Changing economic and demographic trends across the world—in both “more developed” and “developing” countries—will drive an increasingly complex energy mix over the coming years.

This is a key takeaway from the International Energy Agency’s (IEA’s) annual World Energy Outlook report, published this morning. During a webinar to announce the report’s publication, IEA executive director Dr Fatih Birol said that countries beyond China will be responsible for driving the growth in the world’s changing energy mix.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Our world is thirsty for energy,” Birol said. “Demand for energy services and electrification will increase, but we’re seeing new driving countries coming into the mix. Slowly but surely, China will be replaced by India, Southeast Asia, Latin America and a few other emerging countries.

“None of these countries alone will replace China, but together they will be the drives of global energy demand growth in the years to come.”

Unsurprisingly, solar PV looks set to be a key component in meeting this shifting energy demand in the years to come.

The IEA report sets out four scenarios, which Birol highlighted are not forecasts, but potential scenarios, that could determine global power demand and usage: the Current Policies Scenario (CPS), the least ambitious scenario that takes into account policies and regulations already in place in the energy sector; the Stated Policies Scenario (SPS), which takes into account policies that have been announced but not yet implemented; the Net Zero Emissions by 2050 Scenario, which includes measures necessary to reach net zero carbon dioxide emissions by 2025; and the Accelerating Clean Cooking and Electricity Services Scenario (ACCESS), which provides a roadmap to achieve universal access to electricity and clean cooking.

The graphs below demonstrate the potential energy mix, for selected technologies, in both the CPS and SPS cases, with oil set to lead the world in energy generation in both cases. However, the SPS case suggests an additional seven exajoules (EJ) of solar will be in operation by 2040, and an additional 13EJ by 2050, compared to the CPS case. In both scenarios, the world’s solar generation is expected to outpace its combined wind and hydro generation by 2050.

A key driving force behind this trend will be the continued low levelised cost of electricity (LCOE) for the solar sector. The report notes that, since 2010, the LCOE of solar PV has fallen by 90%, in line with a 90% decline in battery energy storage systems (BESS) and greater than the 70% decline in wind. Between 2024 and 2035, the IEA report expects solar costs to decline by a further 40%, compared to 30% for BESS and 10% for wind, suggesting that solar PV will continue to be the most cost-effective form of electricity generation in the decade to come.

Crucially, the report adds that in the SPS case, the projected cost for new solar PV and wind projects have “similar or lower average generation costs” than new coal, gas and nuclear projects in the US, EU and China, suggesting that renewables will soon be on par with conventional fossil fuels in regions with some of the largest energy generation systems in the world.

The report also notes that the co-location of BESS and solar PV is likely to be the most financially viable clean energy technology in the years to come, which echoes a sentiment expressed by others in the sector. The rapid deployment of PV capacity has led to grid curtailment challenges and price collapses in several markets, and many commentators have suggested that better integration of BESS can help sidestep grid issues and improve the bankability of solar projects.

Indeed, the IEA report notes that, by 2035, pairing solar PV with a 4-hour BESS will be “more competitive than standalone PV in major markets, as the added value of dispatchability outweighs the additional cost”.

Growing electricity demand

The increasing cost-competitiveness of solar PV comes as the world’s energy demand is likely to grow and change. The report notes that in the CPS scenario, total energy demand will grow by 14% by 2035, while in the SPS scenario it will grow by 8% by the same year, and Laura Cozzi, IEA director of sustainability, technology and outlooks, said today that in all scenarios, demand for electricity “accelerates significantly”.

“Electricity demand growth from now to 2035 is nearly identical in our two SPS scenarios [to] 10,000TWh, [which is] the electricity that is consumed today in the US, Canada, all of Europe, Japan, Korea and Australia,” said Cozzi. “This will be added in just ten years, and is a very big shift that will demand a lot of investments and planning.”

“We can comfortably say that the age of electricity has arrived,” added Birol, who went on to suggest that the “spectacular” growth in energy demand could create opportunities for the solar sector in particular, as many countries with growing electricity demand have significant potential for new solar deployments.

“Solar is going to play a pivotal role,” he said. “It is also important to see that the bulk of the electricity demand growth will come from the countries where we see a huge amount of solar radiation—they are solar-rich countries—and we see solar electricity playing an important role here, together with other renewables, such as wind, geothermal and hydropower.”

A combination of an ageing and declining population in China will also limit the growth of electricity demand. The report notes that, between 2010 and 2024, China’s total final energy consumption increased by over 2EJ; this is projected to fall to less than 1EJ between 2024 and 2035 in the SPS case, and then decline into the negative between 2035 and 2050.

The decline is even more stark in the “advanced economies” category, which saw negligible year-on-year increases in final energy consumption between 2000 and 2010, and has seen year-on-year declines in energy consumption since 2010, which the IEA notes could persist until 2050 in the SPS case.

