A group of US solar manufacturers, including Qcells, First Solar, Meyer Burger and REC Silicon, have filed allegations that increased solar imports from Vietnam and Thailand are “injuring the US solar industry”.

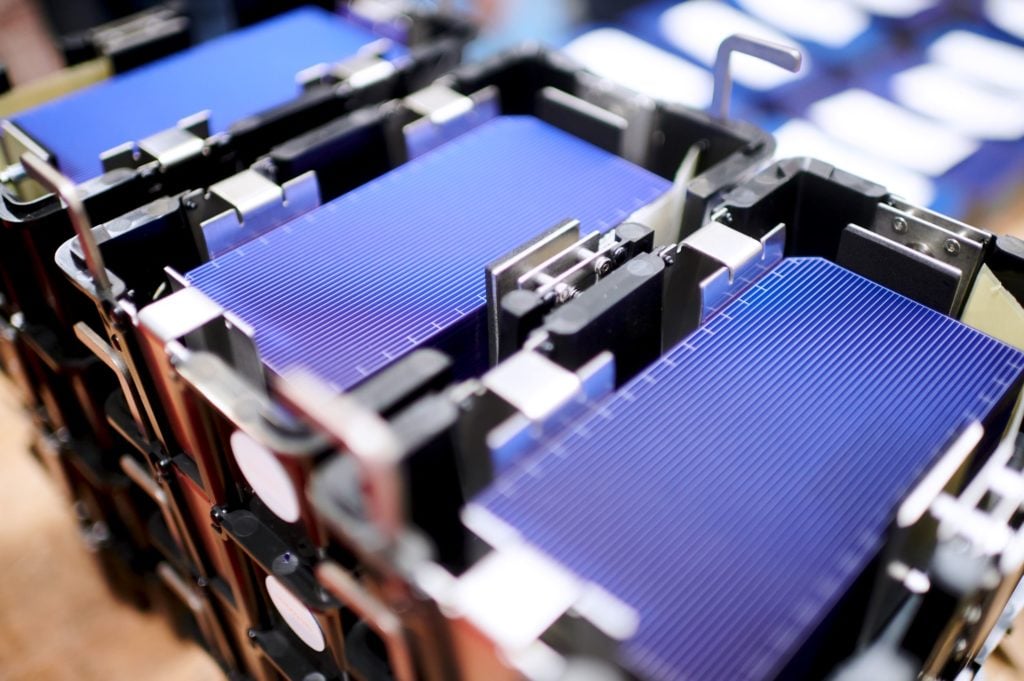

The group—the American Alliance for Solar Manufacturing Trade Committee—has filed Critical Circumstances allegations to the Department of Commerce (DOC) via the law firm Wiley Rein, regarding the import of crystalline silicon solar cells, whether or not they have been assembled into modules.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

It claims that cell imports have increased 39% and 17% from Vietnam and Thailand, respectively, since April, when the Alliance issued an antidumping and countervailing duty (AD/CVD) petition for Southeast Asian (SEA) solar cells to the DOC. This sought to impose steep tariffs on products coming from the two countries, as well as Malaysia and Cambodia, based on the allegation that, predominantly, Chinese solar manufacturers in the region were “dumping” product in the US and circumventing US trade restrictions on China.

Dumping refers to the practice of selling products on a market at unfairly low prices, often below cost, to the detriment of market competition.

If successful, this latest allegation would likely impose tariffs retroactively on imports which arrived in the US within 90 days before 7 June, when a preliminary determination was reached on the AD/CVD petition by the US International Trade Commission (ITC).

Under the filing, Critical Circumstances are deemed to have occurred if the DOC judges that imports to the US market of products currently under an AD/CVD investigation are “rapidly increasing”.

In a statement by the law firm Wiley, which represents the Alliance, it claimed that from January to March the US imported just over 5GW of crystalline silicon solar products from Vietnam and around 3.5GW from Thailand. According to its data, the period from April to June saw over 7GW imported from Vietnam and 4.1GW from Thailand.

It added that June alone saw an “all-time record high” of over 2.5GW of solar poducts imported from Vietnam.

Wiley said: “The data so far presents a strong case that Vietnam and Thailand quickly increased their solar panel exports to the US following the petitions filed by the Alliance to avoid any duties that could follow an affirmative determination.”

“When we submitted our petitions a few months ago, several China-based companies operating in Thailand and Vietnam appear to have actively accelerated their US solar exports, likely to evade impending duties,” said Tim Brightbill, lead counsel to the petitioners. “We were therefore compelled to file these critical circumstances allegations in response to these new surges of imports.

“We cannot allow these countries—and Chinese-owned companies—to continue harming the US market unabated.”

The Alliance also includes Convalt Energy, Mission Solar and Swift Solar. Of the major players, both Qcells and Meyer Burger either have operating cell manufacturing capacity in the US or are building it. First Solar is a Cadmium Telluride thin-film module producer—and the largest manufacturer by capacity in the Western Hemisphere—and does not rely heavily on the silicon solar supply chain.

Preliminary determinations from the DOC and ITC on both the countervailing duty and antidumping cases are expected in September and November, respectively. Final determinations are expected in spring 2025.

Impact on US market is uncertain

Following the Alliance’s initial AD/CVD petition, industry analyst Clean Energy Associates (CEA) predicted that a successful finding could cause a cell supply bottleneck in the US and ultimately raise the prices of both US-made and imported solar modules by up to US$0.15/watt.

The US is heavily dependent on the named SEA countries—and the Chinese companies and subsidiaries that operate there—for its solar cell supply. The incentives under the Inflation Reduction Act (IRA) have led to many more module assembly facilities and announcements than cell manufacturing sites, which are more time consuming and costly to establish.

New tariffs would push up the price of supplying those module assembly facilities with imported cells, as domestic capacity will struggle to meet demand.

However, PV prices across the PV supply chain have fallen dramatically over the last 18 months and modules now make up a far smaller portion of a solar project’s cost than they once did. This could potentially mitigate the impact of raised prices on the US solar market.

PV Tech’s full coverage of everything pertaining to this—and previous—AD/CVD investigations can be read here.