China-based polysilicon producer Daqo New Energy is upgrading CVD chambers and debottlenecking to enable mono-grade polysilicon production to account for approximately 80% of capacity, due to strong demand and higher ASPs, compared multi-grade polysilicon.

The upgrading and debottlenecking will curtail polysilicon production in the second quarter of 2019, coinciding with an expected fall in downstream installations in China from the weak 5.2GW of new PV installations during the first quarter of 2019.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, Daqo expects full-year polysilicon production to be in the range of approximately 37,000 to 40,000MT, including annual facility maintenance later in the year. The company reiterated it was still on track with capacity expansions with its Phase 4A project that should complete construction by the end of 2019 and ramp up to full capacity of 70,000 MT by the end of the first quarter of 2020.

Longgen Zhang, CEO of Daqo New Energy said, “We are currently undertaking a capacity debottlenecking project to gradually upgrade several older CVD furnaces with improved technology, allowing us to increase production capacity by additional 5,000MT. This project is progressing well and we expect to complete the project ahead of schedule in early June 2019. The ramp-up process of this debottlenecking project will temporarily impact production volumes and cost.”

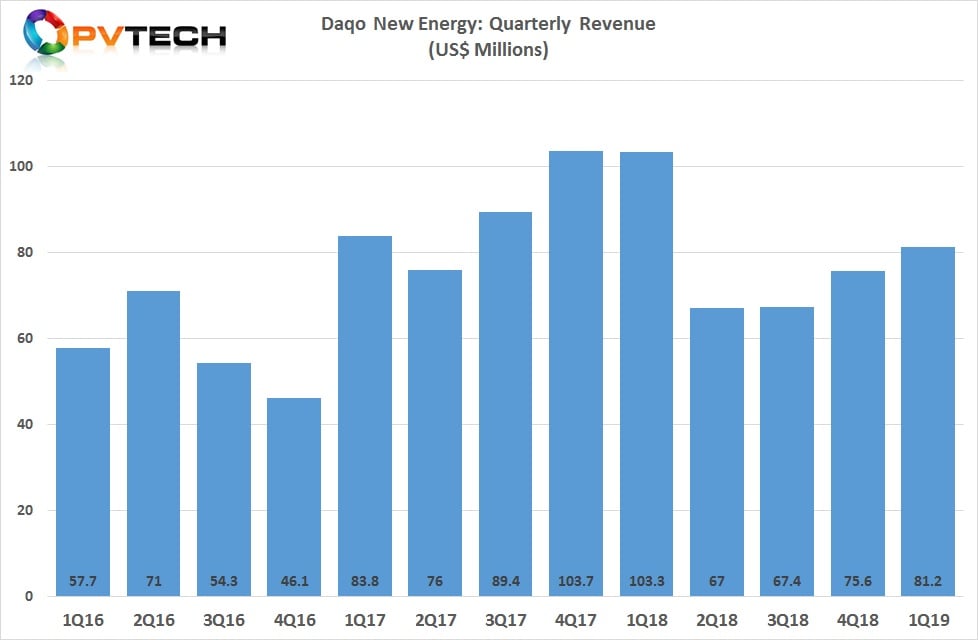

Daqo reported first quarter 2019 revenue US$81.2 million, compared to US$75.6 million in the fourth quarter of 2018 and US$95.6 million in the first quarter of 2018. The sequential increase in revenues was primarily due to higher polysilicon sales volumes partially offset by lower ASPs, according to the company.

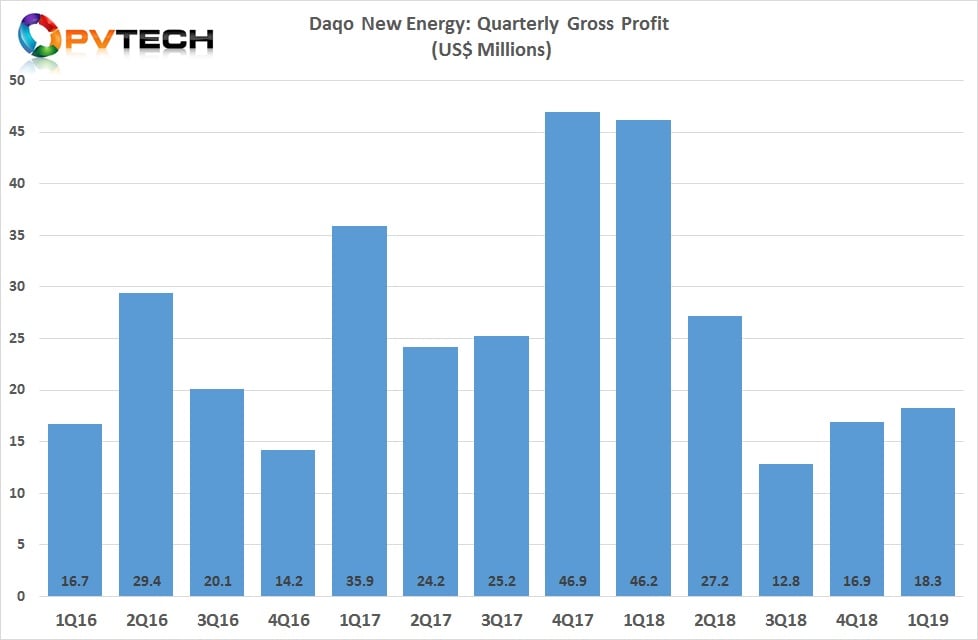

Gross profit was US$18.3million in the reporting quarter, compared to US$16.9 million in the fourth quarter of 2018 and US$43.1 million in the first quarter of 2018.

Gross margin was 22.6%, compared to 22.4% in the fourth quarter of 2018 and 45.0% in the first quarter of 2018. The company said that the sequential increase was primarily due to lower average polysilicon production cost, partially offset by lower ASPs.

Daqo reported polysilicon production volume of 8,764MT in the reporting quarter, compared to 7,301MT in the previous quarter as the company ramped production and maintained full capacity, which also included reducing total production costs to US$7.42/kg, a new record low.

Daqo reported external polysilicon sales volume of 8,450 MT in Q1 2019, compared to 7,030 MT in the previous quarter, another new record for the company.

Guidance

Daqo said that due to the upgrades and debottlenecking it expected to produce approximately 7,200 to 7,400MT of polysilicon in the second quarter of 2019. This would lead to slightly higher total production costs of US$8.0/kg to US$8.5/kg.

Polysilicon sales would be approximately 7,100MT to 7,300MT, during the second quarter of 2019.

The Company expects the total production cost to fall back to around US$7.5/kg in the third quarter of 2019.