The cost of insuring operational solar farms has skyrocketed over the course of the year, triggered by carriers rethinking their approaches to natural catastrophes and other extreme weather events. This has placed additional importance on mitigation strategies. Kevin Christy, COO for North America at Lightsource bp, details how the solar developer has adapted its strategy in the field.

As I sit down to write this piece for PV Tech Power in the Spring of 2021, I’m able to reflect on the truly incredible events of the last twelve months and what they have meant for Lightsource bp and the US solar industry. The COVID-19 global pandemic caused us to reassess how and where we work, and it forced developers, equipment manufacturers, EPCs and asset owners to learn how to meet the needs of their businesses, customers and stakeholders while keeping their employees safe from sickness and harm.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

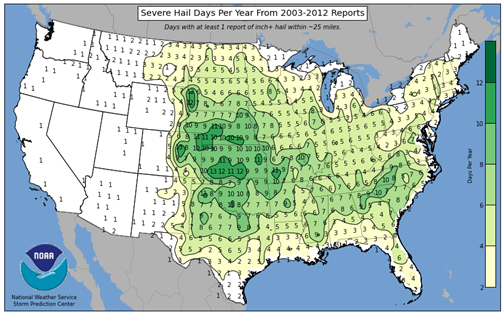

In Spring of 2020, just as the COVID crisis was ramping up globally, Lightsource bp experienced first-hand a new hardening of insurance markets as carriers dramatically rethought their approaches to natural catastrophe (“NatCat”) risk to solar farms in the United States. While we haven’t had the need to file any claims so far on our operational projects, insurers did get hit heavily in 2019 with claims for flooding and wind damage, fire damage, and damage from hail. On our first Operational All Risk (“OAR”) renewal, we were seeing for the first time separate sublimits and deductibles for various categories of weather risk, especially from hail, flooding and “named storms”–meaning tropical storms or hurricanes that meet the National Weather Service (“NWS”) criteria for being assigned a name from their rotating list each year. The net result of these changes was to move significant risk exposure off the insurers’ ledgers back onto project owners. Our insurance broker-consultants declared that the industry was in a “hard market” that might take as long as several years to stabilise, during which we would likely have to navigate new and renewal insurance placements for several gigawatts of solar capacity.

At Lightsource bp, this news had two immediate impacts: first, we doubled down on the level and sophistication of our NatCat screening for our projects, which involved upleveling our GIS capabilities to better understand and convey to insurers the potential NatCat risks to our projects and what we are doing to mitigate those risks. Second, we conceived and launched a comprehensive program designed to protect our solar farms as much as possible from the damaging effects of large hail stones, with several new and innovative aspects. These two efforts have borne fruit and we’re pleased to share lessons learned to date with the industry in the hopes that through collaboration with other developers and asset owners on tools to help us better understand and manage weather-related risks, we can collectively benefit from the old adage that a “rising tide lifts all boats”. The more we can as an industry materially reduce the risk of loss, the more favourable terms we will be able to achieve with insurance carriers and the lower losses asset owners will have to absorb.

And those potential losses are already significant: of the 51GW of installed solar capacity across the United States by year end 2020, about 29GW are installed in states that we consider high risk for hail damage (from the Gulf of Mexico north to the Canadian border along with a number of states east of the Mississippi). That results in an estimated US$8.7 billion of module replacement value. Using Wood Mackenzie’s recent US Solar Market Insight 2020 report[1] forecasts, that replacement value will double by 2024 to US$17.7 billion and nearly double again by 2030 to almost US$31 billion in replacement value for over 100GW of solar capacity in states at high risk for hail damage. Clearly, real investments in hail damage mitigation by developers, asset owners and equipment suppliers are not only called for but urgently needed.

Lightsource bp’s hail mitigation programme

Lightsource bp’s approach to hail mitigation involves using real-time weather intelligence to protect solar farms from damaging hail; improving our understanding of the hail phenomenon through dedicated sensors, higher-resolution wind data and careful event logging; making smarter procurement decisions; and optimising insurance products and underwriting around a better knowledge of hail risk at a site-specific level, taking into account the actual equipment choices for each project. I’ll deal now with each of these workstreams in some detail.

