Residential solar systems in the US continue to grow in size at the same time as battery attachment rates increase and the median installed price of all type of PV projects drops again, albeit only slightly.

Those are some of the key findings of the Lawrence Berkeley National Laboratory’s (LNBL) annual solar report, Tracking the Sun. The report provides an overview of key trends in the US market based on project-level data for roughly 2.5 million systems installed through year-end 2021, as well as preliminary data for the first half of 2022.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

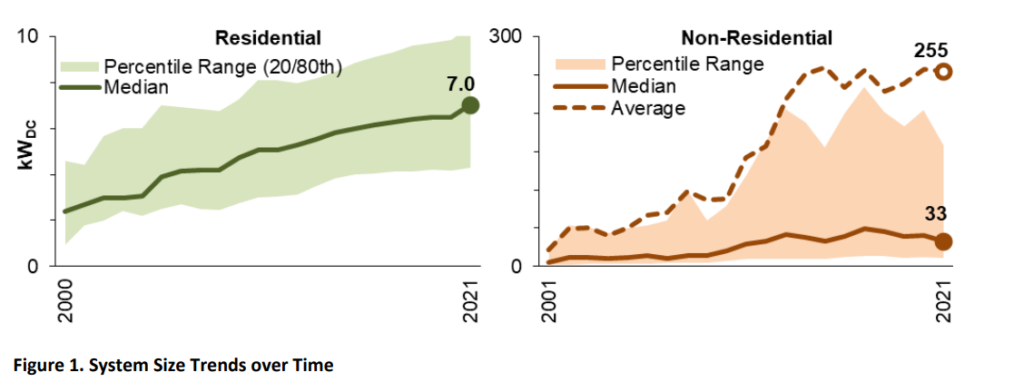

LBNL said residential PV systems continue to grow in size, with the median in 2021 reaching 7.0kW, while non-residential system sizes have plateaued. The laboratory defines non-residential systems as any size and ground-mounted systems up to 5MW.

“Most [non-residential systems] are relatively small, with a median of just 33kW in 2021, but roughly 20% were larger than 150kW, and the average size among all non-residential systems was roughly 250kW,” said the report.

Meanwhile, module level power electronics, such as microinverters or DC optimisers, have continued to gain share across the sample, representing 94% of residential systems, 81% of small (<100kW) non-residential systems and 36% of large non-residential systems (≥100kW) installed in 2021.

Moreover, nearly half (46%) of all large non-residential systems installed in 2021 were ground-mounted, while just 12% had tracking. In comparison, 13% of small non-residential and 2% of residential systems are ground-mounted, and negligible shares have tracking, the report showed.

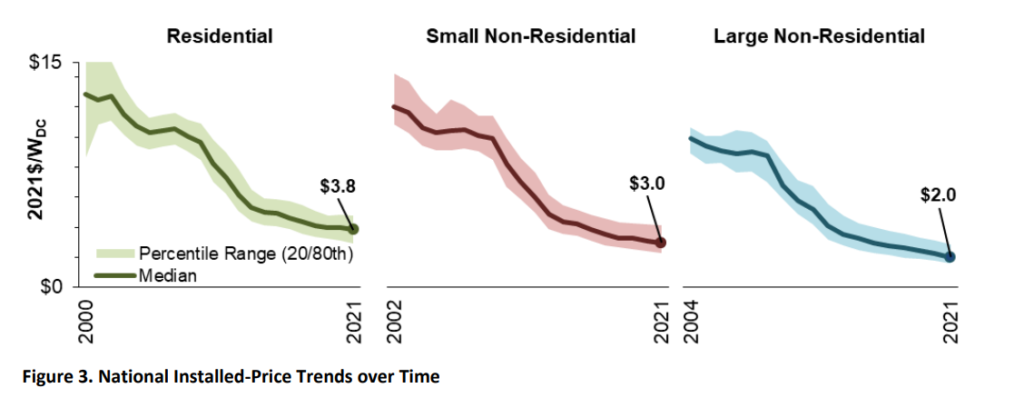

LBNL conducted an analysis of installed price data paid by system owners prior to receipt of any incentives. It was based on a subset of the larger dataset and covered mostly stand-alone PV systems.

It revealed that US median installed prices have fallen by roughly US$0.4c/W per year, on average, but that price decline has tapered off since 2013, with prices dropping since then at roughly US$0.1c-0.2c/W per year.

From 2020-2021, median prices fell by US$0.1c- 0.2c/W across all three sectors in real, inflation-adjusted terms. This is despite rising module costs that have caused upward pressure on prices over the past two years, although preliminary data from the first half of 2022 suggest the median installed prices for residential systems remained flat in real terms compared to the last half of 2021.

However: “Supply chain constraints, widely acknowledged within the industry as putting upward pressure on prices, may not be fully reflected in prices for installed projects, and are also partly embedded within the inflation adjustment of pricing data into real dollar terms. In nominal terms, median prices residential and large non-residential systems rose in H1 2022,” LBNL said.

Again, there was deviation between national and state trends, with half of all states showing an increase in median residential prices from 2020-2021, and most states showing a decline in non-residential prices.

Median prices for PV systems paired with battery storage were US$0.6-1.6/W higher than for stand-alone PV systems in 2021 across the three customers segments. LBNL used a multi-variate regression analysis to estimate a US$1.9/W premium for adding storage to residential PV, assuming a 5-kW battery with 10-15 kWh of storage.

“Given typical residential PV and storage sizes, this equates to an underlying incremental cost of roughly US$1,200/kWh of storage, which is in-line with average residential storage costs reported through California’s Self-Generation Incentive Program.”

Co-located solar-plus-storage

This year’s Tracking the Sun report also included a discussion of trends among paired solar-plus-storage systems, including details on battery storage attachment rates and system sizing.

It found that battery storage attachment rates have been steadily rising in the residential sector, reaching 10% of the data sample in 2021. Non-residential attachment rates are lower and have fluctuated over the years but have still been rising, reaching 4.9% of all systems installed in 2021.

These attachment rate, however, are unevenly distributed across the US, with the increased attachment rates largely reflecting progress in a few states, such as California. Hawaii had the highest attachment rates of any state (93% residential, 59% non-residential in 2021), while extreme weather events, such as storm Uri that ravaged Texas last year, caused demand for co-located battery energy storage systems (BESS) to increase.

And while paired residential systems continue to evolve toward larger storage sizing over time (roughly 42% of systems installed in 2021 had batteries of at least 10kW in size), paired non-residential systems are getting smaller. Of all paired non-residential systems installed in 2021, almost half (46%) had batteries smaller than 10kW.

LBNL said this was down to expanding uptake “among smaller customers into applications beyond demand charge management”.