When Jan Marc Luchies from Tempress Systems (Amtech Systems) took to the stage last week – on the second day of the inaugural PV CellTech conference in Kuala Lumpur on 17 March 2016 – equipment supplier Amtech Systems capitalized on this platform with a press release to highlight a sharp uptick in new order intake for its PV operations over the past two months, taking the company’s solar bookings to approximately US$50 million since October 2015.

In fact, this was one of a number of independent press releases last week from companies speaking, sponsoring and attending the PV CellTech conference in Kuala Lumpur.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Consistent with the takeaways from the event, manufacturing technology finally appears to be getting prioritised by the mainstream PV industry. And the importance for manufacturers and suppliers to associate their products for maximum credibility and impact can only see increased activity in the next few months.

In addition to Amtech Systems, gasses and chemicals supplier Linde Group also issued a press release on day one of the PV CellTech conference, announcing being awarded a number of gas and chemical supply contracts for new solar cell plants across Southeast Asia. And the seventh version of the ITRPV roadmap was released on 17 March 2016 to overlap with co-chair of the ITRPV working group Markus Fischer choosing PV CellTech as the forum to unveil the results of the report for the first time. Another long-term equipment supplier to the solar cell sector, centrotherm also announced new orders placed in the first two months of 2016, last week.

But if technology is so important in the PV industry right now, why have we seen so little discussion on this and what is happening with PV equipment spending of recent, outside of PV Tech's ongoing coverage the PV CellTech event last week?

In this blog, I try to capture why this has been happening in the PV industry, outline a new way of tracking PV capex and technology, and show some examples of how powerful this can be when fully understood and exploited.

Why are PV analysts ignoring technology, manufacturing and outsourcing?

Having spent much of last week on the stage at PV CellTech moderating and speaking, it struck me that it seems such a long time since there was any good discussion about PV equipment spending or useful visuals like graphics displaying new-order-intake, net-revenues and tool-backlogs.

As a leading indicator of what is happening in PV technology and capacity expansions, this type of information is priceless to solar PV manufacturers and suppliers. It is also a damned good way of knowing who is producing and innovating, not to mention who is simply outsourcing across the value-chain.

Not wishing to labour a point here, but could you even imagine a semiconductor industry where there were no analysts bothering to collate and discuss the minutiae surrounding capital equipment bookings trends? A good example is Applied Materials, which spends entire quarterly earnings calls discussing semiconductor equipment and trends but negates similar coverage of its EES division which holds its Baccini solar cell metallization technology and major player in the PV sector.

So, why the lack of analysts covering PV capex and technology spending trends? Why is virtually the whole analyst community forgetting about upstream technology and obsessing about timings of yieldcos that will probably never happen, or assuming that outsourcing half your multi-GW shipment guidance is acceptable?

It is baffling that some people seemed to have decided, almost overnight, that PV panels are commoditised items. Indeed, some of the recent shipment guidance figures at the multi-GW level by listed companies are based largely on the ability to outsource up to 50% of c-Si cells (only the most important part of a solar panel). And not once, have they been picked up on this, and asked where they are getting the third-party product from, and how they can control quality?

It is not hard to see just why companies like DuPont have been trying to prioritize quality and reliability at the module level for the past few years, and it seems surprising that companies whose audit trail is entirely in-house – by virtue of being uniquely differentiated – do not appear to be more vocal on the level of third-party rebadging going on with their competitors.

But even for those companies, the industry as a whole can’t afford a slip up on the quality side, or any questions about the current generation of solar panels being asked regarding component audit trails or long-term reliability.

New PV equipment spending methodology needed

Let’s start by looking at some of the most important equipment supplier data from the past couple of years, and ask what this means for solar PV technology.

Over the past months, when pulling together all the relevant data from the PV Tech archives that fed in part into the dataset for our new PV Manufacturing & Technology Quarterly report, it suddenly dawned on me that – with the exception of the above-mentioned Amtech Systems – the days of dedicated PV business units have almost become a thing of the past.