Alerting

Effective mitigation of hail risk has, at a minimum, three elements: single- or dual-axis trackers with the ability to rapidly move from its current operating tilt to a hail mitigation tilt as rapidly as possible; a means of alerting the site operator that a hail storm is imminent, and a means of advising the site operator that the storm has passed and the site can return to normal operations. On the first element, our current tracker partners have released remote operation tools designed to simplify and speed up the entry into hail mitigation mode, along with helpful guides to the appropriate use of the tool. That leaves the need for weather intelligence that can alert site operators of both when to go into hail stow and when to return to normal. From our perspective, that weather intelligence would need to have zero false negatives, meaning 100% of hail storms hitting the site would have been preceded by a targeted warning, and the warning would need to come in time to move the trackers into full protective tilt.

Given these constraints, we quickly ruled out hail sensors as a means of triggering the dispatch of the trackers, for obvious reasons—by the time the hail sensors starting registering hail strikes, the site would be at increased risk of damage until the trackers were able to move into full protective tilt—a two-to five-minute window of time out of a typically 15-minute hail storm event. For our program to hit its goal of always being in full mitigation before a potentially damaging hail storm strikes, we needed more advanced warning.

In the United States, we benefit from decades of development in storm monitoring and prediction through the National Weather Service’s Storm Prediction Center out of Norman, Oklahoma[2]. The Norman centre produces and updates daily a number of forecasting products, including a Thunderstorm Outlook and a Convective Outlook, with Convective Outlooks for Day 1 (current day), Day 2, Day 3, and Day 4-8. Convective Outlooks can develop into Thunderstorm Outlooks the day of a potential thunderstorm event, and specific areas of the country can be issued Hazardous Weather advisories. As the centre gains confidence about where and when a potentially hail-generating storm may strike, they will issue Severe Thunderstorm Watches, which may develop into Warnings as confidence increases about imminent thunderstorm activity within the region of the Warning.

In an ideal world these Warnings would be sufficient trigger for our needs. However, the NWS targets 0-30 minutes pre-strike for these Warnings which again leaves some risk that the site would not be alerted in time to be in full protective posture before a storm actually struck. In addition, the NWS does not produce for the general public a digitalised version of their web-based Warning products, preferring to partner with commercial weather services to offer more sophisticated products that build on NWS data.

To that end, Lightsource bp has been working with one such weather service provider to develop algorithms that target a minimum 30-minute warning to each of our sites in high hail risk areas. To date, all back end to back end communications and protocols have been fully tested, and the warning algorithm itself will have entered testing by the publication of this piece.

Finally, we intend each warning to further serve as a safety alert to site personnel, as hail that can damage modules may also cause injury to staff—so giving them fair warning to seek cover is a vital part for us of a successful hail mitigation program.

Mitigation

To know what tilt angle and direction is appropriate at each site, we worked with the tracker manufacturers to develop a “rules engine” that takes into account each tracker’s maximum tilt angle, preferred direction of tilt (east or west, based on prevailing wind direction), wind speed and direction at the site, and any higher priority stow mode that may be in effect (flood, for example), taking into account manufacturer guidance and warranty terms. That rules engine has been vetted with each manufacturer and will be updated continually as the manufacturers introduce new models and update their operating instructions for each.

With the instructions as provided by the rules engine, the system can email dispatch orders to a pre-defined list that would include the O&M provider’s operations centre, the site supervisor, and the Lightsource bp asset management team responsible for the site—defining the start time of the event for data logging and analysis. Future development would take that to full automation, with dispatch commands being sent directly to the tracker controller at the site and notification emails being sent to advise interested parties that a hail stow dispatch command is in place. Similarly, as an All Clear notice comes in from the weather service, the system can return the trackers to normal operating mode automatically, defining the end time of the event.

Recovery

We are developing inspection and monitoring protocols designed to assess the site for damage immediately post-event to quickly identify any damaged modules, and over time using data analytics to detect the presence of propagating microcracks. Post-event assessments will likely include drive-downs looking for physical damage, drone flights looking for module hot spots, and field EL-scans to confirm any microcracking in modules that are showing hot spots in IR scans.

