The readers of this publication likely are fully aligned with the need to address climate change and transition coal power (and eventually other fossil-based fuels) to renewables. In electricity, 75 countries worldwide used an installed base of 2,082 gigawatts (GW) of coal power in 2023 (only operational facilities included)[1]. This installed base emits approximately 15.5 gigatonnes of CO2 annually[2], which is around 40% of the estimated 36.8 gigatonnes of CO2 emissions emitted by global energy-related activities. This is a substantial and important market for which to find a solution.

However, only 215GW (approximately 10%) of existing coal power capacity is slated for decommissioning by 2030. From research conducted, it is clear that few of the initiatives to decommission coal power will occur this decade, while many of these transactions that are considered possible are only proceeding with significant philanthropic funding, concessional finance or government subsidies.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, our analysis indicates that this does not have to be the case. Renewable energy is now a cost competitive alternative to fossil fuel-based generation. As a result, this article identifies five opportunities to transition coal assets to clean power before 2030. Based on that, it is estimated more than 800 coal power stations in emerging economies show potential to be profitably replaced by solar PV in this decade.

These transactions would replace coal power with solar-plus-storage capacity, backed by a long-term PPA. The PPA arrangement for renewables capacity allows one to raise enough debt and equity to finance all the costs of the transaction – including the decommissioning of the coal assets – and to cover the profit needs of both the dirty and clean energy players. All this is possible without changing the wholesale price of power in these markets and with no or limited subsidies.

An ambitious large-scale solar buildout and replacement of coal power is envisaged, tempered by phasing the rollout of the renewables over several years to allow the emerging market country to build up its supply chain, pool of skilled contractors and financing partners. This large-scale approach will lead to long-term cost efficiencies and the development of a local employment base. Detailed analysis of this opportunity can be found in the IEEFA report, ‘Accelerating the coal-to-clean transition’[3].

This article is intended to summarise four key findings: i) the costs of a coal-to-clean transaction; ii) the transaction model; iii) case study examples that could be attractive first targets; and iv) how to identify targets.

The upfront costs of a transaction

Before looking at how transactions like this should be structured, this feature explores the cost of such a transaction. The cost breakdown is based on primary research, the author’s own experience and interviews with players in the market. There are four major categories of upfront transaction costs:

Cost of the new solar generation asset

This category is the largest by a significant margin, ranging from 63-88% of the total investment, and includes new generation capacity, energy storage system, grid connection (transmission lines) and grid upgrade. The latter was challenging to cost and was not included in the case studies assessed.

Cost to close the coal power plant

This category cost range varies, typically depending on the age of the coal plant, from 10-20% of the transaction cost and includes: the remaining equity value of the coal asset, other equity obligations associated with it (e.g., community ownership), coal site (and potentially mine) rehabilitation, workforce reskilling and career transition (both directly employed and indirectly impacted), and coal supply termination.

Higher transaction costs are tied to newer facilities where the equity value of the remaining contract term is still significant.

Regulatory transaction and restructuring cost

The smallest share of costs, at 1-2% of the total, these include: fees for bidding for a new PPA for solar generation (not always relevant), penalties to restructure the existing coal independent power producer’s (IPP’s) PPA (the extent varies by local circumstances) and costs of the study and development activities to progress the transaction.

Financing costs

These costs vary substantially, from 1-2%, when very little debt remains outstanding, to 15-20% for newer coal power plants with significant principal and interest outstanding. Includes paying out the obligations of outstanding debt principal plus the interest that would be earned, costs to restructure the debt of the existing coal power plant and fees for raising debt for the new renewable generation capacity.

