The solar PV industry – globally, not just in the US – remains in the embryonic stages of addressing how to prioritise domestically made low-risk module supply channels (alongside an upstream value chain ecosystem), within the overall context of a future energy supply landscape that could see solar PV as a dominant source in coming decades.

So far, no countries nor administrators have come close to creating a workable solution to this problem.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, as discussed in an article I wrote on PV Tech last week – How the US can take full control of PV manufacturing and technology out to 2050 – of all the efforts to put a framework policy in place, the US’s Inflation Reduction Act (IRA) is possibly the most promising scheme to emerge until now.

Worryingly, the PV incentivisation process – outlined within the IRA – may simply stimulate overseas inward investments to the US (for example, across states in the Midwest and Southwest) to set up low-skilled c-Si module assembly facilities, many of which could be mothballed as quickly as they are established.

This article explains that a fundamental flaw with many, if not all, efforts to create domestic manufacturing hubs for solar PV comes from a lack of understanding of several issues: how PV manufacturing works, the importance of the different stages in the value chain and the key raw materials needed to truly have energy security of the installed field capacity.

In this article, I propose a complete rethinking on how this could be corrected. I use the IRA as the most likely platform that could be adjusted to create this, but the overarching themes are valid elsewhere (in particular Europe).

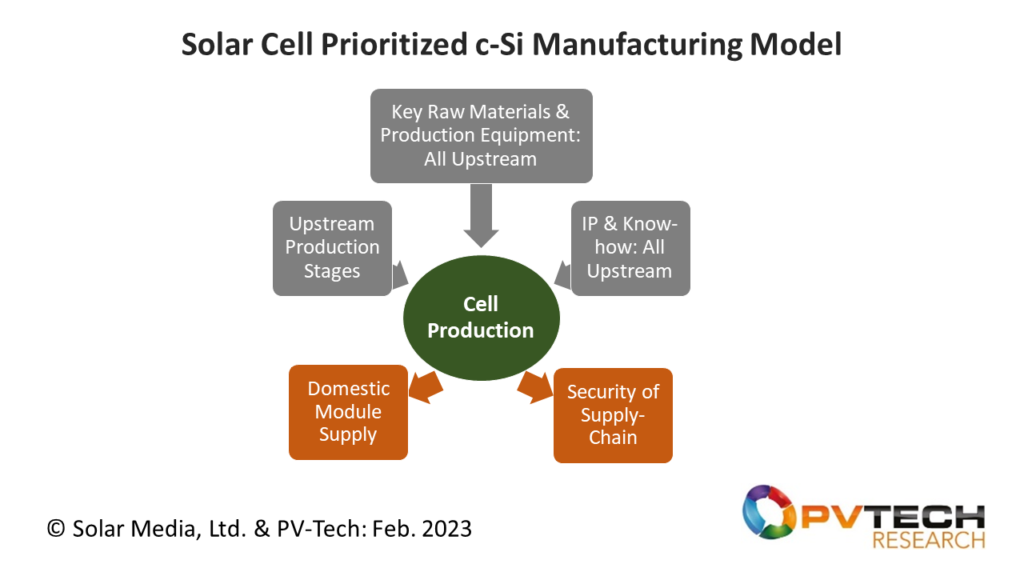

To address the basic problem, I suggest that the solar cell should have the same level of priority afforded to it as semiconductor chips now have in the US, and the PV incentives should be entirely focused on solar cell manufacturing in the short term, with maximum (enhanced) incentive rates given to domestic solar cell production that ultimately has a risk-free supply chain of materials and equipment. And how, in this way, the upstream (polysilicon, ingot, wafer) and downstream (module or ‘final packaging of the cell’) stages effectively take care of themselves.

And to round things off, I discuss how this new thinking could stimulate private and corporate investments into all aspects of PV manufacturing, to rival the focus today in the sector broadly reserved for module suppliers, balance of systems providers and downstream project developers and asset owners.

Back to school for policy-makers, investors and module buyers

There are several major issues holding back meaningful discussions globally (and within the US) on establishing a secure supply chain of solar PV modules: a lack of in-depth understanding of the manufacturing value chain and the existing global dynamics at play in the sector, and an over-emphasis on the relevance of the final module assembly stage.

The misplaced priority on (c-Si) solar module production is perhaps the most problematic one today and in many regards, the module-buying community has played a massive part in this recently. I will try to explain why now.

