Yingli Green Energy topped the charts of solar module manufacturers for shipments in 2013, but what followed was a downward trajectory, driven by rapid capacity expansions, low ASPs and a lack of profitability.

Yingli Green Energy, the holding company once listed on the New York Stock Exchange (NYSE), has now been liquidated, unable to repay long-term debt owed to Yingli China. Total debts to a number of banks of Yingli’s China-based subsidiaries, many directly involved in manufacturing operations, topped US$2.3 billion in 2013.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

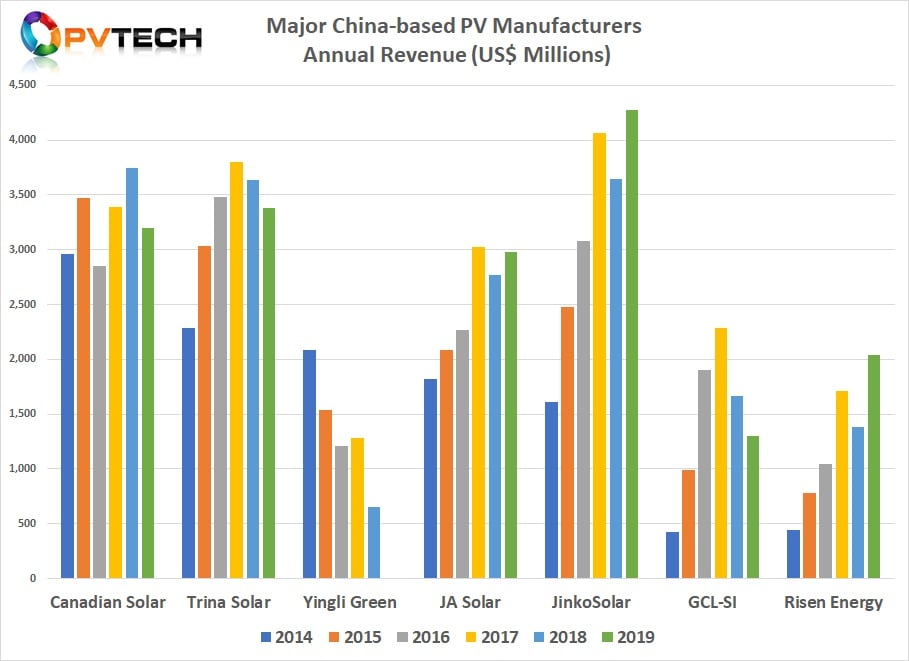

Yingli Green Energy’s annual revenue peaked in 2011 at around US$2.4 billion. As the chart below highlights, by 2014 other companies had surpassed Yingli in revenue terms. Benchmarked against other China centric PV manufacturers, the majority have continued to grow revenue since then, while Yingli’s continued to decline through to the last year (2018) it produced publicly available financial results. In 2018, Yingli’s total revenue was US$648 million, compared to three competitors (JinkoSolar, Trina Solar and Canadian Solar) each reporting revenue of more than US$3 billion.

Major China-based PV Manufacturers Annual Revenue (US$ Millions)

