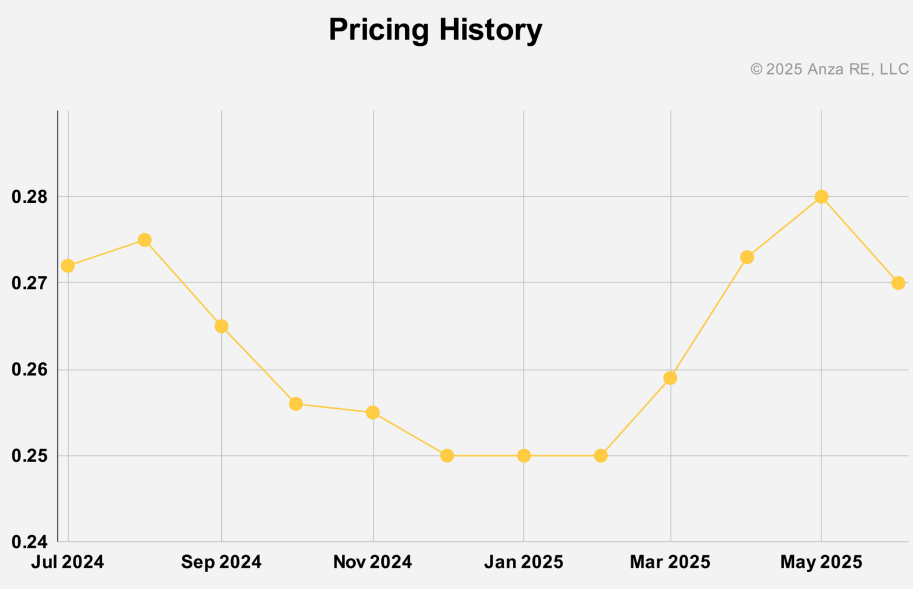

The average price of solar panels used in distributed generation projects in the US increased from US$0.25/W at the start of the year to a high of US$0.28/W in May, before settling at US$0.27/W at the end of the first half of the year.

These are figures from Anza, which this week published a report into module price trends in the US distributed solar sector. The report notes that while June figures are still 3.6% lower than the high reported in May, this is still 12% higher than the prices reported in February 2024, which Anza suggested could be related to ongoing imposition of antidumping and countervailing duty (AD/CVD) tariffs on solar products from a number of markets.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

For instance, cells from the four countries now covered by AD/CVD tariffs – Cambodia, Malaysia, Thailand and Vietnam, upon which tariffs as high as 3,521.14% – cost close to US$0.3/W in May, before falling to US$0.26/W in June. This week, new petitions were filed against imports from Indonesia and Laos, with US companies alleging that Chinese-headquartered manufacturers had shifted their dumping operations from the first four countries to the latter two, and the Anza report notes that the price of cells imported from Indonesia and Laos has increased by 7.7% since February.

However, cells from these countries remain the least expensive of the countries of origin profiled by Anza, giving credence to the petitioner’s complaints that these products are unfairly cheap, especially compared to those made in the US. Each month since June 2024, Anza’s data shows that cells made in the US can cost almost double that of cells made elsewhere in the world, reaching a peak of US$0.5/W either side of Christmas 2024.

HJT remains the most expensive technology

The Anza report also highlights that heterojunction technology (HJT) modules remain the most expensive in the distributed sector, with an average price of US$0.38/W.

While Anza notes that this figure is just represented by three modules on its platform – two based in the US and one in China – this figure is still notably higher than the prices of mono-crystalline passivated emitter rear contact (PERC) and tunnel oxide passivated contact (TOPCon), which sat at a peak of US$0.28/W in May.

In the month since, the average price of mono-PERC fell to US$0.26/W, the lowest among the technologies, while the average price of TOPCon fell to US$0.27/W. Both of these figures, however, are notably higher than earlier this year, with mono-PERC and TOPCon 8.3% and 8%, respectively, more expensive than in February.