In the absence of having quarterly financials breaking out PV equipment spending spoon-fed for regurgitation, another way to get to this is to come at it top-down from real capex being spent by manufacturers across the different segments of the value-chain (poly to module and thin-film), and then remove non-equipment parts of capex (buildings, services, infrastructure, etc.).

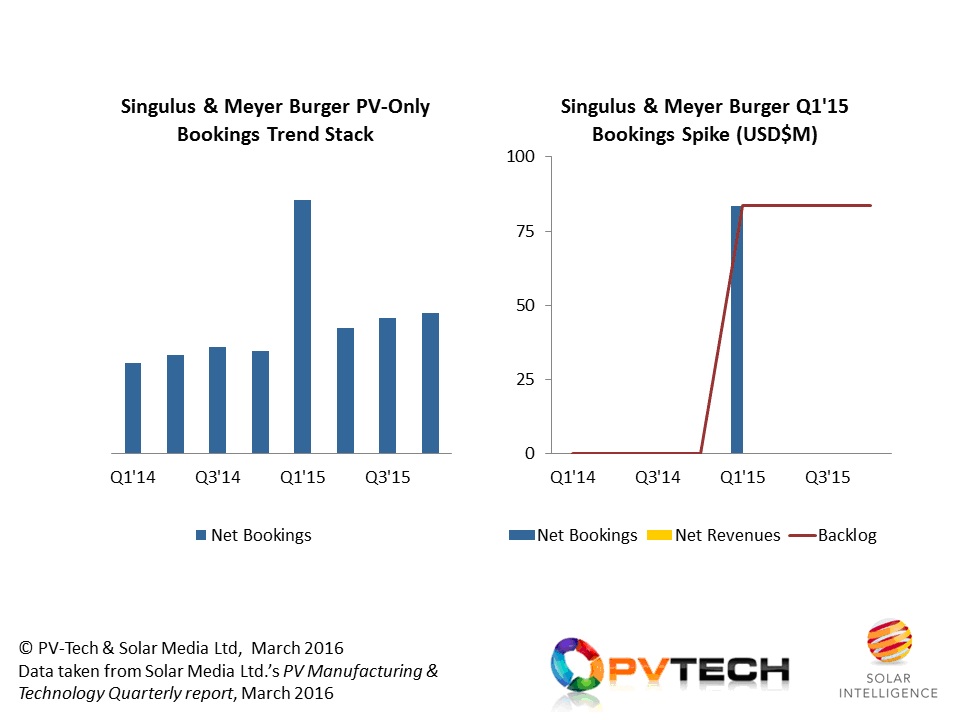

Moreover, sometimes if you know enough about which companies supply the bulk of key process tool types for production lines, you can form control groups and see if there are common trends. Here is one such example of this approach below, where we have collected quarterly estimates for PV-only metrics for two of Europe’s leading PV equipment suppliers, Meyer Burger and Singulus.

Forming a specific tool/technology control group, each company seemed to have a spike in PV-specific new-order-intake during Q1’15. The graphic below-left shows the estimated quarterly PV bookings for the two companies added together. Using this as a starting point, we then set up quarterly baseline levels of bookings, and remove these from the cumulative totals to isolate any uptick delta that may highlight something unexpected.

Doing this type of analysis, we can finally point to an additional order figure of US$80 million during (or around) Q1’15, shown below-right. If you carry forward to today, this booking spike from Q1’15 would appear to be sitting as backlog, which alone is something to ponder.

Validating capex with equipment supplier revenues

Let’s move on now to some of the data coming from the other side of the equation: capex. Here the correlation to company metrics like those above (new order intake, revenues, backlog) is strictly for equipment supplier revenue metrics.

In theory, you could plug in estimates of when you thought these PO’s were placed to join up order-intake dates and then back out backlog levels: but when equipment spending lead times today can vary from weeks to a year, it is worth firmly parking this bit, and just look for a match between manufacturing capex and tool supplier revenue.