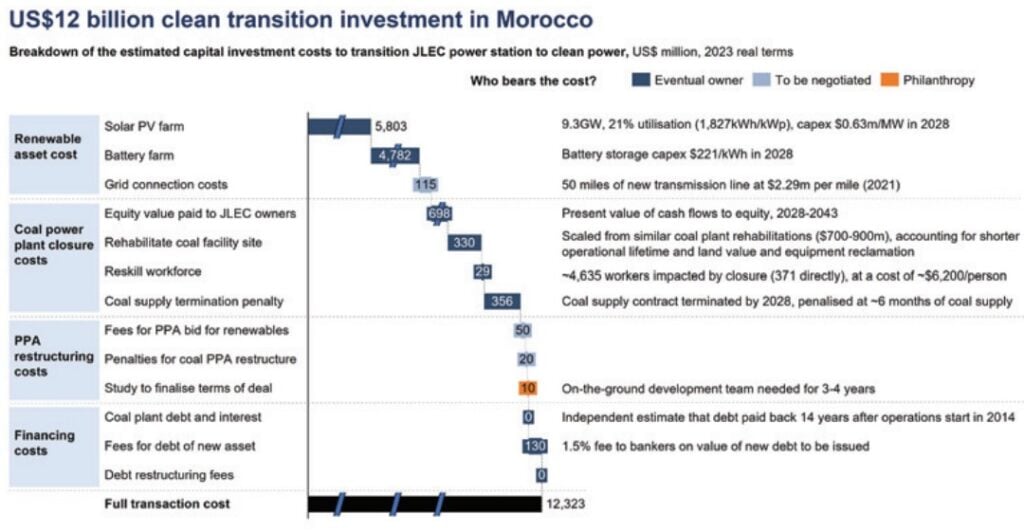

A summary of this is presented in Figure 1, above, using the Morocco case study detailed later in the article as basis. The 13 cost elements that are relevant to this coal-to-clean transaction are bucketed into the four major categories discussed above. As can be seen, most of these costs can be borne by the eventual owner of the clean generation asset.

Figure 1 includes supporting information detailing the key data or assumption used to estimate those costs. Cost data was sourced from local country reports or company financial statements. In cases where cost data was not publicly available, benchmarks or indicative costs were developed for each case and then adjusted to the specific transaction evaluated.

A notable aside: in this case, a 9.3GW photovoltaics installation is needed. The scale is significant and likely to be built in phases over many years. To get a sense of scale, compare it to the largest single-site photovoltaic facility in the world built at the time of writing this article, the ~3GW Golmud solar park, China[4].

The coal-to-clean transition model

In the coal-to-clean PPA transition favoured by this paper, the developer or operator signs an agreement to sell power generated through the solar project with the energy regulator or purchasing authority and ties that PPA with a commitment to decommission the coal plant and compensate its owner. The timing of the transaction sees the renewables built and phased in to coincide with a (time-bound) ramp-down of the coal generation capacity with a commitment to permanently shut down the coal facility within that defined period.

The terms are predicated on the presumption that the existing PPA (if it exists) can be renegotiated. In addition, to ensure a just transition that can win support from all stakeholders, financial compensation for all the impacted parties is included:

- The owner of the coal asset receives a net present value-corrected payout for the equity share of the remainder of the PPA term for which the asset was contracted (or similar basis).

- The owner of the solar asset (potentially the same entity as the coal asset) receives a 20-30-year PPA for the newly built asset that allows the cost of capital to be met.

- Debtors receive the outstanding principal and remaining interest without a haircut.

- The government/public sector receives income through PPA transaction fees. In some cases the developer or renewable operator can also invest in grid upgrades as part of the project cost.

- Employees of the existing coal facility are compensated through training and job placement programmes, covered by the transaction costs.

- Consumers benefit because the transaction economics ensure that wholesale energy prices are unchanged.

- The local community sees investment in renewable assets, a cleaner environment and a provision to support the transition of the businesses tied to the coal business.