PV module buying has evolved hugely in recent years, with investors largely being spooked after the Xinjiang question was raised as part of internal ESG prioritisation at the board level. And add to this the detaining of GWs worth of module crates at US customs during 2022 and the need for upstream audit checks being required almost overnight (in particular related to the source of the polysilicon and its related raw materials).

For good or for bad, this alarm bell did actually help to reset module buyers’ thinking and subsequent demands when undertaking due diligence on how ‘risk-free’ particular module suppliers would be in the future.

As a by-product for example, the current phase of recent institutional investments in module suppliers’ new capacity investments (such as announced by the likes of Enel, Meyer Burger and Canadian Solar) is a direct result of the hunger to shore up future module needs that minimise risk in module selection (if perhaps somewhat a knee-jerk reaction).

On the surface, such actions are understandable. But they come on the back of an over-emphasis on module supply (or sales), and may simply act as a catalyst for module capacity additions and inward investment across states in the US that are desperate to announce new cleantech job numbers.

Put simply, the problem arises from focusing too much on (c-Si) module availability. The risk from an energy security standpoint is absent here, as is the lack of focus on what really matters: the solar cell and its key elements.

It is not good enough to select a module supplier that only assembles modules using solar cells made halfway around the world by another company, themselves free to select wafers (and their associated key components, equipment and materials); such module suppliers are a long way away from having any say in polysilicon supply, or even knowing where it actually comes from. (Today, more than 80% of the top 50 c-Si module suppliers to the sector operate in this manner.)

Technology aside for the moment, module supplier box-ticking is not recognising that solar PV is a sector that needs supply chain securitisation (at the national level). It simply parks the problem for another day, when something happens again that potentially halts module availability (in exactly the same way that the semiconductor chip crisis raised awareness of how fragile the existing Asian manufacturing and raw materials sourcing had evolved into).

I explain in detail later in this article why solar cells are ‘king’ today in c-Si manufacturing, but for now it is simply best to remember that module production (that is dominating current plans by companies to add new capacity across the US during 2023/2024) is a final low-tech assembly stage. Module fabs often simply import the ‘heart’ of the module – the solar cells.

For all purposes, everyone should be thinking of the solar cell as a semiconductor chip and everything else should then take care of itself; for module buyers, for national security as a whole. This is the challenge, and forms the basis of the model I outline within this article.

First though, some background on the PV manufacturing value chain and how this really operates in 2023.

A reminder of how solar manufacturing works

Today is the first time in PV’s 50-year history that understanding technology, manufacturing, equipment and materials, and global supply chain dynamics has truly mattered.

To set the context here; I get more questions today about ‘p-type or n-type’, ‘TOPCon or Perovskite’, or ‘Xinjiang or Vietnam’ from PV site investors and banks than I do from equipment suppliers and cell producers. It is clear at least that the finance community (investing in solar parks and now PV manufacturing) is acutely aware that these issues are important. Ten years ago, such questions were the exclusive domain of a technical audience and R&D institutes. Module buying then was fixated on either module price (how low can you go) or lead time (how quick can I get it).

Furthermore, the mere fact that the IRA is spelling out incentive rate categories for value-chain manufacturing (ingots, wafers, cells and modules) is an indication that it is simply not good enough to stimulate module assembly factories only, but that the upstream value-chain matters.

This is all great. But it is only a starter for 10, and now everyone needs to get much smarter and streetwise, and understand how PV manufacturing really works and how China’s domination has impacted the sector; specifically, just how fragmented and risky the current value chain is, all the way down to the production equipment and materials used at each stage.

Let’s look at the current (and simplistic) understanding of the c-Si value-chain, and then a model I propose that could address all risk elements from an energy security standpoint, and one that could avoid the industry being held to ransom by a lack of a critical part of the value chain that resides with a foreign (potentially high-risk) nation.

