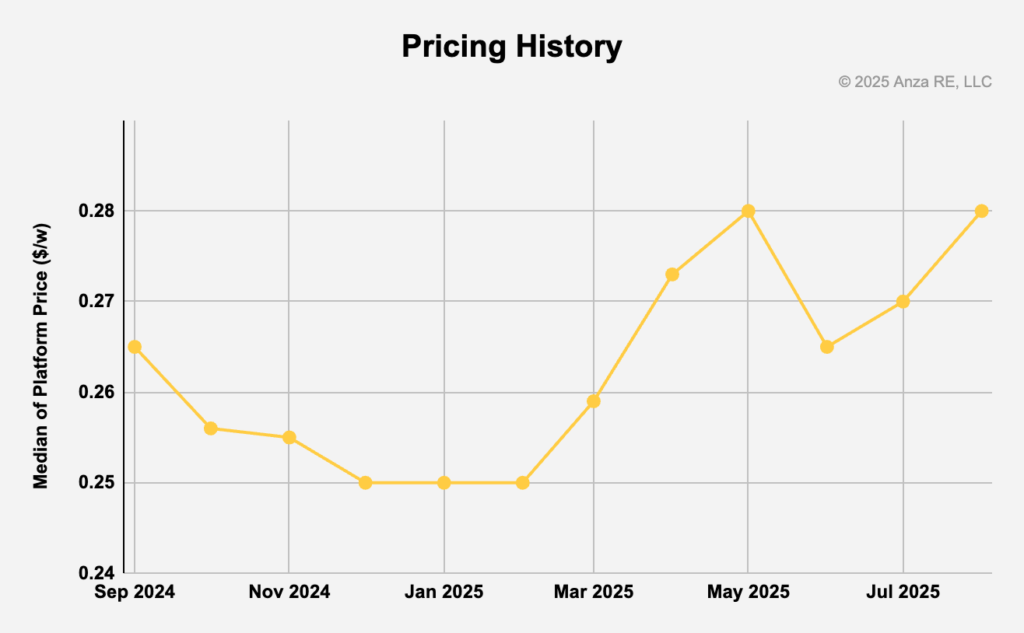

US solar module prices jumped in Q3 2025 as developers scrambled to meet the 2 September 2025 safe harbour deadline for Investment Tax Credit (ITC) qualification, according to supply chain platform Anza.

According to Anza’s latest pricing insights report, median prices rose 3.7% from June to August, reaching US$0.28/W. This represented a US$0.015/W increase from June levels. The surge reflects the impact of new government rules requiring projects over 1.5MW to meet stricter construction commencement standards to secure ITC eligibility.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Anza said the September deadline created a pull-forward effect, with Q4 demand compressed into late summer as developers moved quickly to lock in tax credits before the cutoff. This policy-induced urgency appears to have overridden typical procurement considerations, with buyers prioritising familiar suppliers and established relationships over compliance status, Anza said.

The pricing pressure was particularly notable for Foreign Entity of Concern (FEOC)-noncompliant modules, which saw prices jump 9.2% from June to August. FEOC-compliant modules experienced a more moderate 4.9% increase, suggesting developers rushing to meet the September deadline relied heavily on existing supply chains rather than prioritising compliance requirements for future projects.

Anza’s data, representing median prices from over 40 suppliers capturing more than 95% of US module supply, underscores how policy deadlines and evolving compliance requirements continue to reshape solar procurement strategies and pricing dynamics.

Technology trends

Module technology pricing patterns revealed significant shifts during the quarter. Mono PERC technology saw the steepest increase, rising approximately 10% to US$0.275/W as buyers leaned on its mature supply chain to meet tight deadlines. The technology maintained its position as the lowest-priced mainstream option.

TOPCon pricing increased more modestly to US$0.28/W, with the historic premium over PERC compressing to nearly zero. Anza said this suggests US suppliers may be prioritising PERC manufacturing domestically due to intellectual property concerns surrounding TOPCon technology.

Heterojunction (HJT) modules remained at a significant premium, rising to US$0.39/W, though supply continues to be limited in the US market.

Supply chain diversification continues

Cell origin pricing reflected ongoing supply chain shifts, with most regions experiencing upward pressure. Southeast Asian modules subject to anti-dumping and countervailing duties (AD/CVD) rose 3.7% to US$0.305/W, while Indian modules climbed 5.2% to the same price point.

The Philippines, as the only Southeast Asian country not classified under AD/CVD measures, saw prices increase 4.1% to US$0.28/W as significant manufacturing capacity continues migrating to the region. Middle East and African origins rose 3.9% to US$0.265/W, while South Korea and Germany bucked the trend, declining 8.8% to US$0.31/W.

US domestic cell content commanded the highest premium at US$0.46/W, increasing 5.7% during the quarter.

AD/CVD and poly risks

Anza warned that anticipated AD/CVD determinations on India, Indonesia, and Laos, combined with potential Section 232 tariffs on polysilicon, could create additional upward pressure on module prices in Q4.

Speaking to PV Tech last week ahead of the report’s publication today, Mike Hall, Anza’s CEO, said: “We had a very busy summer, first helping IPPs that wanted to procure against the reciprocal tariffs in April. Then we saw another rush to get out ahead of the OBBB [One Big Beautiful Bill] in July. And then, once Trump announced that he was asking Treasury to revise the [safe harbour] guidance, there was a rush to procure ahead of that. And then after the guidance, there was a rush to procure ahead of the September deadline.

“That’s mostly all behind us, and so we’re not seeing companies push to procure modules in order to preserve ITC or even avoid the FEOC restrictions that come in place at the end of the year. However, we still are seeing accelerated procurements for solar, primarily to get out ahead of tariffs or trade issues. The big one everybody’s radar right now is the 232 potential tariff on poly, because there’s so much uncertainty as to where that will land and what the implications will be for the actual finished solar module [and] imported solar modules that aren’t using domestic poly, which is almost all of them.”

Additional reporting Jonathan Touriño Jacobo