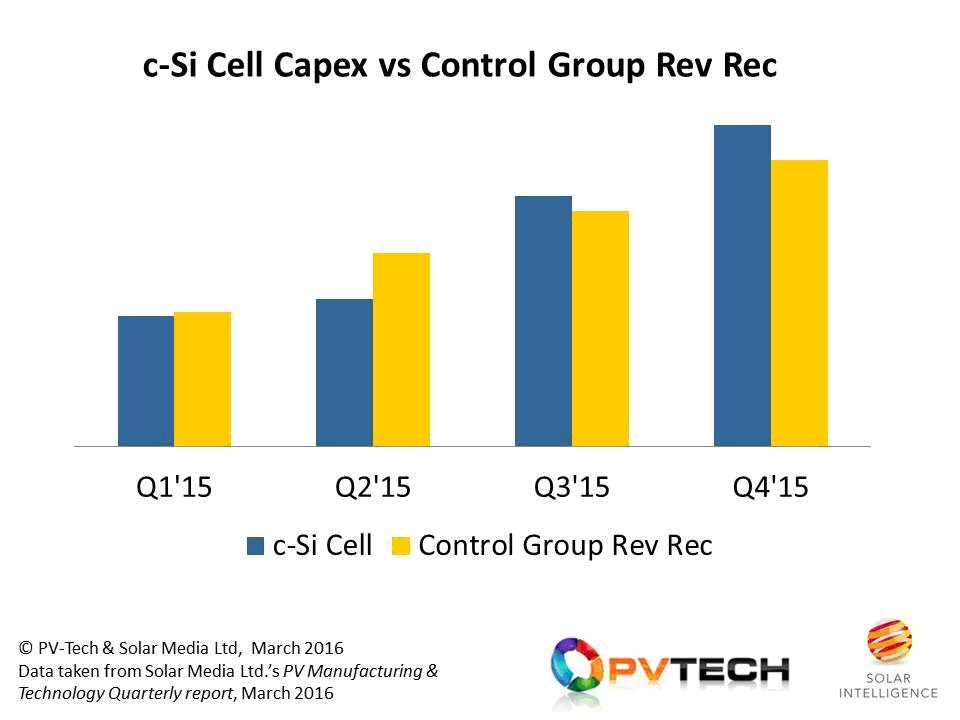

Let’s take the c-Si cell stage as an example to show this now.

The figure below shows our cell capex analysis top down for the cell manufacturing sector, for each quarter in 2015. For now, this is an all-in upstream (or manufacturing) capex figure, and therefore does include new buildings capex, but is more than good for trending analyses. Cell capex is shown in the blue bars in the graphic.

The lighter-coloured bars, shown alongside the top-down cell capex, represent a control group of four key equipment suppliers that have complementary tools used for different c-Si cell process flow stages, added cumulatively for estimated c-Si cell equipment revenues by quarter during 2015. The two datasets are then normalized to best visualize the quarterly trending comparison, and therefore have arbitrary units for y-axis scaling here.

The match in the bars shown above is pretty good, and gives an idea of cell spending growth across the year. You can never get a 100% match as revenue recognition always shifts things a bit, and the estimates from both sides do need various educated assumptions thrown into the mix. But you can see how this type of analysis taken a few steps further can be extremely powerful for a whole range of companies involved in the sector, especially for suppliers of value-chain specific tool types.

More blogs like this will appear in the next 12 months on PV Tech, showing some of the key findings of our ongoing research work. Our new PV Manufacturing & Technology Quarterly report is available for annual subscription purposes.

And by March 2017, PV CellTech will have no shortage of supporting market research to complement the topics and speakers, and hopefully again, will provide the ideal backdrop for PV manufacturers and suppliers to align marketing strategies to show awareness and competence at the PV manufacturing and technology level.