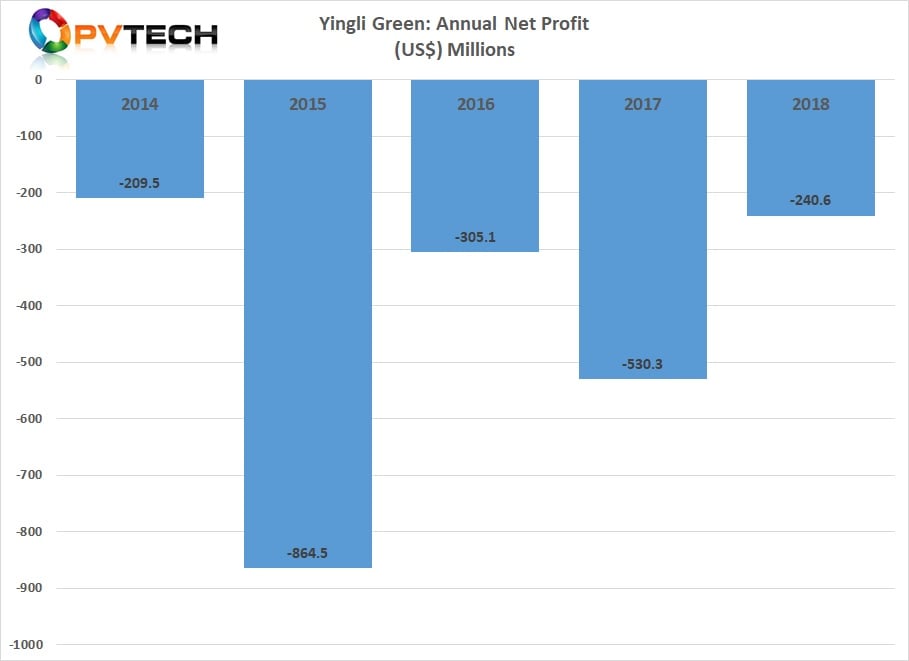

Unable to make profits, debt repayments and defaults impacted the bankability of the company, notably in sales outside China. Between 2014 and 2018, Yingli made cumulative annual losses totalling over US$2 billion, prompting a complete restructure of the company.

Yingli Green: Annual Net Profit (US$) Millions

Inside the restructure

Jump forward to 2020 and Yingli is undergoing a major and complex restructuring process, under the stewardship of the Baoding Municipal Intermediate People’s Court in China’s Hebei Province.

Yingli Green Energy Holdings is to be liquidated with no debt settlements, and attention has switched to Yingli China’s subsidiaries. The planned restructure is aimed at creating a new and agile Yingli, one capable of once again being a viable and competitive company.

PV Tech was invited to discuss at length with Yingli’s CFO, Yiyu Wang, who revealed where the company was with the complex restructuring proceedings and what its business structure and strategies would be once these were complete.

PV Tech: What is the goal of restructuring?

Yiyu Wang: Firstly, you have to understand the difficulties and the opportunities we are facing. The most challenging is that we have a very high debt, notably from bank loans and notes in the range of RMB14 billion (US$2 billion), and accumulated interest payments. These loans not only drive a very significant interest expense annually, but also, because a lot of them have been in court actions more than three years ago, they have impacted the overall image of Yingli, especially with previous business partner banks. So, this is a very difficult challenge.

But the opportunity we have is that the overall [PV] industry has kept developing year-by-year in terms of the global annual capacity [and] in terms of the cost per kilowatt hour, driven by solar’s decreasing costs year-by-year, and because of technical innovation and scale of manufacturing operations. So the market is going very fast.

So our goal of this restructuring has two key aims. The first is to solve the high debt issue we are facing and the second is to bring additional capital to help Yingli ramp-up its [manufacturing] facilities to enable us to produce more cost- and technically-competitive products for the market.

That’s why we are going through this restructuring, which is important to convince the banks to swap a significant part, even a majority of the debt, for equity. Then, the new Yingli will not only have a much lower debt level on the balance sheet, but can also solve the current debt defaults.

Secondly, the new capital injection planned with a local government related company, where the cash is generated from the relocation of some of Yingli’s existing capacity to make some of the land idle or able to be sold in the market to generate additional cash.

After the land is sold the money will be injected into the new Yingli to enhance its cash position. This will be key to initiating the procedures to achieve this restructure. In the last four years, especially after 2015 and now, Yingli has been working on solutions based on support from the local government and banks, all of which have played a big part. We finally came to this proposed restructuring plan.

How long do you think these restructuring activities will take? Notably the financing in place to move forward with your manufacturing plans.

All the related parties, including Yingli management and specialist advisors, have been working on these plans for almost two years and the first milestone we announced, which was very important, was this year in June, when we entered into the legal procedures according to China laws.

This could only happen if the parties were confident of the plan. Since June we have been able to complete all the basic legal papers, including audits, asset assessments, as well as all bank debt figures. The second stage will be to produce the overall restructuring plan, including all the financial numbers, how to transfer that to equity and the operating data such as suppliers etc. This would also include the land acquisition by the government and its resale.

The execution of this restructuring plan starts with the banks starting the processes to swap debt for equity, while the company continues its operational work and signs new contracts with suppliers who will be paid after a certain period. Again, the most important aspect will be the potential time it takes to sell the land, because the manufacturing needs to be moved before the sale. This could be one or two more years, but because the land will be sold in smaller lots, we expect the cash from these sales to gradually come in over this time period.

