The significance of PV-Tech’s forthcoming conference in Kuala Lumpur – PV ModuleTech 2017 – has just moved to a new level, with the key company executives from all members of the Silicon Module Super League (SMSL) giving presentations on stage about the quality, reliability, and performance of their solar modules.

The SMSL comprises the seven companies that will each ship in excess of 4GW of module shipments during 2017, and stand apart from the other 400-plus companies globally making solar PV modules.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This multi-GW module grouping – comprised of Canadian Solar, GCL System Integration, Hanwha Q-CELLS, JA Solar, JinkoSolar, LONGi Solar, and Trina Solar – have been key to the solar industry collectively shipping 100GW of solar modules in 2017.

For project developers, EPCs, asset owners, O&Ms, module equipment and materials suppliers, and test/certification/insurance companies/bodies, PV ModuleTech 2017 has just become the must-attend event on the PV calendar for 2017.

This article takes a fresh look at just how important the SMSL companies are to the above mentioned categories of companies that rely on doing business with this group of seven module suppliers, either selling products/services or by entering into utility-scale module supply agreements.

Over the next couple of weeks, we will reveal also the other major module manufacturers that are setting the benchmarks for module quality, reliability and performance for utility-scale deployment, as confirmed speakers at the PV ModuleTech in November 2017.

The top 13 module suppliers to China and non-China

During the past few weeks ago, we have featured a series of articles on PV-Tech relating to module supply in 2017, and which companies are dominating the global landscape. Especially this year, we have seen the full impact of the seven companies that make up the SMSL, and for many, the utility segment (both within China and globally) has been a major factor in their ability to scale module shipment levels to above 4GW annually.

Let’s remind ourselves of the leading module suppliers to the PV industry in 2016, where we show the top-10 global suppliers by volume of shipments, the top-5 for China-only, and the top-10 for global shipments when excluding the Chinese market.

We have highlighted below in green the confirmed companies to speak at PV ModuleTech 2017 in November, with the graphic providing a clear visual on how important the SMSL is to the industry today.

If we classify the group of companies in the figure below as effectively the top-13 module suppliers of 2016 (recognizing the strategic importance of the non-China global supply segment), then only First Solar, Yingli Green, Wuxi Suntech, SunPower, SolarWorld and REC Solar are waiting to be confirmed as speakers at PV ModuleTech 2017.

Industry supply from the ModuleTech 2017 target list

With our expectation that all of the above listed module suppliers will be on stage at PV ModuleTech, explaining to developers and EPCs what differentiates their module supply, with specific focus on module quality, we decided to do some data-crunching on the global coverage of this group of module suppliers in 2017. This is shown in the graphic below.

