Vietnam remains one of the most attractive destinations of solar finance in South East Asia despite fears of market saturation, but access to capital in the region remains a key hurdle.

That was the view from panellists speaking at today’s Solar & Storage Finance Asia event, which heard the perspectives from investment experts and assessed the strengths and weaknesses of Asia’s solar and storage markets.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

While India was mentioned as a market of significant potential, as detailed within another session at the event, both Han Meng Chan, founder and managing director at ADL Capital Group, and Bence Szegedi, vice president at SUSI Partners, considered Vietnam to be the clear frontrunner.

This comes despite fears over a saturation of solar in the country, which installed some 9GW of PV last year, prompting the nation’s grid operator EVN to raise concerns over grid stability and curtailment. Prabaljit Sarkar, director of business development at InfraCo Asia, a public company funded by governments but which acts as a private entity, argued that Vietnam now has a surplus of solar energy and is oversaturated with private sector interest.

But there was broad consensus among panellists that access to capital funds was a stumbling block for emerging economies, causing a knock-on effect on investment decisions, bids and tenders.

Szegedi said that financial institutions remained reluctant to finance in US Dollars as projects may not be fully bankable from the perspective of internationally agreed standards, adding: “We often see that there is liquidity but that the regulations just don’t match the requirements of this liquidity, and this is also reflected in the cost of capital.”

One solution identified by Vikram Raju, head of EM and climate impact, AIP private markets at Morgan Stanley, has been to work with development financial institutions to get concessional funding is US Dollars in tandem with domestic investors. He said this approach had worked for Morgan Stanley in Africa, where similar capital access constraints exist.

While there was broad consensus on the cost of capital, there was far less agreement when it came to energy storage and green hydrogen in particular.

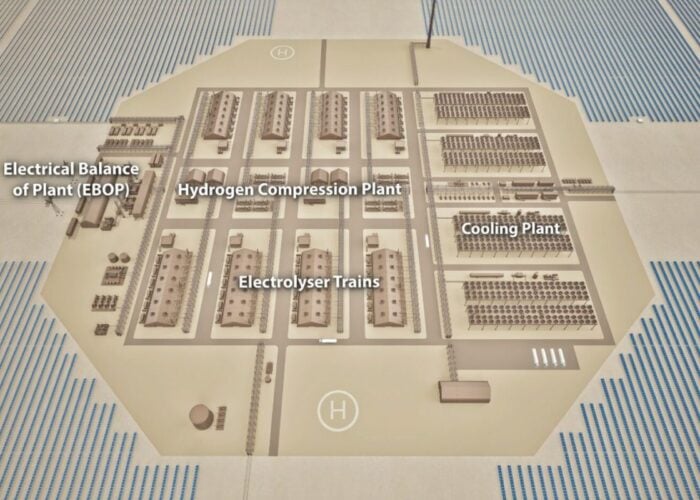

Sarkar noted the trend toward green hydrogen, but pointed to its shortcomings in terms of emissions, transportation and safety. Pumped hydro storage, on the other hand, “is well proven”, he said. “It has a natural synergy with renewables, like how the same hydro dam can be used for floating solar and a pumped storage system… I don’t see in the short term the deployment [of green hydrogen storage] becoming that important”.

Szegedi, however, sees green hydrogen storage as a “potentially very interesting solution” as battery storage may not be appropriate in all places. Although admitting the technology had issues, he said there was vast potential in accessing remote areas without grid access. “Overall, we are quite enthusiastic about green hydrogen’s potential,” he added.

Raju took the middle ground in this debate and said to watch this space. “Solution sets arrive when you have adaption at scale, so watch China,” he said. “What does China do in this space with regards to hydrogen trucks in particular. And if that takes off, the entire supply chain gears around it.”