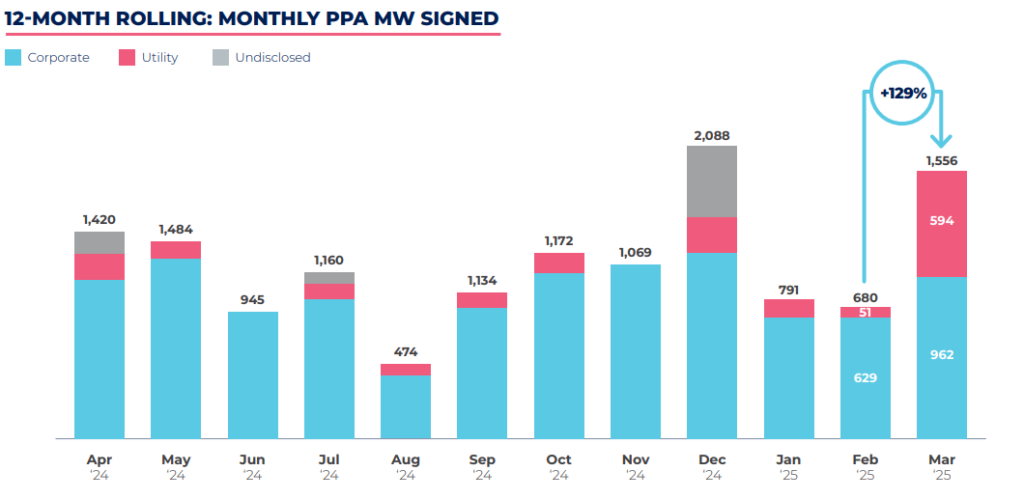

Europe completed power purchase agreements (PPAs) for 1.6GW of renewable energy capacity in March, more than double the capacity contracted in the previous month.

This is according to Swiss consultancy Pexapark’s latest monthly ‘PPA Times’ report, covering the European PPA market in March. Agreements for solar projects dominated the month’s dealmaking, with 17 deals signed, for 1.4GW of capacity, for solar projects. This compares to four deals signed for 19MW of capacity for wind projects.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Around one-third of the month’s contracted solar capacity was accounted for in a single transaction – an M&A deal involving Enel, Masdar and EGPE Solar comprising 446MW of solar capacity – and solar deals made up the second- and third-largest deals by capacity. These deals, both signed in Italy, are the largest solar PV deals ever signed, among those tied to a single asset.

The month-on-month growth in contracted capacity is a positive development for a market that had seen consecutive months of decline, and the total capacity contracted in March is the highest figure reported this year. Corporate PPAs were particularly popular, with 962MW of capacity contracted in March, more than the capacity contracted in all renewable power PPAs signed in February and January.

Europe also saw a total of 24 PPAs signed, the same figure as in February, reversing three consecutive months of month-on-month decline in the number of PPAs signed.

However, the growth in the capacity of renewable power being contracted contrasts to the decline in European PPA prices from February to March. Pexapark’s Europe composite figure gives an average PPA price of €49.5/MWh (US$56.1/MWh), a 1.4% decrease from the €50.2/MWh reported at the end of February.

This trend was reflected across the continent, with Germany, the UK, Spain, Portugal, Italy and Poland all reporting month-on-month falls in average PPA price, with Poland posting the largest decline, of 4.8%. The Pexapark report attributes this to declines in the carbon price within the EU Emissions Trading System (ETS), and increasing solar generation in Poland, which increased 80% month-on-month.

PV Tech’s publisher Solar Media will host the Renewables Procurement & Revenue Summit on 21-22 May 2025 in London. The event will explore meeting Europe’s energy demand, the role of data centres in the energy transition, the outlook for European power and PPA prices and more. For more information, go to the website.