Grid outages in Australia dented the performance of UK-based solar asset owner Foresight Solar Fund (FSFL) in the first nine months of the year.

However elevated wholesale power prices in the UK and beyond helped mitigate any drag on the investor’s financial performance, boosting actual cash generated by Foresight’s portfolio of solar assets.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Issuing a Q3 net asset value (NAV) and operational update today, Foresight noted that electricity generation from the company’s portfolio was 3.2% below expectation for the first three quarters of the year, driven primarily by underperformance of the company’s assets in Australia.

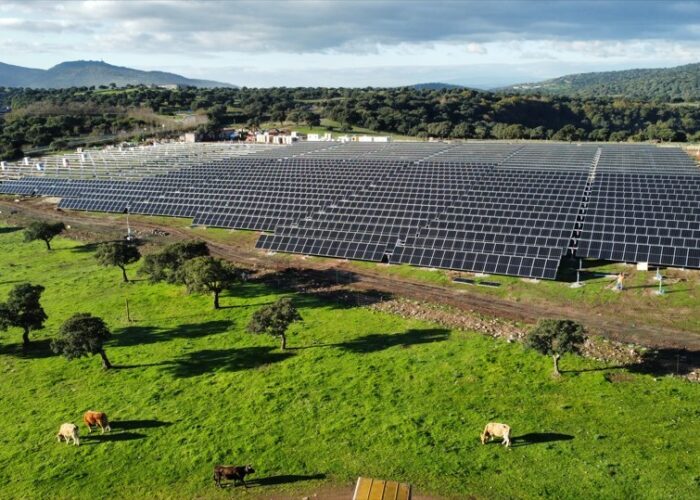

Foresight owns 146MW (net peak capacity, with FSFL owning a share of some assets) of grid-connected solar assets in Australia, however grid outages and lower than forecast irradiation in Australia was a drag on performance in the reporting period.

While Australia is not the only market which has experienced issues with its power grid, concerns about curtailment and the regulatory framework surrounding it were cited by solar investors who have withdrawn from the market. PV Tech Power volume 28 covered the issue within a feature article exploring the investment landscape for solar in Australia, which can be read here.

Nevertheless, total revenue in the nine-month period was some 14% ahead of budget as a result of spiking power prices in the UK. High gas prices and tight power margins have contributed towards spiking merchant power prices in the country, with operational generation assets able to capitalise.

Foresight noted that its NAV rose by around £0.061 per share throughout the three months ended 30 September 2021, around £0.007 per share of which was attributable to the fund’s UK solar assets being able to capture the “exceptionally high” power prices during the reporting period.

Furthermore, approximately one-quarter of this uplift – around £0.015 – was attributable to an increase in power price forecasts, with the effects of Europe’s energy crisis set to continue.