First-time inclusion in A-6 auction to land PV winners with 20-year deals

30 August: Solar winners of the first Brazilian A-6 auction ever to admit PV bids will be offered 20-year supply deals with the government, newly-released official documents show.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Over the weekend, the Brazilian Energy Ministry confirmed solar firms prevailing at the new generation A-6 tender next month will be contracted between January 2025 and December 2044.

The 2025-2044 deal – an identical timeframe to wind’s but shorter than hydro’s and thermal power’s – means PV players will have six years from the contract signing point to ensure projects are built and ready to supply to the grid.

Rubberstamped by Energy minister Bento Albuquerque, the new government document indicates the A-6 tender will take place on 18 October, later than initially floated dates around September.

PV players – banned from A-6 bidding until the rise to power of controversial Brazilian president Jair Bolsonaro – have shown huge appetite for the tender, tabling in June 29.7GW of all 100GW-plus bids recorded across all energy sources.

This year’s separate renewable-only A-4 auction sparked similar solar bidding enthusiasm (26.2GW) but ended up only awarding 203MW to industry players, with PV prices hitting ultra-low averages of BRL67.48/MWh (around US$17.5/MWh).

LONGi to ship annual 200MW to distributed PV in Brazil and others

2 September: For Brazilian PV, the prospect of yet another highly contested auction approaches as the country’s bullish industry draws the eye of global players, in a race documented by a soon-to-be-published PV Tech Power feature.

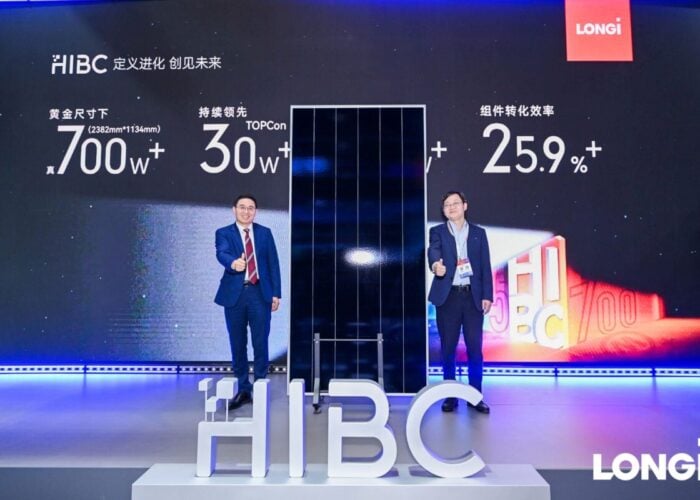

Joining Actis, Enel and other foreign operators making Brazilian moves in recent months, PV maker LONGi recently inked a deal to supply 200MW of its modules to the country and other key Latin American markets every year.

Sealed at last week’s Intersolar South America 2019, the agreement with distributed specialist SICES will see LONGi’s high-efficiency mono PERC modules – both the Hi-MO 4 and HI-MO X lines – added to projects of the segment in Brazil, Mexico and others.

Foreign interest in Brazil’s distributed segment is building two months after the entire market hit the 1GW threshold, with PV found to dominate all energy sources with an installed share of 870MW. Legislative changes in the pipeline could see subsidies phased down, however.

For LONGi, the Brazilian deal comes after the Shanghai-listed PV maker revealed its Hi-MO 4 modules had broken the 2GW sales mark. PV Tech understands these units, designed with M6 (166mm) wafers, are set to become available in the European market in Q4 2019.

Mori Energia to deploy 110MW DG solar pipeline in Minas Gerais

30 August: In another distributed solar-related turn of events, a deal was inked in the state of Minas Gerais for the roll-out of a 110MW pipeline to help drive down power prices.

State governor Romeu Zema penned a protocol that will see BRL523 million (around US$126 million) invested to set up 32 PV plants across 17 municipalities, generating 1,500 jobs in the process.

The distributed solar installations – each designed with a 25-year lifespan – will be deployed by São Paulo-headquartered Mori Solar and supply Minas Gerais with 300GWh in combined power output.

According to the government’s statement, the projects should be completed within months and will help cement Minas Gerais’ position as a PV “leader” in Brazil.

As governor Zema remarked, the large volumes being contracted will make sure energy prices stay “competitive” and industries can be drawn to the state.

Top Brazilian bank to back Canadian Solar’s utility-scale duo

28 August: Two auction-backed projects Canadian Solar is deploying in Brazil are to be built with support from Banco do Nordeste do Brasil, Latin America’s self-styled top regional development bank.

BNB, as the entity is known in its Portuguese acronym, will back the 114.3MWp Francisco Sa and 112.4MWp Jaiba schemes with a BRL487 million (US$120 million) debt package.

The non-recourse project financing – spread across a 23-year period – will bankroll both construction and operation of the two projects, set to come online in 2021.

The financing milestone comes almost 18 months after Canadian Solar’s duo reaped government support at Brazil’s A-4 renewable auction, bagging 20-year PPAs at prices of BRL118/MWh (around US$29/MWh).

A feature examining the opportunities and risks of Brazilian and Mexican PV will be part of PV Tech Power’s Volume 20, scheduled for publication this month. Subscribe for free now

The prospects and challenges of Latin American solar and storage will take centre stage at Solar Media's Energy Storage Latin America, to be held in Colombia on 28-29 April 2020.