Asset managers as key value contributors during the plant lifecycle

There is a myth about solar photovoltaic (PV) plants, that once the plant is built and the panels installed, as long as the sun is shining, the plant will require minimal management and operational effort. As more and more large-scale solar plants are being developed and built, it is important to recognise that this is, indeed, a myth.

Stakeholders in the industry, whether strategic or financial investors, have been crucial for the continuous growth of solar PV and have sustained high expectations as to the ultimate performance – both operational and financial – of solar plants. This has resulted in stakeholders indirectly imposing ambitious targets for service providers in the solar sector.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This article examines the wide variety of services an asset manager should provide to a solar PV owner, as a means of achieving the desired return. To achieve the expectations set by many owners and investors in the industry, it is not enough for the sun to shine – asset managers must deploy resources, skills and strategies well beyond what the industry expected in the early days of solar. These skills involve operating advanced digital asset management platforms, which enable the effective management of diverse solar portfolios. To help key stakeholders, asset managers, and asset owners in particular, deal with these new challenges, SolarPower Europe’s O&M and Asset Management Task Force developed the industry-first Asset Management Best Practice Guidelines, based on the experience of leading asset management experts, covering the essential topics to facilitate high-quality service provisions.

When considering a solar PV plant as a business unit in its own right, it becomes apparent that, while fewer risks are involved compared to a traditional power plant, it is not risk free from a financial, operational and technical perspective. For the asset manager, this risk profile underpins the need for a multipronged approach to the risk mitigation and management of solar plants, and the importance of working efficiently to address the significant volume of work in an increasingly competitive environment.

This challenge has also presented an opportunity to forward-looking asset managers. It is apparent that successful asset management organisations, whether independent service providers or business units within independent power producers, are not simply driven by the objective of fulfilling the services related to their scope of work, but are ultimately focused on realising the maximum return potential of the solar plant.

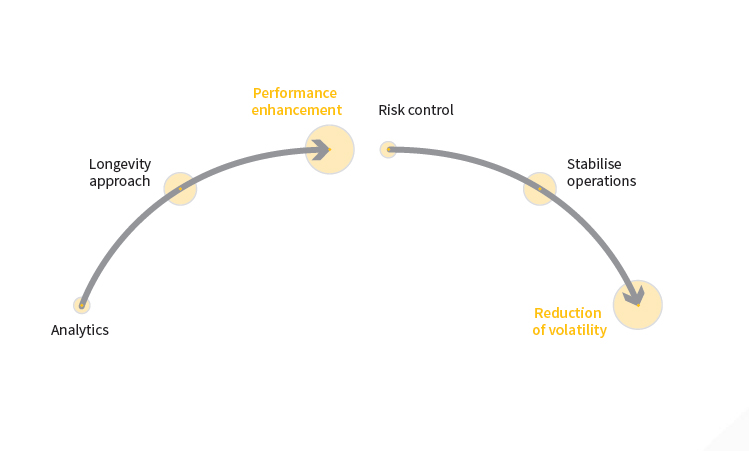

If the mandate of an asset manager involves working to ensure that each solar plant meets its expected value generation for the owner, then the entire suite of asset management services is designed to reduce volatility, through the stabilisation of operations, and to enhance performance, through the optimisation of the sites with the goal of increasing their longevity.