How are the debts to suppliers being resolved?

We have been working with suppliers for almost four years and during this time we have had some disputes, of course, and sometimes some legal costs that were paid off. But mainly suppliers have maintained a reasonable relationship with Yingli and supported the company in continuing to produce an average of between two and three gigawatts of modules each year. Importantly, we do not have any significant disputes with our suppliers so far. Obviously, we have had some small legal disputes, but all solved on a fair enough basis, which is why suppliers have supported Yingli and let us continue operations.

Secondly, we have no plans to expect debts to be written off, so their debt will be solved in a reasonable period after the restructuring, unlike if Yingli was entering bankruptcy rather than court restructuring under Chinese law. Ultimately, the restructuring is intended to allow Yingli to grow again, be healthy and we can have more business with our suppliers.

Under the restructure, is the existing Yingli management team also being given the confidence vote of the banks to continue to run the company?

Obviously, under the restructuring the company will have a new shareholder structure that will include a group from the banks and the government related company as it injects cash into Yingli. I think there will be two steps on this. Firstly, we will start with institutional shareholders and around three or four of the largest banks having board directorships, which account for around eighty percent of our debts. Of course, the board would also include a few Yingli senior directors. There may be a need to appoint new management people into Yingli for certain roles, but many of the senior management have remained at Yingli and have support from the banks and government.

The second step will be the introduction of an independent commercial company investor, after all the restructuring activities have been completed, which will see a first round of capital injected into the new Yingli. This will give us a new and impressive image. There are two companies we are working closely with on this. Maybe in one year’s time we would have a strong new investor and they would also be a board member.

What does the manufacturing consolidation actually mean to growth in the future and where will the manufacturing hub be?

Our working plan, say starting next year, is to take two to three years to expand our manufacturing capacity to a level that would put us back into the top 10 companies globally, in terms of total capacity.

Further analysis of Yingli's manufacturing plans will be published tomorrow, 26 November 2020.

We have seen several Chinese PV manufacturers exit foreign stock exchanges and relist a few years later, on Chinese exchanges. Is this part of the future strategy?

Yes, we do have a plan to go to the equity market again but at this moment it is very difficult to predict when this could happen, whether this is overseas or domestic. Of course, before we go back to being public we will have engaged top tier auditors and voluntarily disclosed our financials on our website, which would be done on a quarterly basis in our bid to go public again.

With a new investor expected later as we have discussed, then we will be able to look at more downstream business opportunities in building and also owning PV power plants to diversify our revenue streams.

Overseas markets give you profits if the right regional markets are carefully selected, but these usually require companies to have bankability status. However, we have noted that Yingli has been able to secure module supply deals on several relatively large utility-scale PV power plant projects overseas, so how were these made possible?

Over the last few years this has been a challenge and I have spent a lot of time with our project teams on this matter. In China, our customers have placed more requirements on us such as quality control but, as is quite common, they can retain a small percentage of the total purchase price until the project is operating and meeting performance requirements.

For international markets it’s almost impossible. However, I would say around half of the projects we win are based on trust from companies that have known us for many years. That said, they always follow the quality control measures very, very closely, like our Chinese customers.

We have former customers that would still like to buy from us but simply cannot. We therefore keep in contact with them and share our restructuring plans with them as quickly as possible. Before the financial issues, over 70% of our sales were international and roughly 30% were sales in China, but in recent years this shifted to roughly 80% of sales in China and roughly 20% of sales overseas.

With the restructuring completed and the cash injection received, we will have a healthy balance sheet, one that will be similar to many competitors. We will share our financial data with customers once audited by a tier one accountancy firm and, though it will take time, banks will regain confidence in us and we will gain new credit facilities, such as bonds, to support customer needs. Sales in China would increase first and international sales would improve gradually each year. We should be back on track with everything normal in three to five years.

So YGE will be disbanded, but will the brand remain the same?

Yes, the Yingli Solar brand remains the same. Yingli Green Energy Holding, the holding company, will be disbanded. But we will be announcing the new shareholders and properly and clearly communicating on the new Yingli – who you are dealing with and what our products are.

Although the restructuring activities remain challenging and rebuilding its manufacturing and overseas sales footprint will take time and only be achieved with new investors, the new Yingli is definitely in the making.