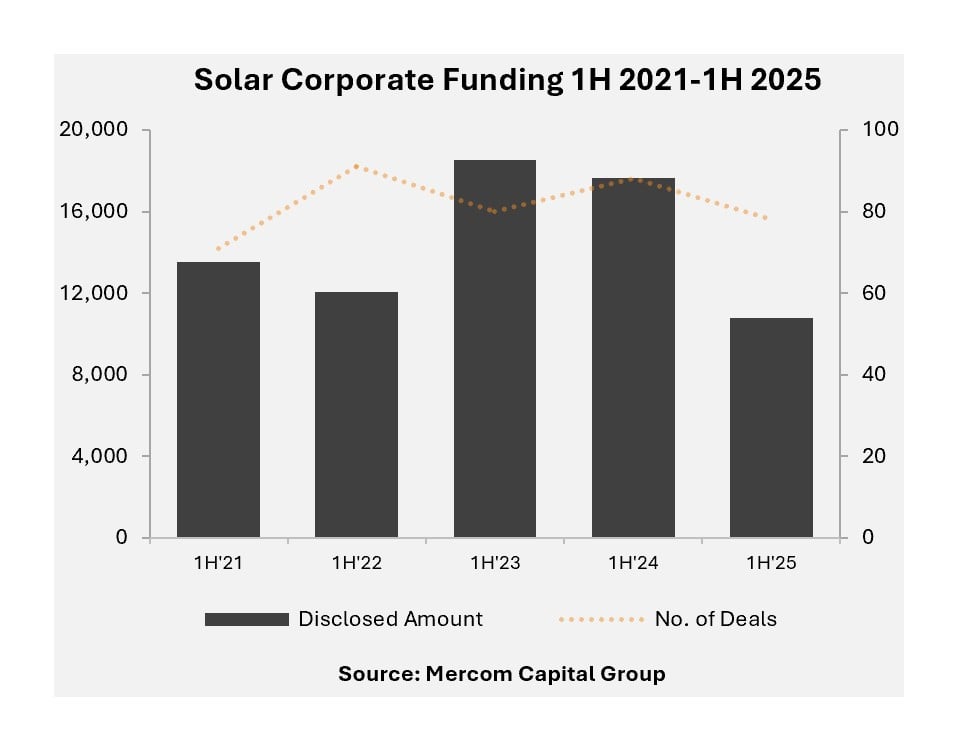

Corporate funding in the solar sector fell by 39% in the first half of 2025 compared with the same period last year.

According to a report from energy market research firm Mercom Capital, the decline in funding was caused by a “wave of legislative, trade, and capital market disruptions” over the first six months of the year. Raj Prabhu, CEO of Mercom, said the challenges “led to a broad reset across the solar sector, altering the industry’s trajectory with both immediate and long-term impacts.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Total corporate funding stood at US$10.8 billion in the first half of 2025, down from US$17.6 billion in 2024. These figures include venture capital (VC), public market and debt financing in the sector.

The data establishes a downward trend in solar investment, after 2024 already saw a 24% decline year-on-year compared with 2023.

The biggest decline in the first half of 2025 was in public market financing, which fell by 73% year-on-year from US$1.7 billion in the first half of 2024 to US$467 million so far in 2025.

Debt financing reached US$7.8 billion across 41 deals, a 41% decline from US$13.2 billion across 51 deals in the same period of 2024.

VC funding declined the least, falling just 7% from US$2.7 billion to US$2.5 billion. The biggest VC deal was secured by US-based Origis Energy, which bagged US$1 billion in strategic financing from Brookfield Asset Management and Antin Infrastructure Partners in January.

The next two largest deals were also in the US: solar developer Silicon Ranch secured US$500 million in April from AIP Management, and solar tech firm Terabase secured US$130 million in March from the Softbank Vision Fund. The fourth and fifth largest deals were for Germany’s Enpal and France’s Solveo Energies.

