US solar assets “are not meeting performance expectations”, according to research from insurer kWh Analytics.

kWh Analytics has published the 2022 edition of its annual Solar Generation Index (SGI), which compiles learnings from more than 500 operational solar assets in the US, with a total installed capacity in excess of 11GW.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

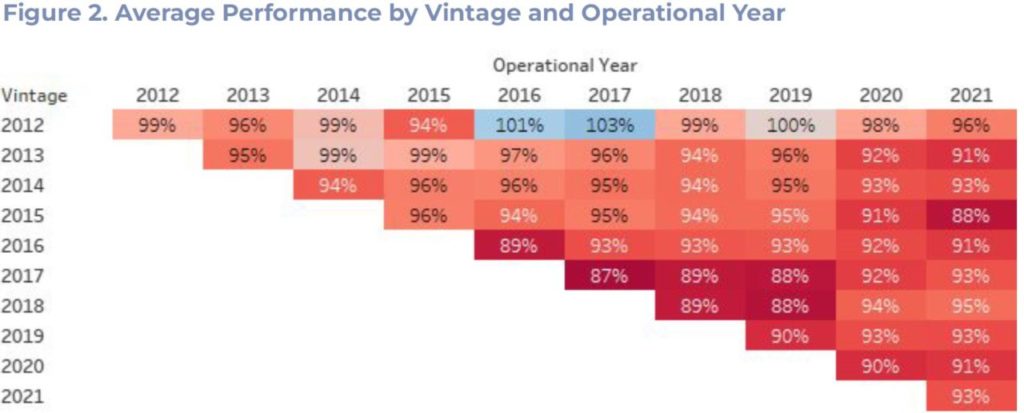

Analysis from the 2022 SGI, which reflects on the weather-adjusted performance of solar assets between 2012 and 2021, concluded that solar asset underperformance persisted in 2021, and over the past decade underperformance has impacted projects independent of their capacity, region and mount type.

This year’s analysis continues to show newer projects performing worse than projects constructed in the early 2010s relative to their P50 estimates, however the average performance of projects constructed in 2021 had a minor improvement from those in 2020.

Despite an increased performance of solar assets built after 2015 for last year and in 2020, those projects did however miss their P50 estimates by 7-13% in their first year in operation, with scarce improvement in the following years.

The underperformance of solar assets, independent of when they started to be operational, was similar when taking into consideration their size, which was separated into three groups – assets of 1-10MW, 10-50MW and more than 50MW – and the analysis shows that independent of their size, assets continue to underperform.

Meanwhile, projects with bigger capacity (>50MW) have performed worse relative to their P50 estimates compared to projects between 10-50MW since 2019, which has seen a small increase in 2021 compared to the previous year.

An introduction in the SGI asset performance is based on the different mount types, with single-axis trackers favoured in recent project developments over fixed-tilt systems, according to kWh Analytics, but the performance of both has had a similar steady decline. From 2015 until last year, fixed-tilt systems had maintained a better performance but in 2021 both mount types saw their performance converge at 92% of their P50 estimates.

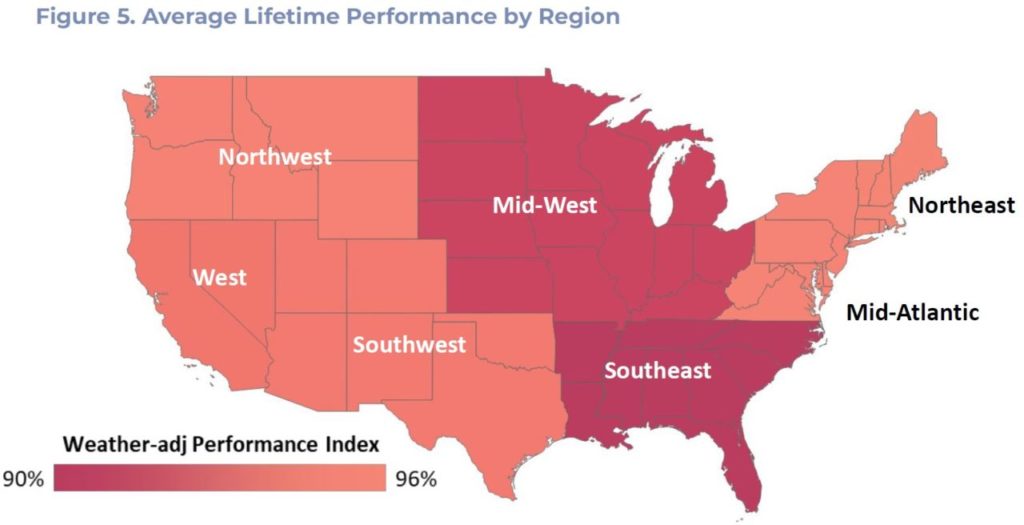

Furthermore, the underperformance trend remains a nationwide issue with average lifetime performance ranging from 5-10% below initial P50 estimates across the US, with the exception in 2021 of the Northwest and Southeast regions which improved by 1% and 2%, respectively.

The analysis has led kWh Analytics to conclude that the difference between P50 estimates and actual performance continues to widen and thus a solution to the underperformance of solar assets has to be found to ensure the industry’s financial stability.

“Underperformance affects investors and lenders critical to the success and growth of solar projects,” said Jason Kaminksy, CEO of kWh Analytics. “As an industry, we must collaborate to find ways to course-correct in order to ensure the industry’s long-term financial health.”