Funds managed by private equity firm Antin Infrastructure Partners have secured a deal to acquire a majority stake in US solar and storage developer Origis Energy.

Expected to close in late 2021, the transaction will see Antin acquire the stake from Origis CEO Guy Vanderhaegen and Global Atlantic Financial Group, a life insurance company that has held an interest in the developer since 2018.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Antin will support Origis Energy with additional capital and resources as it builds out its contracted pipeline, while the developer will also look to expand its operations and maintenance business.

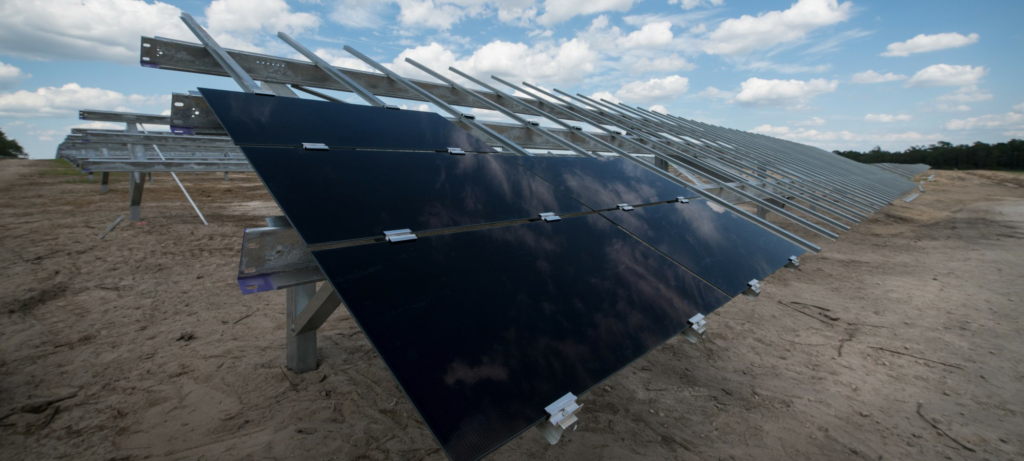

Founded in 2008, Miami-headquartered Origis Energy has developed 130 projects and currently operates 2GW of solar and energy storage capacity.

“We are delighted to partner with Antin Infrastructure Partners to support our growth story. With its backing, we can continue to capitalise on the fast-growing US renewables market, which benefits from a supportive regulatory environment and compelling technology fundamentals,” said Vanderhaegen.

The acquisition comes after Origis announced a management buyout of its original shareholders earlier this year, with Global Atlantic providing financing for that deal, increasing its interest in the company.

Antin’s activity in the solar sector has previously seen the firm sell its Antin Solar Investments platform of Italian PV plants in 2015.