the World Bank's IFC as the sole investor of the US$60 million bond, the funds of which will be used exclusively to finance climate-smart projects, particularly renewable energy.

TMB aims to expand its green lending portfolio from US$280 million to US$470 million in the next five years with guidance and support from IFC

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The overall aim of the bond is to expand financing for private sector investments that help address climate change, by providing an alternative source of long-term green finance in the country. It will also help Thailand achieve its target of reducing greenhouse gas emissions by an unconditional 20% by 2030 relative to its Business As Usual (BAU) scenario.

“Thailand is vulnerable to climate change,” said Piti Tantakasem, CEO of TMB.

“This green bond, the very first issued by a financial institution in Thailand, reiterates our commitment to further stimulate private investments in renewable energy and energy efficiency, which will ultimately benefit both the environment and the economy. Environmental sustainability is one of the pillars of TMB’s Sustainable Banking framework, and the bank has already financed many projects related to renewables, energy efficiency, and waste reduction.”

TMB will also issue a second bond, raising US$90 million from IFC, to support its SME lending program and increase access to finance for Thailand’s SMEs. The green bond and SME bond will also be the first seven-year bonds to be issued by a private bank in the market, said an IFC release.

In related news, today the IFC and the Monetary Authority of Singapore (MAS) signed a Memorandum of Understanding (MOU) to work together to accelerate the growth of green bond markets in Asia, partly by raising awareness and also by promoting the use of internationally recognised green bond standards and frameworks.