A shift towards renewables is among the factors identified as a key driver of a likely surge in global copper demand over the next decade.

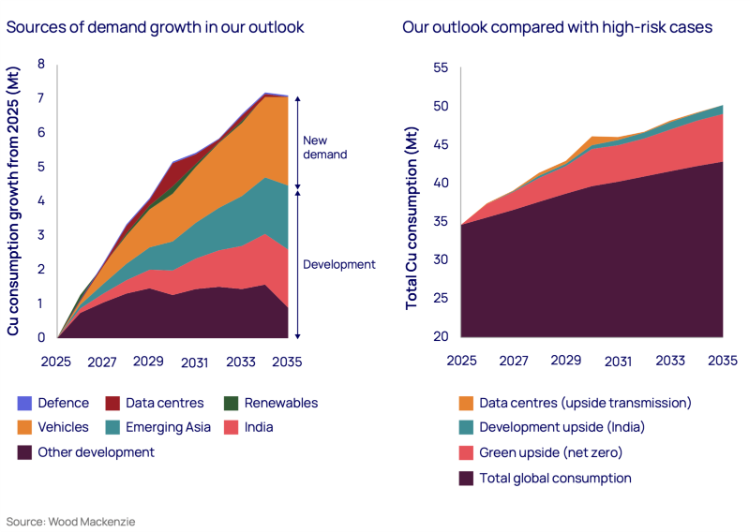

According to new analysis from Wood Mackenzie, global copper demand is poised for significant growth, with consumption expected to surge 24% to 42.7 million tonnes per annum by 2035.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Alongside traditional economic development, Wood Mackenzie identifies four key “disruptors” driving this demand surge: the energy transition, artificial intelligence infrastructure such as data centres, the ongoing industrialisation of India and Southeast Asia, and increased defence spending. Together, these factors will account for 40% of total demand growth, adding three million tonnes annually by 2035.

Wood Mackenzie’s analysis reveals that annual copper demand from the renewable energy sector is projected to climb from 1.7 million tonnes today to 4.3 million tonnes by 2035, with geopolitical factors amplifying the urgency. Nations seeking to reduce dependence on volatile energy imports are accelerating renewable deployments, further intensifying copper requirements.

The growth in batteries and electric vehicles (EVs) will be a major driver of demand for copper in the energy transition.

“Each electric vehicle contains up to four times more copper than a conventional car,” said Peter Schmitz, direct of global copper research at Wood Mackenzie. “As battery technologies advance, copper demand intensity across charging infrastructure and power systems will remain high. By our forecasts, EV-related copper demand is set to double by 2035, cementing the metal’s role at the heart of the global energy transition.”

Charles Cooper, Wood Mackenzie’s research director and head of copper research, said copper could become a critical supply bottleneck in the shift to renewables.

“Copper has become the strategic bottleneck of the global energy transition. From Detroit to Shenzhen, the impacts of commodity supply chain disruptions and the industry’s inability to deliver will be acutely felt. If governments and investors fail to act, we risk turning the metal of electrification into the metal of scarcity.”

The analysis suggests that in a supply-constrained environment, these demand disruptors could trigger prolonged periods of high prices and unpredictable market fluctuations, potentially slowing the pace of energy transition projects globally.

The implications for solar photovoltaic technology are potentially significant, with copper frequently touted as an alternative to increasingly costly silver as a metallisation material.