Five case studies

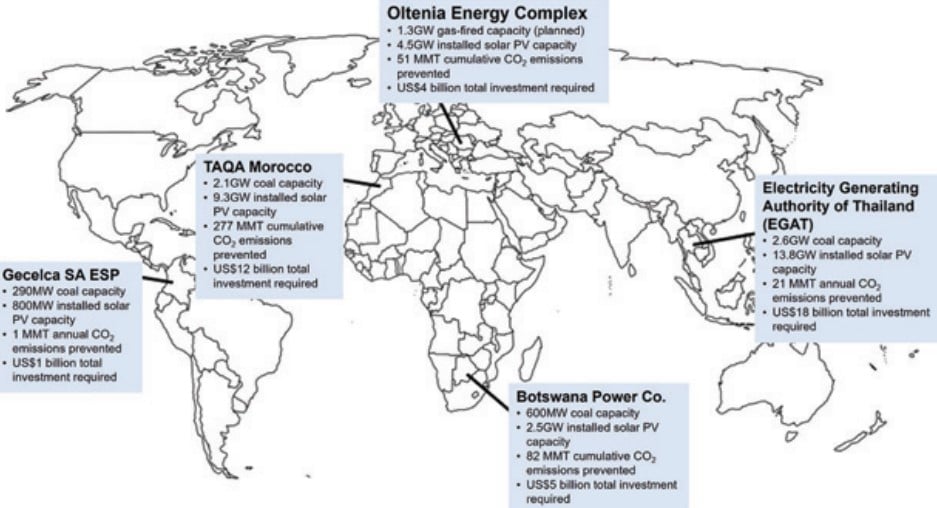

From a pool of 1,329 coal units in 54 countries, seven cases in five countries were chosen for deeper exploration: Botswana, Colombia (two cases), Morocco (two cases), Romania and Thailand. Five specific opportunities were identified among these five countries that together represent approximately 8GW worth of coal assets, where it is economically profitable to run a PPA programme to replace coal generation with an investment in solar generation (and, in some cases, with energy storage). These five cases have a profit margin from the renewable asset that is more than enough to pay for the full upfront transaction and coal plant closure costs while still generating an economic profit for the operator of the power facility.

The economics indicate that if (hypothetically) the replacement renewable generation facilities are operational in the 2026 to 2028 timeframe, these five projects prevent up to 500 million metric tonnes of cumulative CO2 emissions should those coal power plants have continued operating after 2029. All five of these projects were found to be viable without major subsidies except for some upfront funding for the development of a bankable investment case. These upfront subsidies would provide the ideal entry point for government support or philanthropy to play a role in the transactions. The five projects are outlined in Figure 2, below.

Apart from profitability, each of these projects is considered viable because:

- The wholesale price of electricity in that country does not increase outside of the estimated 2023 price for the existing energy generation mix, accounting for local inflation rates.

- The owner(s) and debtors of the coal asset are made financially whole (that is, all the debt is paid off with outstanding interest and the remaining intrinsic equity value of the asset is paid out).

- The cost of grid upgrades to enable the inclusion of renewables is included.

- The local population is supported financially with job retraining.

- The costs of decommissioning and site rehabilitation are included.

- The new assets meet their weighted average cost of capital (WACC) and debt repayment requirements.

- Capital subsidies are not needed.

How to find viable projects

The developers and investors numbered amongst this publication’s readership are likely to ask whether there are more of these projects and how to identify them.

The opportunity pool is immense: as previously stated, 1,329 units across 54 countries. This group’s emissions are estimated as 1.7 billion million tonnes of CO2 per annum, and it is estimated that the transition to solar-plus-storage requires 940GW to 1,250GW of solar power installation. The analysis assumes an average coal plant utilisation of 65% and 1.92 metric tons of CO2 emitted per kilowatt-hour, with average solar utilisation of 1,300 hours per megawatt (15%) to 1,750 hours per megawatt (20%), which is a typical range for the relevant regions. The assumption that coal is fully replaced by solar power photovoltaics is purely illustrative as other generation technologies are also relevant.

In monetary terms, capital investment could cost approximately US$600 billion to US$810 billion (in forecasted 2026 prices), with approximately another US$680 billion required if eight-hour battery storage is included. An average cost of US$650 per kilowatt peak (2026 forecast) for solar power and US$225 per kilowatt-hour for battery storage (2026 forecast) were used for the estimates here and for the opportunities discussed earlier in this article.

The assets within this group are varied as well. Of the 1,329 units:

- 629 units (120GW) are older than 30 years.

