The US Department of Energy (DOE) has earmarked US$128 million to invest in research and development in a bid to bring the cost of utility-scale solar power down by 60% in 10 years.

The initiative, launched by US Energy Secretary Jennifer Granholm yesterday (25 March 2021), comes as part of an “all out war” on climate change launched by US policymakers.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Granholm yesterday outlined an ambitious spending package for R&D to boost the US solar manufacturing sector to meet a new target of bringing utility-scale solar power costs down to an average US$0.02 per kWh by 2030, slashing the current US$0.046 per kWh price by more than half.

The target price forms part of the Biden Administration’s wider goal to have the US running on 100% renewable electricity by 2035 and achieve net-zero carbon emissions by 2050. Granholm told a virtual conference for industry stakeholders that “one of the fastest and easiest, really, paths to these goals is through solar” adding that she hopes to see “hundreds and hundreds” of gigawatts of new capacity deployed in the coming years.

As part of the plan, the DOE has allocated US$128 million in funding to go towards the development of new and existing technologies that it hopes will be central to growing the US’ manufacturing base.

It includes:

- US$40 million to be allocated to 22 R&D projects for perovskite materials; a family of emerging solar materials that have potential to make thin-film solar cells with low production costs.

- A further US$3 million providing seed capital for newly formed companies to scale up the commercial production of perovskite technologies.

- US$20 million to fund the creation of a consortium that will work to bring down the cost of producing cadmium telluride (CdTe technologies), which make up roughly 20% of all solar modules installed in the US.

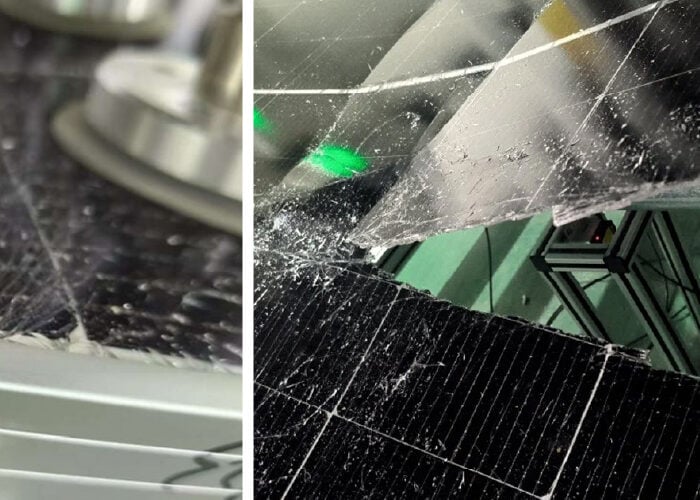

- US$7 million to fund R&D that will increase the longevity of silicon-based PV systems from 30 years to 50, bringing down operations and maintenance (O&M) costs.

- US$58 million earmarked to develop Concentrated Solar Power (CSP), improving solar thermal plants’ reliability and find new applications for solar thermal in industrial processes. This includes US$25 million to build a research facility to further develop CSP, with the aim of bringing its power costs down to US$0.05 per kWh.

The funding, Granholm said, will help US solar manufacturers “unlock cutting edge solutions that drive down costs even further” and create “new opportunities for American companies to lead the clean energy revolution.”

US-centric R&D

US developers were dealt a blow last month when the Biden Administration decided to keep “punitive” tariffs on bifacial solar panel imports in place, following their implementation last autumn.

The tariff exemption on bifacial panel imports was removed in order to incentivise growth of the country’s own manufacturing capabilities. The world’s solar module production and supply is dominated by nine Super League companies, the majority of which are based in China, with the exception of Canadian Solar and First Solar, both headquartered in north America.

Granholm’s R&D policies should lend a great deal of support to the US’ handful of companies focused on building products for solar asset owners and operators. It includes US$20 million to establish a consortium to develop cheaper CadTel technology, focusing on low-cost manufacturing techniques and domestic research capabilities. The DOE hopes this will increase opportunities for U.S. workers and entrepreneurs to “capture a larger portion of the $60 billion global solar manufacturing sector”.

Domestic production of thin-film cadmium telluride (CdTe) solar panels has been a key part of First Solar’s operations for a number of years. The company is also known for its research investment, and was estimated to have incurred US$93.7 million in R&D costs last year, according to Statistia. It is worth noting that First Solar’s share price has risen 3.6% since markets opened following the announcement to reach US$83.64 per share.

Earlier this month and before the new funding package was announced, First Solar’s chief executive Mark Widmar told PV Tech that he hoped the Biden Administration’s renewable energy policies would “allow us to compete on our own merits against companies propped up by foreign subsidies”.

Granholm’s plans to support the government’s climate change policies, he said, are “an opportunity to boost a healthy and competitive domestic manufacturing sector while ensuring that America’s fight against climate change is not beholden to Chinese interests.”

“We remain ready to step up and, given the right policy environment, expand manufacturing capacity in the United States.”

Perovskite development

Ramping up manufacturing capabilities now will be crucial for developers in the US to be able to deploy the “hundreds and hundreds” of gigawatts at the low cost Granholm has targeted. Perovskite solar cells (PSC), a type of solar cell which includes a perovskite-structured compound as the light-harvesting active layer, was noted in the announcement as having the “potential to make highly efficient thin-film solar cells with very low production costs.”

The DOE had already said it would set aside US$20 million to advance perovskite solar photovoltaic technologies last August.

Dan Brouillette, Granholm’s predecessor as Energy Secretary, said last year that perovskites are “a promising solar technology that could help us reach the next level of innovative and efficient solar power”.

Since then, the DOE has now allocated US$40 million for R&D to nurture 22 perovskite solar initiatives, plus US$14 million to establish a “neutral, independent validation of the performance of new perovskite devices”, and a US$3 million “Perovskite Prize” for startups looking to scale up their own production.

During the announcement this week, a number of US manufacturing industry leaders discussed their goals for the coming years, including Steven DeLuca, chief executive of New York-based startup Energy Materials Corporation. EMC is partnering with film printing firm Eastman Kodak to use the latter’s roll-to-roll printers to fabricate perovskite solar cells. DeLuca said the company’s near-term goals will be to launch with a new perovskite product next year, and establish a 4GW manufacturing facility by 2023.

“Even though our capital requirements are an order of magnitude less,” he said, “we still need significant capital to bridge the time from manufacturing startup through initial deployments and bankability, and we need to do that in a market with highly subsidised foreign competition.”

DeLuca said he hopes there is a “robust public/private collaboration in process now that can reduce those financial barriers, and help us enable the deployment of US made product at massive scale.”

Improving PV system components

In addition to funding new technology, the investment package focuses on another area that has seen a handful of US manufacturers come to the fore: system components.

A total US$7 million will be awarded for research to improve PV system components such as “inverters, connectors, cables, racks, and trackers”, according to the DOE’s statement. This forms part of a broader package also launched by the Solar Energy Technologies Office (SETO) this week, which aims to provide US$39.5 million to advance both solar PV and CSP research.

SETO said in a separate statement that it will address balance of system challenges to increase a system’s useful life from 30 years to 50. Projects, it said, should aim to improve components through “data analysis, sensor development for data gathering, characterization, component hardware improvements, more efficient operations and maintenance schedules, and increased durability.”

The funding should provide additional support for US-based companies like Nextracker, PV Hardware, and Array Technologies, which collectively make up a large portion of the global solar tracker market.