Technical asset management and critical monitoring services

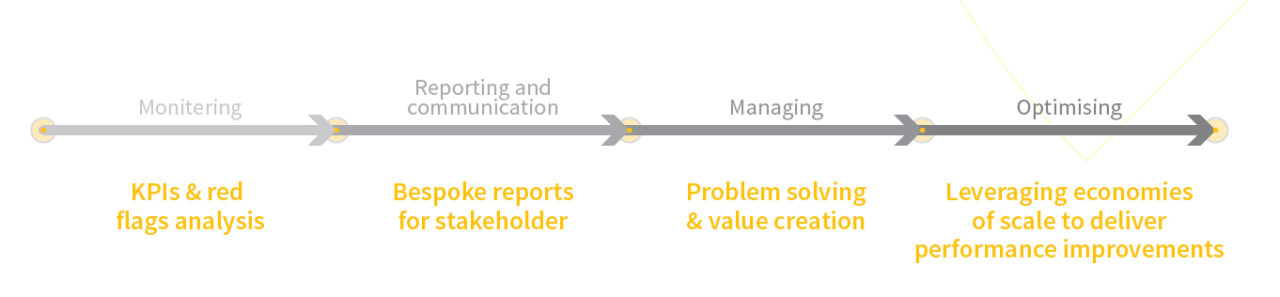

Technical asset management (TAM) is focused on providing value to the asset owner through assistance relating to the regular operations of the plant. TAM involves a holistic approach, anticipating the asset owner’s requirements in terms of the management support of its operations; not only from an asset perspective, but also keeping in mind other stakeholders, such as lenders, suppliers, or advisors.

The general guidelines when carrying out a TAM contract include the following activities:

- Communication with the asset owner and all relevant stakeholders, focusing on reporting the owner’s needs and presenting suitable alternatives that can add value to the plant;

- Optimisation of value for the asset owner by maintaining a regular interest in opportunities applicable to the project – such as maximising energy production, minimising downtime, reducing costs;

- Mitigation of operational, financial and technical risks, and avoidance of general distress of the asset owner towards the plant – including compliance with national and local regulations and contracts, and repowering investments;

- Selection and implementation of asset management software and portfolio monitoring system for operational projects – such as, monitoring performance of operations assets, issue resolution and coordination of information flow;

- Insurance of risk management systems and processes, and contributing to policies, processes, and procedures.

The asset manager is expected to play an integral role in the design process from pre-construction to post-onsite delivery (operation phase), and must ensure that the best output is presented to the asset owner. Such an important task may only be accomplished by working closely with local teams and partners.

The coordination of the design process is something that the asset manager must do when dealing with sub-contractors and onsite issues; the ability to manage the process and ensure it is cost- and time-effective are key drivers of success. In this regard, the asset manager must be a central point of contact for local team members working on operating assets, and the main person responsible for monitoring a pipeline of operational assets. The role includes not only the oversight of day-to-day administration, but also reporting on information flow, policies and corporate governance, along with monitoring project performance. To perform these tasks, the asset manager must be supported by critical monitoring systems and a dedicated team of experts.

The basis for the asset manager’s data and monitoring requirements should be a specialised asset management platform, which will cover the storage and management of operational and non-operational data related to the asset or portfolio, as well as static and dynamic data. Such a platform makes it possible for the industry to transition to an asset-centric information management approach, which addresses five key challenges: (1) minimising production losses; (2) significantly improving efficiency; (3) reducing lack of data transparency; (4) improving the levelised cost of energy (LCOE); (5) positively impacting the return on investment for solar asset owners and operators.

The asset management platform will include plant performance data management, which covers key performance indicators with a daily follow-up, incident remote detection, direct dispatching, and standard reporting elaboration. Further, the platform will include O&M site activity supervision, covering the full traceability of all maintenance completed for the plant or to particular equipment. Finally, the platform includes contract management and administrative optimisation.

The detailed data storage and treatment promotes the reduction of detection time and downtime, which will result in mitigating energy losses in the advent of an abnormal situation. Strategies for reducing and controlling operation & maintenance (O&M) costs, based on comprehensive plant data, can also be devised. The automation of monitoring, which is becoming increasingly popular, in combination with advanced data analysis, can lead to significant returns. This technology allows operation teams to make decisions based on the up-to-date data they receive from monitoring providers, SCADA systems, data loggers, inverters, satellite irradiation data, weather forecasting services and other sources.

Beyond the business sector trends, there is a growing tendency of opting for solutions that integrate the functionalities of monitoring systems, computerised maintenance management systems (CMMS) and enterprise resource planning systems (ERP) into one central platform. These integrated solutions should be regarded as a valuable contribution to asset management, highlighting that centralised data of a high quality is critical for reliable asset operations and effective decision-making. In fact, a recent study conducted by MIT showed that companies using data-driven decision-making are 5% more productive and profitable than their competitors. Indeed, asset managers are increasingly relying on advanced analytical tools to help asset owners reduce the LCOE and to facilitate the development of solar projects around the world.

This is an extract of a feature first published in Volume 22 of PV Tech Power. The full feature can be read here, or in the full digital copy of PV Tech Power 22, which can be downloaded for free here.