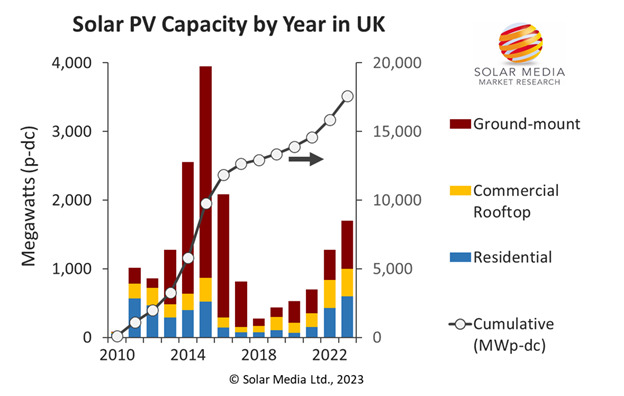

The UK solar industry is set to add an additional 1.7GWpdc of new solar PV capacity in 2023, continuing its post-subsidy, which includes feed-in-tariffs (FiTs) and renewable obligation certificates (ROCs), growth phase towards being a multi-GW market over the next few years, according to the latest research findings from the Solar Media Market Research team.

The market has now grown annually for five years since 2018, the point at which the legacy ground-mount incentive rates were discontinued.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

As predicted over the past few years on Solar Power Portal, the major capacity additions are now coming from large-scale solar farms, as investors break ground on the massive pipeline of approved applications poised to have a major impact on solar’s contributions to the overall UK energy mix.

Final numbers for 2023 will be known in a few months from now. Currently, we are putting a -5%/+10% error bound on the cited 1.7GW figure. The upside is conditional on several large-scale (nominally 50MWac in size) sites being completed this year; some of these may be pushed out to 2024.

The 1.7GW of new deployment in 2023 represents 33% year-on-year growth, compared to 2022, with the residential and ground-mount segments being the ones most driving the annual growth dynamics. The residential market is now at levels seen only when FiTs were introduced back in 2010 at the attractive rate of 43p (US$0.52) /kWhr.

Once again, it is the ground-mount sector that is responsible for the lion’s share of the new installed PV capacity in the UK. And, like most of the previous periods of large ground-mount solar farm build-outs, much of this is being done in stealth mode. This is likely because of any possible political backlash, 12 months out from a general election, when local ministerial stances are firmly centred on prospects of re-election.

Furthermore, despite there being a much greater visibility of solar energy in the country as a whole, solar farms are still being treated as hot potatoes by the major parties. Still the safe rhetoric is to proclaim allegiance to rooftop PV potential.

The forecasted 1.7GW of solar PV added in 2023 will take the cumulative PV installed in the UK to circa. 17.6GW, of which approximately 60% is coming from large-scale solar farms. At some point going forward, there will come a time when this is lauded, and credit will be taken – even if it is not fully justified. We are just not at this point yet. Perhaps a solar champion politician (on roofs and on the ground) is waiting in the wings today?

Moving into 2024, there is no reason why deployment should not reach the 3GW mark. The sector is now in major contracts for difference (CfD) build out mode, and the first nationally significant infrastructure projects (NSIPs) will also start adding capacity to the grid. These factors alone have the scope for large quarterly and annual additions, regardless of what happens with the residential and commercial rooftop sectors.

And all the while, planning applications (or simply grid applications) continue to stack up. The total ground-mount pipeline is now well above 100GW, made up projects currently under construction today to tentative grid applications out as far as 2039.

To understand which projects are the most likely to be built in 2024 and over the next few years, please contact our Market Research team here to access our monthly database reports.