Chinese merchant cell producer Aiko Solar will work with RENA Technologies to support its ongoing transition to passivated emitter and rear cell (PERC) technology.

The latest tool order includes a partnership to introduce plated front side contacts to Aiko’s PERC cells as it looks to trim production costs.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

RENA is also providing alkaline texturing equipment (RENA BatchTex) and edge isolation equipment (RENA InOxSide+) that will enable Aiko to tailor its PERC production lines for mono-, multi- and bifacial cells.

Aiko announced during this year’s SNEC exhibition in Shanghai that it was planning to extend its cell capacity to 8GW by 2022 at a cost of RMB6 billion (US$883 million).

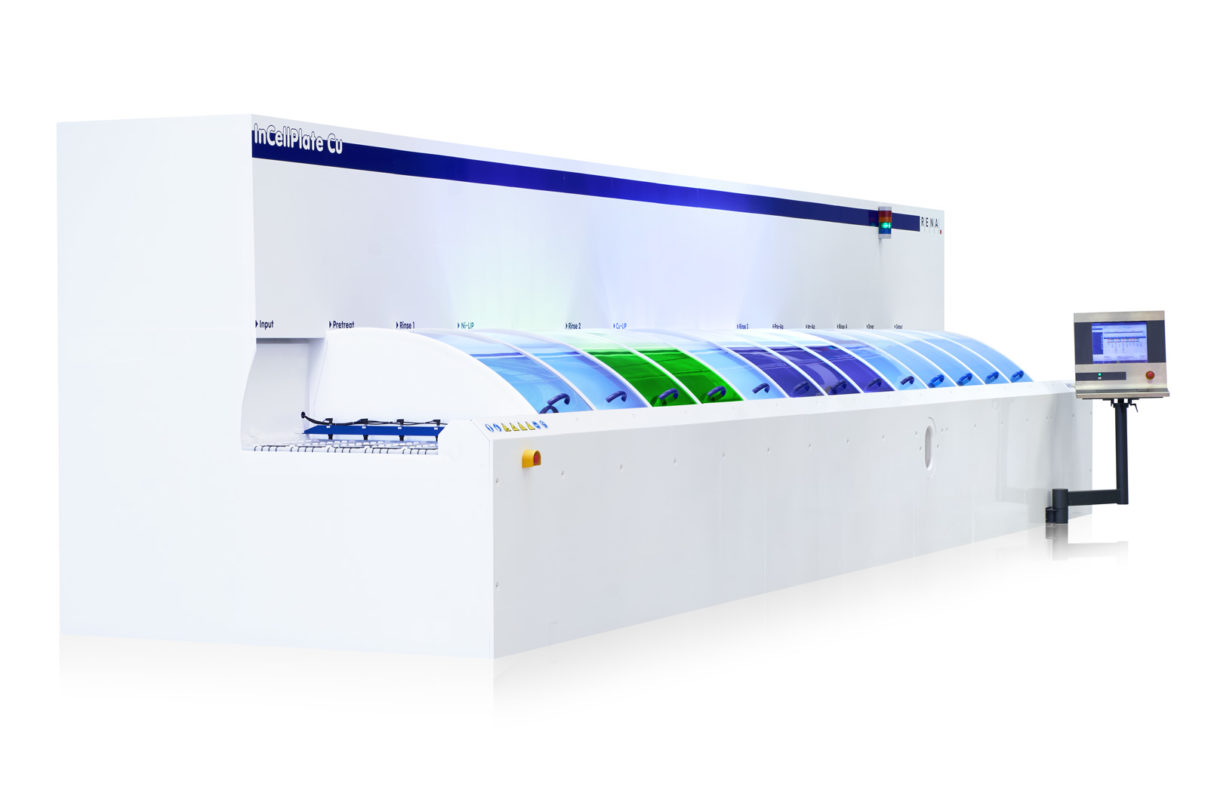

The partnership on plated front side cell contacts will see RENA deliver an InCellPlate production tool later in 2017 to Aiko’s new fabrication site at the city of YiWu, Zhejiang province. The company has previously told PV Tech that its plans to open 650-700MW of mono PERC capacity at the facility before the end of the fourth quarter.

In a joint statement, the companies claimed that more than US$0.01/Watt, or 15%, could be saved in the fabrication costs of the cells.

“The price pressure in the solar industry continues to push us to constantly look at cost-down measures, said Chen Gang, chairman, Aiko.

“Aiko Solar is committed to implementing the newest and most innovative technologies into production to achieve such cost reductions. The plating technology using the RENA InCellPlate [tool] will help us to drive down the cost as we can replace the screen-printed front side silver electrodes. This will be a major cost saving,” he added.

Aiko has a wafer supply deal with monocrystalline evangelists Longi, which is itself undergoing GW-scale expansion plans.

According to Finlay Colville, mono cell production is expected to account for 49% of all cell production in 2018, and is expected to be the dominant technology used in the industry by 2019.

Aiko Solar has also previously stated that it signed a number of deals with western suppliers during SNEC 2017.

In May, InnoLas announced an order from an unnamed Asian customer which included tools for the laser contact opening (LCO) process required for PERC cells.

RENA, materials firm MacDermid and InnoLas are technology partners in providing front-side metalization plating, replacing costly Ag printing, as detailed in one of two guest blogs for PV Tech.