Specialist PV manufacturing equipment supplier Amtech Systems is restructuring its solar cell manufacturing equipment business with job losses after China-based customers have pushed-out capacity expansion plans after government cuts were made to downstream solar installation targets as deployments far exceeded goals.

Fokko Pentinga, Chief Executive Officer of Amtech said, “In our solar business, recent changes in China's domestic solar policies have slowed cell capacity expansion plans. However, we believe follow-on orders for the next phases of the large 1 GW+ turnkey project will be received in the next few quarters and look to participate in other selective growth opportunities as we serve core customers over the long term.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Amtech said that the restructuring plan for its solar business segment included a reduction in its workforce of approximately 35-40 employees. In Amtech’s last annual report of September 30, 2017, the company employed a total of 455 people globally but sis not break-out employees by business segment.

The restructuring was said to lead to approximately US$0.6 million to US$0.8 million of related costs that would be recorded in its fiscal the fourth quarter.

The company also announced that it had sold its remaining 15% stake in solar ion implant equipment manufacturer, Kingstone Technology Hong Kong Limited for approximately US$5.7 million.

Financials

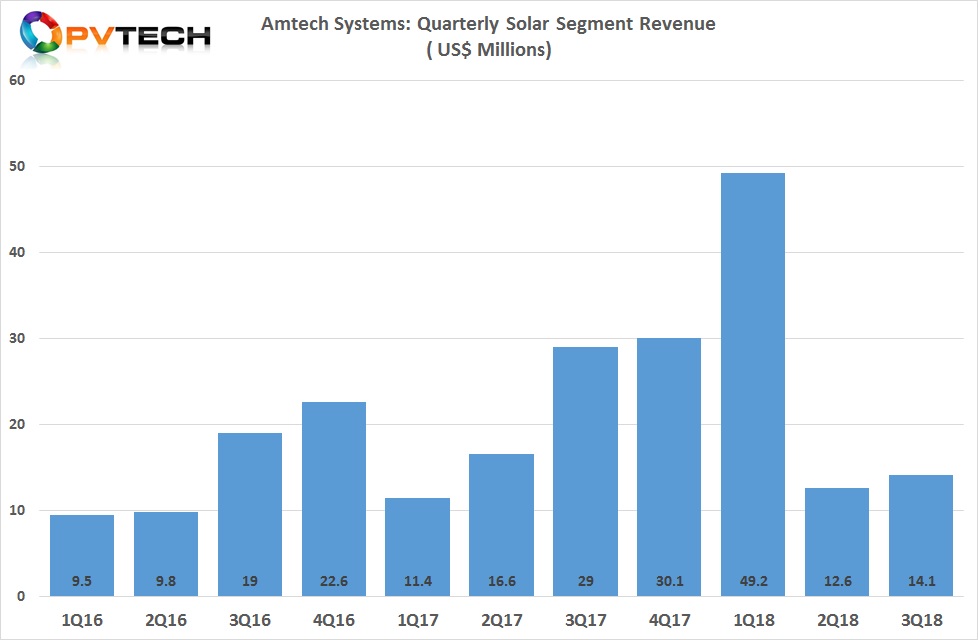

Amtech Systems reported solar segment revenue of US$14.1 million in its fiscal 2018 third quarter, compared to US$12.6 million in the previous quarter.

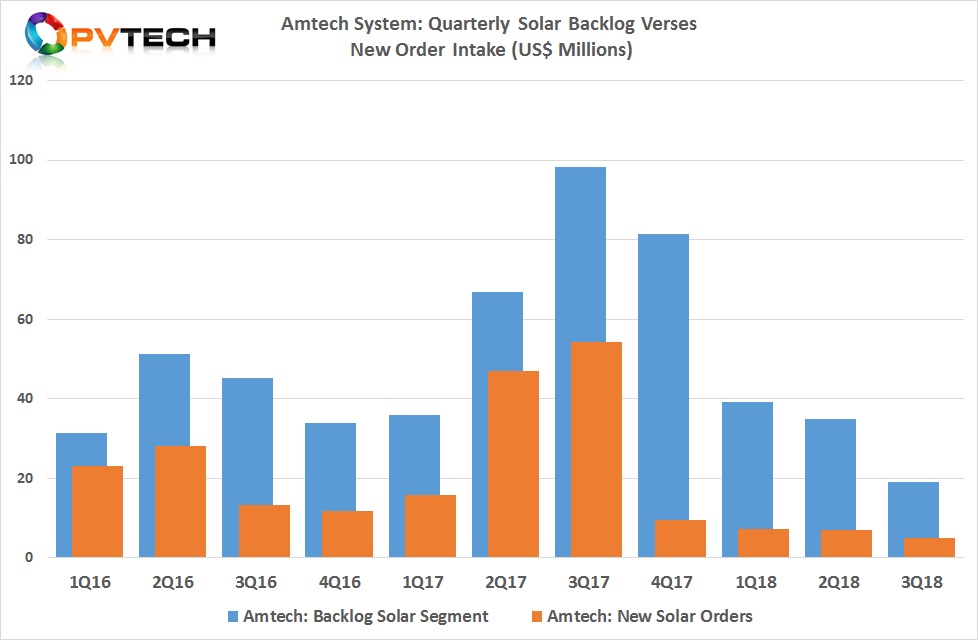

Solar segment new orders were US$5.0 million, compared to US$7 million in the previous quarter. Order backlog stood at US$19.0 million, compared to US$35.0 million at the end of the previous quarter.

The company also highlighted that solar segment sales would be significantly influenced by the timing of future orders from an existing customer that had recently delayed a 1GW turnkey cell expansion in China.