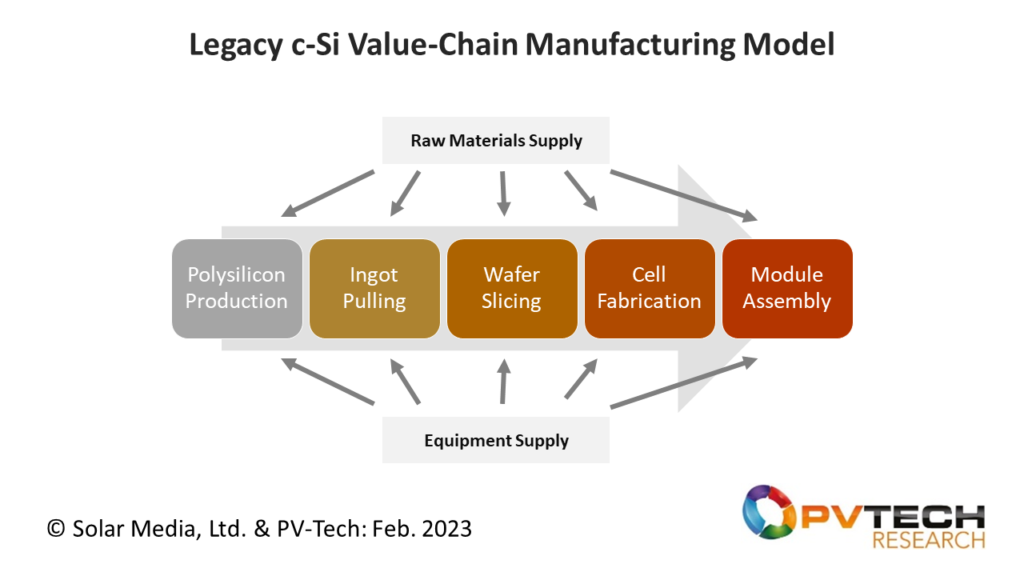

The basic thinking of how c-Si solar manufacturing works today is shown in the generic process flow diagram below.

Back to basics here. There are two ways to make solar panels: silicon-based (simply written as c-Si, standing for crystalline silicon) and thin-film (mostly deposition on glass). Today, more than 97% of solar modules shipped are produced by the c-Si route, and there is only one thin-film supplier in production, First Solar. Almost by default therefore, the focus falls on the c-Si approach as the one to crack.

As an aside to remember also. All existing c-Si solar cell manufacturing is based on what is called a single-junction architecture – essentially a single piece (or substrate) of silicon wafer that has front and rear side processing to become a single-junction solar cell. This technology has taken the solar industry from the lab 30 years ago to the burgeoning energy sector that it is today.

But there is a limit to the efficiency (or energy generation) that can be obtained from a single-junction c-Si solar cell. The next technology evolution will use multiple junctions, or stacks, that can move performance to much higher levels. Today, multi-junction solar cells have only found applications in space-related projects.

In 10 years, the industry will not be thinking about a simplistic characterisation of ‘c-Si or thin-film’, but more advanced concepts in general.

But for now – and tomorrow – the above-noted percentage share of silicon-based modules (>97% of the market) tells the story of PV manufacturing.

For c-Si, the value chain is usually shown as five sequential stages: polysilicon production, ingot pulling, wafer slicing, cell fabrication and module assembly. (Even having these ‘enhanced’ labels – ingot pulling, not just ‘ingots’ – helps, as will become apparent later in the article.)

The c-Si sector has evolved today (in its current 300-400GW annual production state) such that there are dominant players at specific parts of the value chain (in particular, polysilicon production, ingot pulling, wafer slicing and cell fabrication) that are headquartered in China and either make all the parts there (including the use of manufacturing equipment and key raw materials) or in southeast Asia (in principle, to circumvent 2012 US AD/CVD duties).

Each of these dominant Chinese companies (and their equipment/materials suppliers) can in effect control pricing and availability globally to the solar industry. The polysilicon pricing hikes recently being a visible example of how a small grouping – or cartel – of suppliers can hold an entire sector to ransom. (Cue the most recent rhetoric from Beijing on threats to ban domestic equipment suppliers of wafer and cell equipment from exporting, as a direct outcome of this China-centric dominance today and its aim to keep control of the sector.)

And now the bare facts – which are emphatic, startling and unavoidable.

90% of polysilicon used in the PV industry is made in China. Last year, about half of this Chinese polysilicon was made in Xinjiang. All the capacity expansions of note going forward for polysilicon globally are in China (albeit just not in Xinjiang). All the production equipment for these polysilicon plants is made in China. Most (if not all) of the key raw materials (cue the Hoshine issue) are made in China.

99% of ingots and wafers are made in China. Ditto all the manufacturing equipment and raw materials. Add in here the current ‘know-how’ in making ingots and wafers in high volume and at low cost. The only ingot and wafer capacity additions outside China today are in Vietnam, by Chinese module suppliers, as part of overall ‘US-friendly’ c-Si value-chain requirements to allow module shipments to the US market now.