“For developers, investors, and manufacturers alike, the period was defined by the need to recalibrate in real-time amid a rapidly shifting market landscape. As a result, financial activity declined sharply,” Prabhu said.

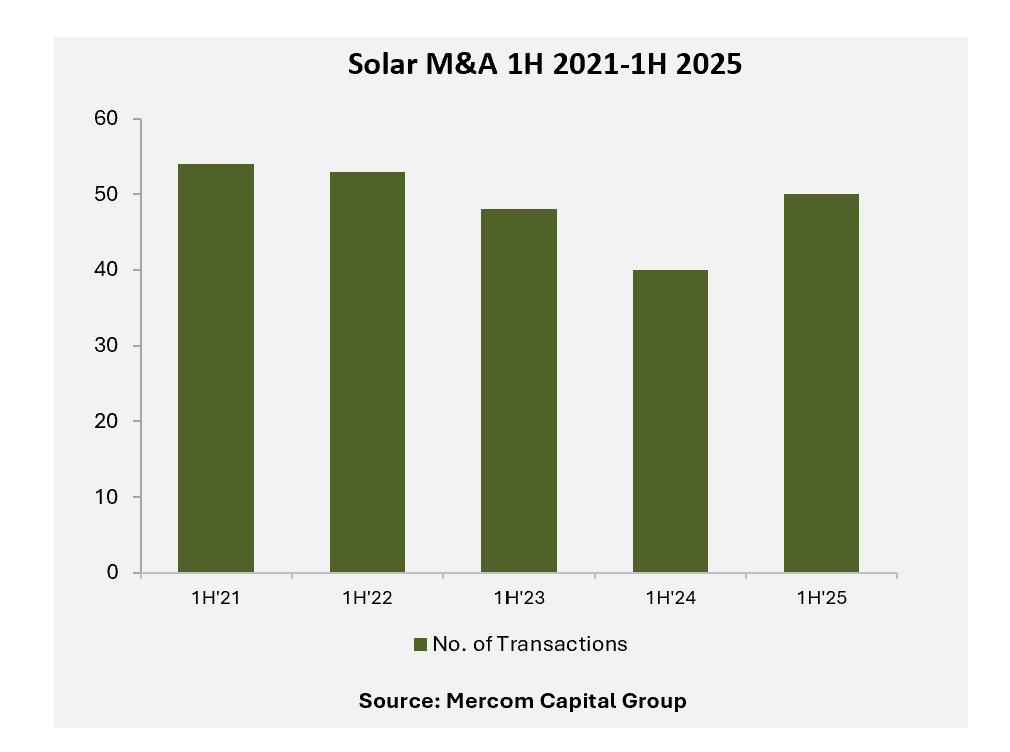

“While the industry navigated significant headwinds, M&A activity both at the corporate and project levels grew year-over-year, as investor demand remained strong for attractively valued solar assets.”

Indeed, mergers and acquisitions (M&A) grew by 25% year-on-year. 50 were made in the first half of 2025 compared with 40 in 2024. Mercom also said there were 106 project acquisitions over the period, totalling 19.9GW of nameplate capacity, compared with 113 deals for 18.5GW in the equivalent period in 2024.

These two statistics point to the growing size of solar projects and, perhaps, to greater consolidation among big investors and asset owners. Though the absolute figures are lower than in 2022, when the market was healthier, the figures are still notable.

The 106 project acquisition deals signed from January to June 2025 were for more capacity than the 113 deals signed in the same period last year. In Q2 2025, investment firms, independent power producers (IPPs) and utilities led project acquisitions relatively equally, whereas Q1 saw a lot of activity from IPPs.

There were also significantly more M&A transactions over the period, though Mercom did not disclose who was making the acquisitions.

“Looking ahead to the second half of the year, the industry’s ability to adapt to the new policy environment and restore capital flows will determine the pace and direction of recovery,” Prabhu concluded.