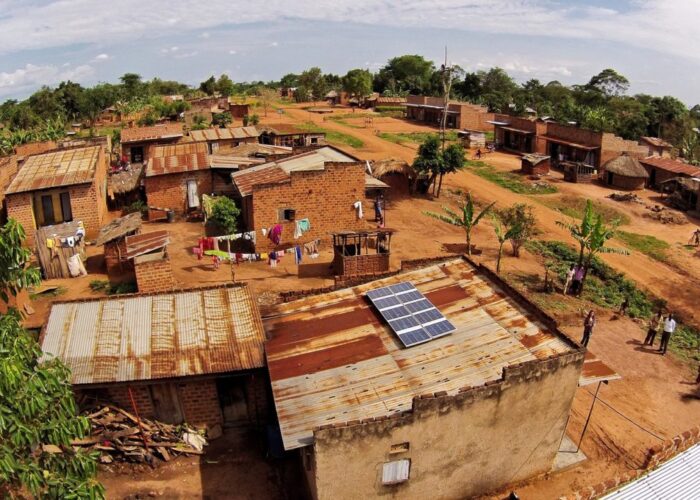

The market for distributed or decentralized PV electricity started in the early 1980s. At that time, it mainly consisted of off-grid installations that were not connected to any grid. This market has experienced a steady growth over the past 30+ years. It didn’t follow the exponential trend of its counterpart, the grid-connected solar, but still, it developed. Since 2010, its growth even accelerated thanks to new business models and technologies, which brought Pay as you Go (PAYG) for Solar Home Systems and micro and mini-grids. Such grids are enabling a change of paradigm that is commonly called ‘decentralized electricity,’ a term preferred to ‘off-grid’ as they are in some cases connected to the main grid. In developing countries, mini-grids are an alternative to grid development and are experiencing an important growth. Even in developed countries, mini-grids represent sometimes a more interesting option economically.

Below are some of the highlights of the industry from the last year:

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

1. Global status on 2017 Distributed PV electricity Tenders

In 2017 we accounted for over 450 relevant tenders (i.e. above US$10,000 amount) over a base of 90 countries. And we could quantify 415MW and 3.29 million units out of 311 of these tenders that contained quantitative information.

Year over year, this represents an increase of respectively + 128MW and 2,2 million units. While small lighting systems represented the majority of the units, this increase was mainly driven by one big tender in India. On the other hand, the megawatt amount is a logical extension of what happened in 2016: community and mini-grids are growing and represented the majority of the megawatts tendered.

Over the world, we could split the megawatts tendered in 2017 as follows:

Unsurprisingly, Asia-Pacific in particular and Africa led the pack in terms of installations, as they have done over the past three years. You should also note that we do not track tenders on China, so our numbers on Asia may just be the tip of the iceberg. Latin America has a more erratic growth, 2017 was not a good year as tendered capacity decreased strongly over 2016. The Middle East, on the other hand, grew strongly over 2016 and gained the third position.

2. Top countries for Distributed PV electricity tenders in 2017

Leading countries in Asia-Pacific were:

- Pakistan with, among others, a big tender on Education facilities

- Afghanistan, where international help is trying to reconstruct the electricity supply by decentralized installations

- India which is active in many fields, including Solar Home Systems, Lighting and Mini-Grids

Leading countries in Africa were:

- Sierra Leone with 90 mini-grids and PV-hybrid installations

- Mali also with PV plants for villages and mini-grids

- Senegal with 177 villages and 76 PV mini-grid.

In addition, in the rest of the world, Middle East was active mainly through Jordan and Lebanon and South America with Bolivia and Ecuador.

3. Top applications for Distributed PV electricity tenders in 2017

Depending on how we measure top applications, by quantity (units) or by tendered capacity (MW), we shall have different rankings. We chose the latter, which gives the following top 5:

- Education facilities with over 159MW tendered worldwide (over 31,000 units)

- Off-Grid Plants (kW or MW size, for various usages): 153MW (around 200 units)

- Agricultural (pumping & irrigation): 36MW (over 2,000 units)

- Village Electrification by Mini Grid: 26MW (around 1,000 units)

- Solar Lanterns & Solar Home Systems: total of 22MW split 50/50 between these applications (with volume of respectively 3 million units and over 100 000 units).

We found out that rural electrification programs and their associated tenders are still making a big part of the market. It’s uncommon to have education facilities rank #1, this is mainly driven by a single tender in Pakistan which concerned over 20,000 schools. Then we still have Solar Lanterns (also driven by one big tender in India) and Solar Home Systems, but to a lower degree this year. The big change is the larger size of installations, mainly off-grid plants and mini-grids, which are driving up the installation size and associated megawatts. As we could see before, it’s particularly the case of Africa.

So off-grid market today is not anymore only about single homes or personal systems, it’s also about communities and larger systems. They complement each other well; it is also a sign of increased maturity of the market and proof that the industry is moving towards decentralized electricity solutions.