Data centres an ‘important driver’ of power demand

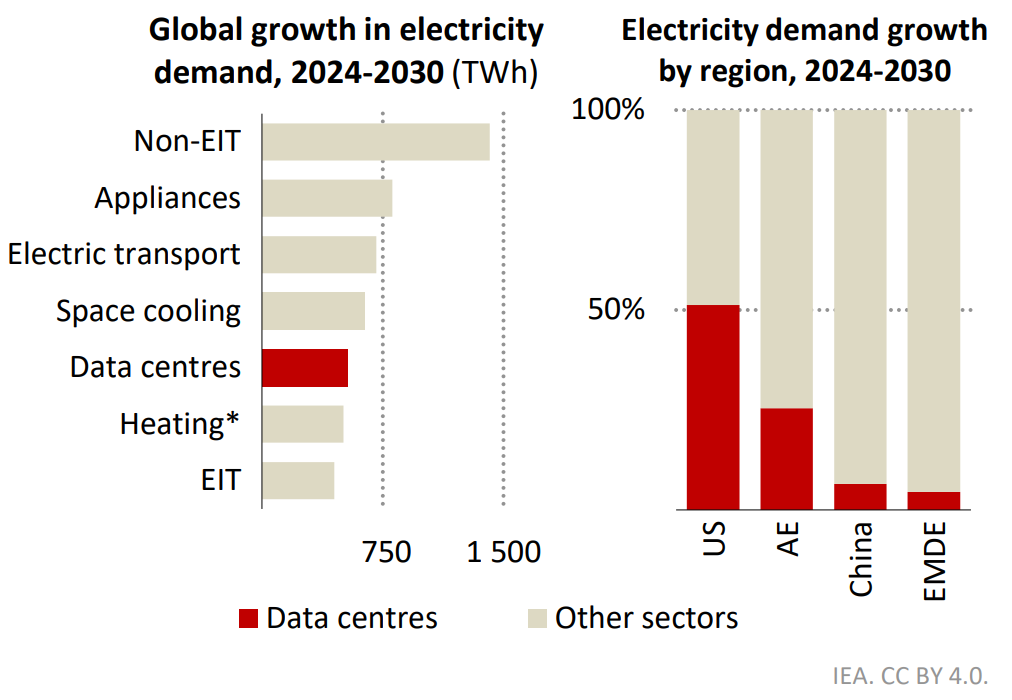

The report’s authors also highlighted that data centres are likely to be significant contributors to changing energy demand; this year, the world is expected to invest US$580 billion into data centres, compared to US$540 billion in oil.

“Data centres are an important driver, especially in the US, where they account for more than 50% of demand growth in the next decade,” explained Cozzi. The report adds that globally, data centre electricity consumption is expected to double by 2030. While they will only account for less than 10% of global electricity demand growth between 2024 and 2030, the doubling of consumption is a striking trend.

The graphs above, from the IEA, show how the US and advanced economies will drive electricity demand growth from data centres in the next five years for the SPS case, and how data centres will see greater growth in electricity demand than sectors such as heating, which in this case refers to space and water heating in buildings.

The IEA report notes that, in the SPS case, renewable power will account for 45% of the growth in electricity supply to meet data centre demand through to 2035, totalling nearly 40TWh. This percentage is slightly power in the CPS case, of just 40%, but this is still a larger percentage than any other fuel type.

Solar under-production

While the report points to several examples of significant potential for growth in the renewable energy industry in general, and the solar sector in particular, it notes that current economic systems do not facilitate the kind of growth in renewable energy deployment necessary to meet the more ambitious scenarios.

The report points to “significant surplus capacity” for module manufacturing in China, which has contributed to a downturn in both module manufacturers’ profits and significant reductions in manufacturing output. The IEA report notes that, in 2024, Chinese module manufacturers had a nameplate production capacity of over 1,000GW, accounting for the majority of the world’s nameplate production capacity, but actually produced closer to 600GW. The same trend is true for other clean energy technologies—battery cells saw production drop to less than half of its nameplate capacity—and this highlights the challenges associated with generating profits in the current economic climate.

“Market forces alone are not going to deliver that resilience and diversity that we need [in supply chains],” said IEA chief economist Tim Gould during the launch of the report. “There is a need for coordinated, determined policy action to enhance preparedness against potential disruptions, but also to build up new partnerships and projects that diversify supply chains more quickly, and this will continue to be a very important focus for the IEA.”

Cozzi noted that there are “at least 42 countries” currently implementing or changing energy regulations to better position renewables to deliver profits in the coming years, and Birol explained that challenges in “the political domain” will need to be overcome in order to meet some of the world’s more ambitious clean energy deployment targets as the 2050 goals loom ever larger.

“When we look at climate change, I see two trends, both of them in the political domain,” said Birol. “I talked with several government leaders, business leaders and others, and I see that the priority given to climate change at the national level is at a decline in most cases. At the same time, of course, we know that 2024 was the hottest year in history. The current policy scenario is almost in line with a [temperature rise] of three degrees Celsius.”