96% of all c-Si cells are made either in China by Chinese companies, or by Chinese-owned companies with satellite or subsidiary operations across Southeast Asia (most notably Malaysia, Thailand and Vietnam). Production equipment and raw materials for these cell fabs are dominated by Chinese companies or European companies with manufacturing plants in China. Of note here – and different to the polysilicon/ingot/wafer summary above – IP and know-how is not a China-owned phenomenon and this does offer hope, especially given my proposal here that the solar cell is viewed like a semiconductor chip.

94% of c-Si modules are assembled in China, or by Chinese companies in fabs overseas (in particular Southeast Asia). The same reason for the Southeast Asia element is true for modules, as noted above for cells: to bypass 2012 US AD/CVD (although for a brief period about 10 years ago, this was undertaken also to bypass the short-lived European Minimum Import Price, or MIP, legislation.)

But module assembly is more ubiquitous in a sense, meaning that modules can easily be assembled anywhere; and there is also sound rationale for having module assembly in the country of final project build. This explains why there are so many pure-play module companies globally (Chinese and non-Chinese): across the whole of India; now prevalent across the US. (Module assembly is the lowest technology-threshold part of the value chain, has the lowest capex and can be built quickly using non-Chinese production equipment. It is also the least IP and manufacturing know-how intensive part of the value chain.)

It is crucial not to focus simply on adding a few GWs here and there of module assembly capacity, but to look at the fundamental parts of the entire value chain (and especially the cell fabrication stage) that have elements to them that pose a security threat 20 years down the line when solar energy has moved to one of true national, strategic importance.

Hopefully, I have now explained the problems and the challenges at hand. Now the solution.

Start by prioritising solar cell production

The concept of prioritising cell fabrication, or production, is not new by any stretch of the imagination. The solar industry only exists today because of cell R&D and innovation. Remove this and the industry stagnates and dies.

Solar cell fabrication today is based on technology breakthroughs driven by the Western world (Japan, Europe, the US and various global research institutes, such as the University of New South Wales, most visible in the fact that the current mainstream technology is called ‘PERC’). Western companies also created the equipment that allowed this R&D to become a manufacturing phenomenon, and more than a decade ago (albeit in a much smaller industry), tooling for PV manufacturing was provided by equipment makers from Japan, Europe and the US – almost exclusively.

Today, China has commoditised nearly all of this. The country has made 5-10GW cell capacity increments the norm and has created a cost structure for this that prevents cells being made – on a like-for-like basis – in high volume anywhere else in the world (aside from Chinese companies producing in Southeast Asia). In so doing, leading Chinese cell makers have had carte blanche to make all incremental improvements to solar cell performance levels, increase R&D budgets and create new technology barriers; all while the Western world has been powerless, and is now even having to learn how to catch up with current state-of-the-art cell manufacturing in China.

At the same time, equipment and material supply has migrated (largely, but not exclusively) to Chinese companies that were either encouraged by central government to feed the cell factories in China or are essentially equipment manufacturing entities controlled (at arm’s length) by the leading cell makers today in the country (their customers).

Much of this narrative could be extended to the polysilicon, ingot and wafer stages of the c-Si value chain when looking at how China operates as a collective unit.

Indeed, to be a top five leading global PV module supplier today, you must ‘own’ the cell manufacturing stage. This is true not simply from a technology-leadership perspective, but more importantly, from any geopolitical and energy security aspect.

It is critical to have full and risk-free production equipment supply, materials supply and IP/know-how capability in-house. And add to this a rock-solid ingot/wafer supply-chain and control over who makes the polysilicon and where in the world.

This buys a seat at the PV table now, and will do for many years to come. It is one of the main reasons that cell production has been, is today and will be going forward the end goal of PV dominance; and this is what all policy-makers should be focused on.

It is absolutely no coincidence that leading PV module suppliers today include the likes of JA Solar, JinkoSolar and Hanwha Q CELLS; the three c-Si companies in the top 10 now that view cell technology and innovation as more important than any other stage of the value chain.

In a direct analogy between c-Si and thin-film manufacturing, it is exactly why First Solar has been so successful in the past 20 years, both from a technology-leadership and supply-chain ownership standpoint. In some respects, looking at First Solar’s in-house manufacturing model and its equipment and materials supply-chain management provides a template of what the c-Si segment domestically could look like; aside from the obvious benefits of simply having US-owned entities as the clear market leaders in US-supplied PV modules today.