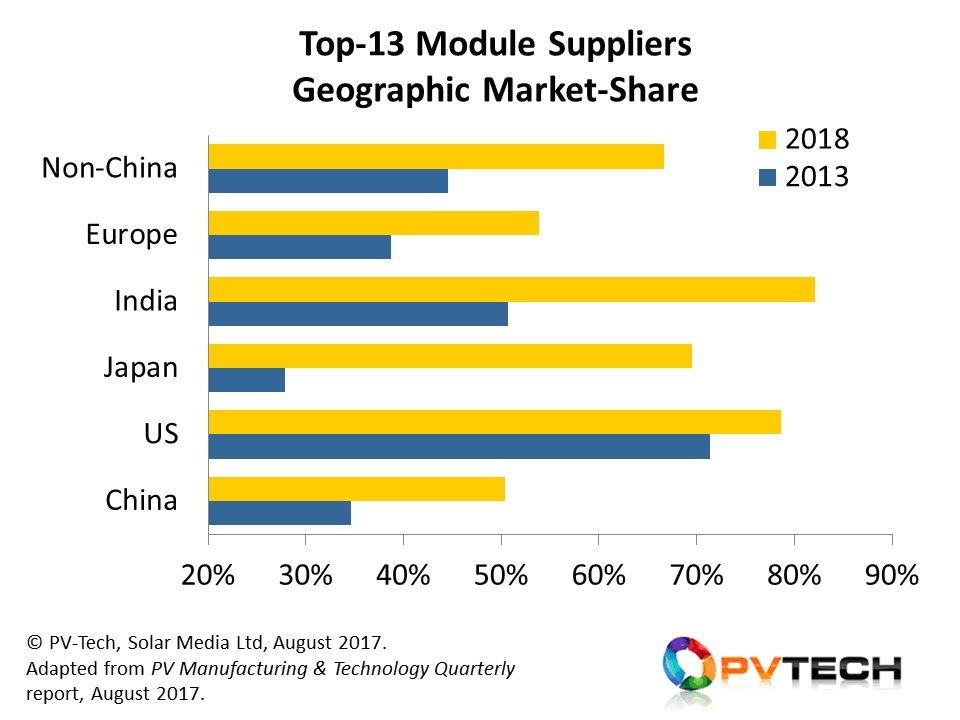

The above graphic shows the share of modules supplied to each of the five key geographic regions of the solar industry in 2017/2018, looking specifically at the share gains between 2013 (actual) and 2018 (forecast). The graphic is extremely powerful in explaining the overall strategy of the leading module suppliers in targeting the key countries driving solar demand today.

The two countries that stand out are Japan and India. Both of these countries have been targeted heavily by the Silicon Module Super League in particular, but most of the other module suppliers listed above have changed their sales and marketing strategies to Japan and India in the past couple of years.

While it is generally true to say that the share-gains of the leading module suppliers into Japan and India have come at the expense of domestic module suppliers, there is a massive difference in these two countries.

Since 2013, India has grown dramatically, and in this respect, the share comparison between 2013 and 2018 is less relevant. Yes – there were more Indian modules in the 2013 Indian market, on a percentage basis: but the massive growth of the Indian market would only have occurred with multi-GW of modules coming into the country from China. This conundrum continues to challenge politicians and industry players alike in India today, in terms of the roles and aspirations of domestic players across both upstream (cell/module manufacturing) and downstream segments.

Japan is a different proposition altogether. The market-share gains in Japan have been entirely at the expense of domestic branded Japanese module suppliers (Sharp, Kyocera, Panasonic and Solar Frontier for example), with each of these companies having to adjust manufacturing strategies to limit loss-making returns in solar/energy related business segments.

It would be fair to say that the rate of change of the market conditions impacting Japanese companies has been much faster than their ability to change business operations, and as such, there appears to be constant re-organizations of production sites somewhat after the market conditions have changed. It remains to be seen if the annual erosion of effective ramped cell/module capacity from Japanese solar companies can actually be halted, or whether we are looking inevitably at the wholesale capitulation of an upstream segment that led the industry during its early growth phases.

Non-China market needs to be isolated

In some ways, a red line does need to be drawn around the whole of mainland China, when it comes to module supply. In this respect, all the companies that rely on non-Chinese markets for solar business opportunities (international developers, EPCs, O&Ms, asset owners, asset managers, and testing/certification organizations) need to understand what is happening with module supply that is not simply being made for the Chinese market.

Referring again to the above two graphics, we can see that the top-13 module suppliers shown will increase their market share (for non-China) from approx. 45% in 2013 to about 70% in 2018. Indeed, if we were to isolate ground-mount utility based solar farms, the figure in 2018 would increase to more than 80%.

Therefore, the group of parties noted above – international developers, EPCs, O&Ms, asset owners, asset managers, and testing/certification organizations – have many reasons to fully align with the module availability, technologies supplied, roadmaps for modules, and exactly how this group of module suppliers is minimizing their risks in terms of long-term field-performance reliability and operation.

Industry still needs to understand module quality

In the rush to expand capacities and module shipments to above 4-5GW annually, it has to be remembered that module quality and field performance ranks above shipment volumes or any snapshot league table that ranks one company above another, including the SMSL grouping we use at PV-Tech that is based purely on shipped volume levels.

There are many different test, inspection and certification routes being taken by leading module suppliers today and some of the companies performing these functions will be speaking at PV ModuleTech 2017, alongside the key module suppliers.

But perhaps the key still comes back to identifying materials traceability and module manufacturing processes through to field operations and linking the two together to optimize plant operations and investor return-on-investment. In this respect, there are certain key issues that emerge such as inherent temperature coefficients arising from the module technology chosen by EPCs and other field-specific factors that are not often fully understood by developers or asset owners.

This remains one of the key aims of the PV ModuleTech 2017 event in November, with the expectation that our PV-Tech website platform will be used to extensively cover the companies and themes that are presented and discussed in Kuala Lumper, to the broader PV community globally.

To register to attend the PV ModuleTech 2017 event, or to get involved during the 2-day conference, please follow this link.