Sensing

While hail sensors aren’t appropriate as triggers for hail stow, they can provide higher-resolution data about the volume of each size of hail stone that hits the site. Further, on larger sites, multiple sensors can be deployed to capture spatial differences in the size and volume of hail across the site. We can then pair that hail data with post-event inspection data to better understand how a particular profile of hail storm may result in particular damage patterns and how those damage patterns may change for modules of varying construction.

Insurance optimisation

By all indications the loss models that insurers are using to evaluate and price hail risk to solar farms are blunt instruments compared to loss models developed from the ground up using site- and manufacturer-specific experience data that take into account the hail mitigation capabilities that may be in place. This will be an ongoing effort, partnering with the risk analysis team at our insurance broker-consultants, third party advisors and our insurance providers to continually refine our understanding of this risk. However, even in the near term, merely having a program like the one described in this article can result in some improvement in commercial terms from insurers such as lower deductibles, fewer exclusions, higher hail sublimits, and lower premiums if the program can convey enough confidence that the program will meaningfully reduce carriers’ risk of loss on the project or portfolio.

Module durability

Finally, a key piece of any long-term hail mitigation solution has to include a better understanding of how various modules perform under hail storm conditions. Current UL pass/fail hail testing protocols don’t provide enough data about the relative performance of different modules under different sizes of hail stones striking at angles other than 90 degrees. Ideally, a more “test to fail” protocol would provide enough data to asset owners to actually drive procurement decisions, with potential trade-offs of initial capex against the net present value of losses due to hail over the project’s lifetime. Over time, with improved test protocols such as RETC’s Hail Durability Test (HDT)[3], module procurement decisions can be much better informed. RETCs HDT protocol pushes well beyond the limitations of existing UL tests and would serve as a more useful comparison across manufacturers and construction methods. Our hope and intent is that before too long, tests like the HDT will predominate and the results will be widely available to asset owners and purchasing decision-makers. Without such data, building better loss estimation models may always be limited by a least common denominator view of module durability.

Our hail mitigation experience to date

As the commercial weather service algorithm and end-to-end automation are in development, we are using the NWS’ weather intelligence products to inform us as to project-level risk from developing thunderstorms, usually beginning 1-2 days prior to the anticipated event. When it appears that a mitigation order will likely be issued, we send an informational advisory to our O&M partners at each site with the text and charts from the NWS as context. We clearly mark the email notice as “informational” to avoid any misperception that any particular action is requested.

These informational advisories are then forwarded on to any Lightsource bp construction team that may be building a project within the threatened region so that our site staff and construction partners are aware of approaching severe weather. Even where control functionality may not be available yet at a site, we have developed in conjunction with our tracker partners a set of Standards of Care guidelines for how to lock down trackers into a protective posture against hail prior to a transfer of care, custody and control to our O&M partners, which is when our hail mitigation program as described above would go live for that site.

So far this year, we have issued ten separate hail mitigation orders for our operational projects in Kansas and Texas. Three of those events did result in hail strikes of stones about 1,25” in size or less, with no detectable damage.

The path ahead

At Lightsource bp, we’ve become advocates of increased industry collaboration to reduce the risk of hail losses to EPC providers during construction, asset owners during operation, and of course to our insurance partners throughout. It is in this spirit that we have provided this level of detail into our workstreams, methods and experience to date. In a very real sense, we are all in the same boat together and the scale of the risk warrants more coordination, cooperation and transparency. We believe that with each industry segment working intently to reduce its contributions to the overall risk, losses will reduce and insurer confidence in these efforts will increase.

Author

Kevin Christy: COO, North America, Lightsource bp

Kevin Christy is a veteran renewable energy executive and recognized voice in the industry since 2002. As COO, North America, Kevin manages the operational needs of Lightsource bp’s North American fleet. Kevin co-founded the utility-scale PV developer Axio Power in 2007, which successfully sold to SunEdison in 2011. While at SunEdison, Kevin managed the North American utility-scale development portfolio, served as General Manager of North America for SunEdison’s Global Services O&M and asset management team, served on the Advanced Solutions energy storage team developing next-generation commercial applications for battery energy storage, and served as the COO of SunEdison’s North America Utility team.

[1] https://www.woodmac.com/research/products/power-and-renewables/us-solar-market-insight/

[3] https://www.retc-ca.com/services/hdt