Now let’s factor in energy security. This changes everything for the solar cell. Here we have to confront all upstream aspects in particular: where the fabs are located, what production equipment is used, where the key raw materials come from and with whom the key IP/know-how resides. This should form the basis of any policy mission statement going forward from administrators in different countries/regions.

So, instead of looking at the legacy, step-wise figure of PV manufacturing, consider the one below that puts the cell at the heart of the solution, in exactly the same way you would do with a semiconductor chip.

To avoid the legacy of the IRA in two years being a collection of foreign-owned module fabs spread across the US, buying in solar cells made by Chinese companies in Thailand for example, here is how I think it could be tweaked to work effectively.

Put all incentives today into solar cell production (classifying thin-film production as analogous to solar cell production, which effectively it is when you remember that a thin-film panel is comprised of interconnected strips or ‘cells’).

And now for the radical part: remove incentives for ingots, wafers and modules in the short term. And at the same time, redefine with watertight precision, what cell production means (i.e. not simply building a factory that claims to ‘make a cell’).

Have the end goal (say in five years from now) as solar cell production being defined as that which meets all the different aspects of energy security in terms of equipment, raw materials and IP/know-how. Whether this means manufacturing everything domestically is not essential, as no country is blessed with having free access on its own soil to any rare element it so desires that may be essential to equipment or materials needed. But hopefully you get where I am coming from here. Maybe reframe this as: have conditions that remove, or minimise, the risk of supply chain disruptions being in the hands of a non-friendly entity.

Set an incentive rate for this type of ‘solar cell production’ that is not aspirational, but a hugely motivational level that galvanises banks, institutional investors, the best of US manufacturing and innovation all at the same time, and now. Make the rewards so lucrative that an entire industry can’t wait to reach this endpoint as soon as possible.

And in the meantime, have a lower incentive rate simply to get cell production up and running. This allows all other parts of the jigsaw to come together and fall into line accordingly. And as I mentioned before, module assembly simply takes care of itself. Nobody is going to make a solar cell, ship it halfway around the world and return a module to the same country the panel is going to be deployed.

Identify the showstoppers today from getting cell manufacturing up and running, allowing these parts of the value chain to get established in order to benefit from the gold rate of incentives on offer further down the road.

In terms of numbers, I would look at fast-tracking 50GW of domestic cell capacity by the end of 2026. This would entail capex of about US$3 billion. Module capacity would take care of itself, likely running at about 20-30% higher than cell capacity at any given time.

This time period would allow the ingot and wafer side to raise capital, sort out equipment and materials supply chains and instantly have a sales channel to sell into at the 50GW level by the start of 2027. This is another reason why cells are so important; they create the market opportunity for poly/ingot/wafer domestically.

Today, it is hard to fully make the case for upstream tooling, when the only part of the value chain in production in the US is at the module level. Maybe take the ingot/wafer incentives out of the overall IRA ‘pool’ for two years, and increase current preliminary levels for ingot/wafer production incentives from 2025 or 2026.

Polysilicon takes care of itself. 50GW of module supply is likely to require about 100kMT of polysilicon in 2027. Hemlock, REC Silicon and Wacker – with a bit of prevailing wind – could easily do this, and would if the supply chain at the ingot side is seen to be a reality. If there are signs first of 50GW cell capacity, and the same again on ingot/wafering, then the business case is made for any incremental polysilicon capacity by 2027. Incentivising this would only be prudent planning also.

Thereafter, set 100GW of cell capacity as the goal for 2030, but by this time meeting the requirements to qualify for the gold standard IRA rate. And this would also allow for the legacy (non-US-made) modules in the field to be replaced (an IRR spreadsheet justification by asset owners, but surely should have a financial incentive from treasury to stimulate).

Then going into 2030, there is a fully secure value chain and a fully audited solar plant fleet in place. Ambitious, yes. But if that is not the goal, then you are likely never going to get anywhere close to this perfect position in reality.

In fact, auditing of components across the full value chain, domestically produced in the US, now becomes commonplace. No longer is all focus on testing imported modules: but homegrown wafers, cells and modules, inclusive of factory audits locally. What a game changer that would be.

In creating this cell-prioritised model, the sector also moves away from the misleading China cost-competitive exercises that serve no purpose today. This is explained in the next section.

Stop trying to compete with Chinese income statement numbers

It is alarming, to say the least, to read ‘cost models’ today advocating upstream PV manufacturing on the basis of equating to Chinese numbers as reported in financial statements. This is being done across research institutes, government agencies and various third-party consultancy firms, the world over.

