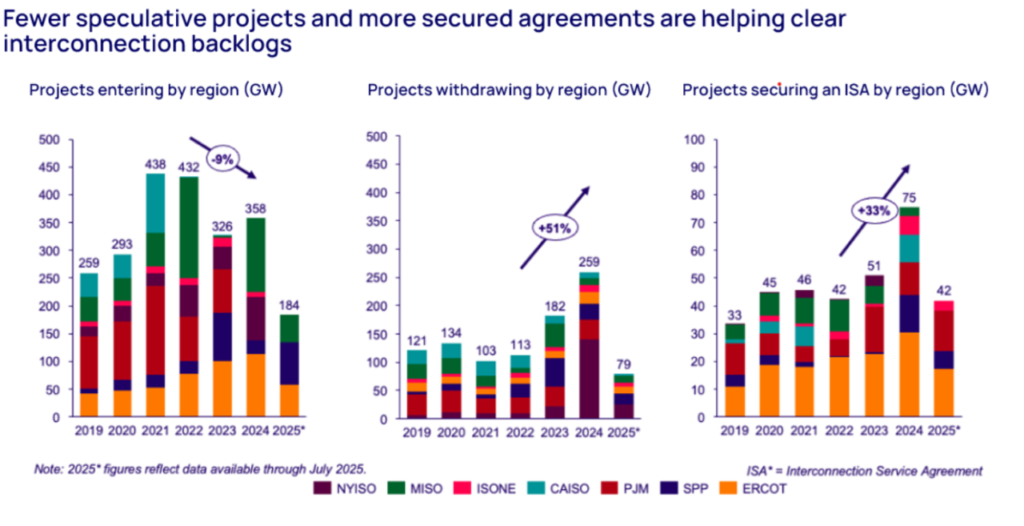

US grid interconnection agreements grew by 33% in 2024, reaching 75GW, with three-quarters signed for solar PV and battery energy storage system (BESS) projects, according to a new report from energy market analyst Wood Mackenzie.

The increase in agreements was down to interconnection reforms passed at federal and regional levels in 2023, Woodmac said, most notably the Federal Energy Regulatory Commission (FERC) order No. 2023. Passed in November that year, this was intended to “Ensure that the generator interconnection process is just, reasonable, and not unduly discriminatory or preferential.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Woodmac said the reforms have had “considerable impact” on the US interconnection process, “driving improvements through reducing speculative projects and clearing queue backlogs.”

A 2024 report from the Lawrence Berkeley Laboratory in California said the US had 2.6TW of project capacity waiting in interconnection queues, around 95% of which was renewable or clean energy technologies, including solar, BESS and wind. In January 2025, the Laboratory published data showing that around 80% of prospective projects withdraw from the US grid queue.

In its report this week, Woodmac said that in 2024, regional grid operators experienced a 51% increase in withdrawals of non-viable projects since 2022 and 9% fewer new project entries.

“It’s clear that these reforms are showing early signs of promise in accelerating the pace of interconnection studies,” said Kaitlin Fung, research analyst, North America utility-scale solar for Wood Mackenzie. “We saw a record year in 2024, with 75GW of secured capacity. 2025 is maintaining this momentum, as major grid operators have already secured 36GW through July 2025, positioning the year to match 2024’s record.”

Solar PV and BESS projects accounted for 75% of the interconnection agreements signed in 2024. This amounts to 58GW of capacity.

Despite a more challenging policy environment for renewables and the economic uncertainty which attends that, Woodmac said that 2025 is on course to see a similar distribution of technologies.

Regionally, Fung said that interconnection rates and queue processing times “vary dramatically” across the US.

Texas’ grid – the Electric Reliability Council of Texas (ERCOT) – has the fastest processing and highest rate of successful projects due to its “streamlined queue process through their connect-and manage approach,” the report said.

ERCOT has been a model for US interconnection management for some time. In October last year, PV Tech Premium spoke with grid reform expert Tyler Norris about the lessons that the rest of the country can learn from Texas’ grid processes.

ISO New England (ISONE) has the second-highest project success rate but the longest processing time “due to its delayed transition from serial to cluster-based processing.” California’s ISO (CAISO) comes in third, though high numbers of speculative projects have driven down its overall success rate.

“Regional disparities in processing times highlight the need for continued reform efforts,” Fung said.