Australian firm Carnegie Clean Energy has raised AU$5.3 million (~US$4 million) to grow its solar PV, battery energy storage and wave energy businesses.

Carnegie previously announced on 30 April 2018 that it had initiated a Share Purchase Plan which allowed all eligible Carnegie shareholders to purchase between AU$2,500 and AU$15,000 worth of shares in Carnegie at 3.0 cents per share.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Carnegie said the funds raised would be used to move its wave and solar-hybrid businesses toward profitability, being used as working capital to deliver its existing projects, to further develop and convert its contract pipeline, develop its build, own and operate project pipeline and to pursue opportunities to expand its businesses either organically or through corporate transactions.

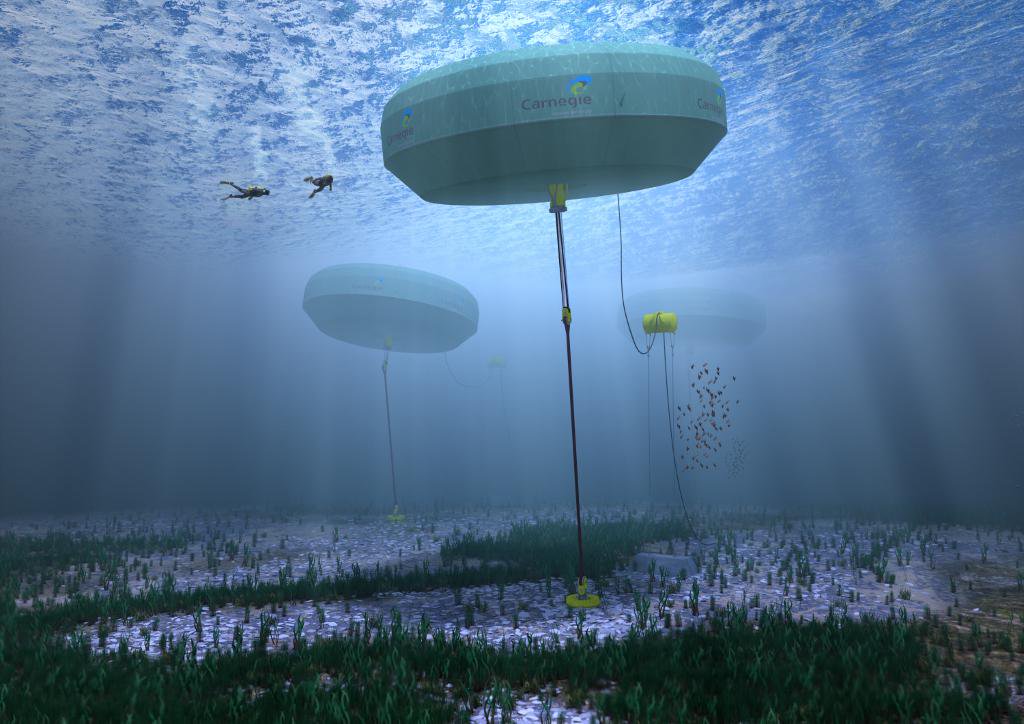

Carnegie owns CETO Wave Energy Technology intellectual property as well as Australian battery and solar microgrid EPC company Energy Made Clean (EMC), which specialises in the delivery of mixed renewable energy microgrid projects to islands and remote and fringe of grid communities.

Carnegie’s managing director, Dr Michael Ottaviano, said: “We thank our shareholders for their support in the capital raise. We will now use this new capital and our existing funds to accelerate our businesses towards financial sustainability.”

In March, Carnegie started constructing the 10MW Northam Solar Farm, which will be amongst the first utility-scale PV projects to be developed on a merchant basis in Western Australia.