- 192 facilities (44GW) are 15 to 30 years old, the ideal sweet spot for targeting for coal-to-clean projects as transactions are likely to be viable before 2030.

- 508 facilities (125GW) are younger than 15 years and are likely to be attractive for coal-to-clean transactions towards the mid-2030s.

Not all coal assets present a viable economic case for decommissioning and replacement before 2030. The transaction works because the EBITDA generated by the solar PPA is significant and guaranteed for 20 to 30 years. Coal power plant assets are targeted when their EBITDA margin is far lower than for a renewable facility. Note that it is common for coal power IPP facilities to receive attractive PPA terms where wholesale prices and availability payments make them highly profitable – presenting a profitability challenge to the transactions described here.

By way of comparison, a typical EBITDA margin for solar assets ranges from 75% to 90%, while for the coal power plants in the case studies, the EBITDA margins range from negative (that is, subsidised) to approximately 40%, with 20% being common for IPPs[5]. The cost of capital in these markets was influential, but did not shift the economics dramatically. This means despite rising interest rates, these projects should still be viable.

Other characteristics of suitable assets identified were the following:

- Built before 2015, preferably between 1990 and 2010.

- At least 1GW capacity is preferable.

- Countries without onerous PPA legislation and subsidies to power plants.

- Clarity about debt holders.

- Existing IPP framework.

- Coal IPP owners demonstrating an interest in disposing of their coal assets.

- Able to be linked or bundled.

- Countries where power demand will grow.

- Countries that import coal and/or gas.

Some of the other countries utilising coal power that looked promising include, for instance, Brazil, Chile, Czechia, Greece, Guatemala, Kosovo, Mexico, the Philippines, Vietnam or Zambia.

Final remarks

Governments, investors and philanthropic organisations need to build on these opportunities. However, progress is hindered by a lack of resources and dedicated teams in the countries mentioned to develop the projects, limited access to appropriate financial market players who are willing and able to finance these projects, and a lack of funding for the development activities necessary to get a project ready for financing. Two necessary activities can move this forward:

- Dedicate resources to identify viable transaction opportunities that can be implemented within three to five years.

- Invest in funds that establish and support local teams in the countries identified that will do the hard work of preparing a bankable business case.

It is hoped this article sets the stage for photovoltaics developers, investors and energy financiers to take a serious look at identifying and developing similar transactions that can be actioned in the next three to five years. Global economies and the climate will depend on it.

References

- The Global Coal Plant Tracker (January 2023 version) from the Global Energy Monitor database was utilised for this research, as well as other information available from the Global Energy Monitor, such as its plant facility wiki site.

- 1 gigatonne is 1 billion tonnes. ‘CO2 emissions in 2022’, 2 March 2023, International Energy Agency.

- Jacobs, P., ‘Accelerating the coal-to-clean transition’, June 2024, Institute for Energy Economics and Financial Analysis https://ieefa.org/resources/accelerating-coal-clean-transition.

- The Eco Experts, ‘The 15 largest solar farms in the world 2024’, 12 March 2024, https://www.theecoexperts.co.uk/solar-panels/biggest-solar-farms

- These are estimates by the author based on published financial reports or approximations based on benchmarked data from sources including Lazard’s Levelized Cost of Energy Analysis—Version 16.0 (April 2023), Botswana Power Corporation Annual Report 2021 (Botswana), IRPC Annual Report 2022 (Thailand), Electricity Generating Authority of Thailand Annual Report 2022 (Thailand), TAQA Annual Financial Report 2022 (Morocco), financial statements published by EBSA in 2020 (Colombia), Enel in 2022 (Colombia) and Gecelca in 2021 (Colombia), and press articles about Complexul Energetic Oltenia (Romania).

About the author

Paul Jacobson is president of Jacobson Solutions LLC and a guest contributor at the Institute for Energy Economics and Financial Analysis (IEEFA). He has worked for more than 20 years in engineering, developing and financing major capital programmes in energy, infrastructure, and other industrial projects. He writes representing the views of Jacobson Solutions LLC.