The whole of the Fortune 500 is looking into clean energy tax credit transferability deals, according to tax credit investment banking firm Foss & Company.

Advanced manufacturing tax credit incentives in the US clean energy space could also grow to be worth billions of dollars a year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

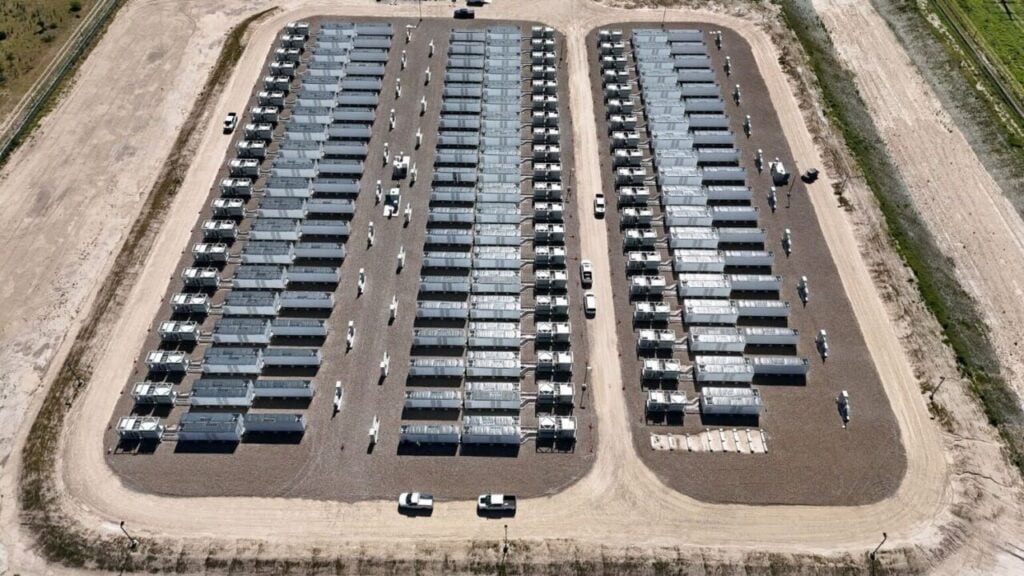

This is the opinion of managing director Bryen Alperin, who spoke to our colleagues at Energy-Storage.news Premium exclusively last week. While much of this discussion centred on the battery industry, considering Foss & Co’s recent investment in Plus Power’s Anemoi battery energy storage system (BESS) in Texas, Alperin noted that the ability to transfer tax credits, such as the 45X manufacturing credit, could be a significant part of the US clean energy sector in the coming years.

The 45X rules are a key component of the Inflation Reduction Act (IRA), and the Department of the Treasury finalised its terms last week. Most notably, companies will be able to receive tax credits for investing in clean energy manufacturing industries, and include the costs of materials and extraction when calculating tax credits, which could be a boon to the US solar sector, which has seen significant investment as the US looks to reduce its reliance on Chinese-made solar products.

“The 45X area seems to be ramping up with lots of manufacturing projects being built,” said Alperin. “We don’t know how large that market could get but it could become billions a year. That market will basically be straight transferability.”

This transferability component has grown to be a market in its own right, with the sheer volume of deals being signed, and the number of companies eager to strike such deals, growing exponentially. Figures from Crux show that, in the third quarter of this year, advanced manufacturing technologies accounted for the majority of tax credit transfer deals in the US, demonstrating growing appetite for clean energy manufacturing tax credit transfers.

“Pre-IRA, there were maybe 50 or 60 companies involved in tax credits at high volumes,” Alperin told Energy-Storage.news Premium. “Now, I would say the entire Fortune 500 is either actively participating or is starting to. That’s partially down to transferability but also the IRA as a whole creating awareness of these tax credits.”

Read the full interview with Alperin on Energy-Storage.news Premium here.