All look plausible on first reading. But they do not live in the real world. In short, you cannot try to equate current Chinese cost numbers with anything in the Western world, in particular Europe and the US.

I do not think there is any ulterior motive in how these cost models are being presented: I just think there is a lack of understanding of how China works and how this has translated into current c-Si upstream manufacturing costings presented in RMB.

But if the Western world – and India – wants to have a market-competitive offering domestically (different to ‘competing head to head with China’), it needs to take a crash course in real-world silicon-based manufacturing.

China has made cell manufacturing a zero-sum game. That is, making cells is either a national priority (as seen in the creation of various pseudo-pure-play cell makers in China in the past decade, each now having cell capacities around the 50GW level) or is a production stage by a few vertically integrated ingot-to-module suppliers that is needed to retain technology leadership (and not making any profit on cell making).

Today, cell makers with 40-50GW annual production make gross margins in the single-digit range, and just about break even quarterly. No one in China is getting rich from dividends, when it comes to cell manufacturing. And this is with a cost model often based on free land, free buildings, provincial support and the use of similarly subsidised equipment and materials suppliers.

So why is the Western world (the US and Europe in particular) trying to be competitive with this, purely from a cell manufacturing perspective? It is not a real comparison, compounded by the fact that any new cell fab in the US or Europe is talking GW additions, while the break-even status in China is from 50GW production levels.

This is just one example of how the Western world needs to get smarter today and rethink the problem. Not simply say that a few cents/Watt on European or US-based cell production is going to make any difference.

The reality is that it would likely still be cheaper to buy a cell from China, pay 300% duties to import into the US and make a module in one of the new incentivised module fabs there; and provide greater module gross margins than if the cell was made in the US with a few cents/Watt of incentives.

The worry in this regard is that current ‘plans’ to add cell/module capacity in the US, or wafer/cell/module capacity, would simply see these companies build the module fabs and ruminate indefinitely over ground-breaking on the cell part, while in the meantime, buying in cells from Thailand or Vietnam. A few years down the line, maybe the cell fab would never materialise.

It simply makes the case again to change current thinking.

Stop thinking that offering a few cents/Watt across the value chain is going to make a difference at the cell level. Ask: what is the price of not having a single country (e.g. China) dominating the PV industry in 20 years from now and having pole position in solar energy generation? Imagine a world in 20 years where 99% of global solar energy generated comes from solar cells (and upstream components) made in China. This is where things are headed at the moment.

But to solve this, the obvious question to ask here is: where is all the money for this coming from? So far, I have largely presented a model that requires government subsidies. However, this should be to serve as a stimulus, not something that props up an entire sector indefinitely.

This is where the corporate world kicks in.

Get the financial community excited about investing upstream

Making solar energy – and its constituent manufacturing supply chain – a national priority drives investment.

But make no mistake. What China has done in this regard – through a series of five-year plans – has been incredibly successful. State-driven policy in prioritising solar has led to a global domination today (with only First Solar and Hanwha offering any real global opposition) and has de-risked the loans and investments needed to build out the infrastructure required in China.

However, the Achilles’ heel to this is simple: it has been too successful. And in the process, China’s dominance has alienated the rest of the world, only now awakening to how important it is to have security in the whole solar manufacturing supply chain.

While the workings of the model I propose above are geared to how the US could change this current paradigm, it is equally valid anywhere else in the world. It could be argued that if India had taken a similar approach, it would not be in a constant dilemma on how to backward integrate from what is essentially a module assembly nation today. And if Europe had gone down this route in the days of MIP, then the European landscape could be moving forward today from a very different starting point.

But the US is of course the one place on the planet where such an approach could and should be fast-tracked to gain global supremacy. Corporate investment and capital should flow not simply into module assembly activity, but to all parts of key manufacturing and materials supply elements for the solar cell; ingot pulling fabs and equipment suppliers, cell factories, diamond wire saw activity and so on.

Stock market-listed activity should not be the domain of companies just selling modules. View the example of Nextracker’s IPO as just the start of a process that sees the financial operations of domestic equipment and materials suppliers taken seriously, where raising cash is a priority. In short, provide investors with long-term security to release capital today.

The scope to stimulate job creation now goes way beyond a few hundred people simply going into a module assembly factory in Alabama for a few years.

Watching to see how this unfolds now will be fascinating. It has the potential to create a stakeholder clientele in solar cell manufacturing that is the envy of the world and lay out a blueprint in how to succeed in owning and controlling a critical high-tech segment moving forward.